Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Private investors have piled into UK government bonds this year to lock in attractive yields as the Bank of England has kept interest rates at a 16-year high.

Hargreaves Lansdown, the UK’s largest do-it-yourself investment platform, said gilt purchases in the first three months of 2024 were three times higher than the same quarter last year, with gilts “by far and away” its most popular fixed-income product, according to Tom Lee, the company’s head of trading.

Interactive Investor, the second-largest DIY platform, said gilts had attracted more cash than any other investment for 10 straight months, while AJ Bell said four of its top 10 traded securities had been individual gilts so far this year.

When Hargreaves Lansdown experienced the first maturity of a gilt that was widely owned on its platform last year, “we saw a significant percentage of clients reinvesting back into other gilts”, said Lee, demonstrating the continued appeal of a security that before 2022 was often plagued by unappealing yields.

Private investor gilt purchases have been concentrated in short-dated government bonds that were issued with low coupons when yields were low, providing a tax-efficient alternative to cash.

That’s because for investors who own gilts outside tax wrappers, income tax is payable on the coupon — the fixed cash payment issued every six months — but there is no tax on any increase in the gilt price when it matures or when it is sold.

The most heavily bought gilts in recent months include one that matures in 2025 and pays an annual interest payment of 25p, as well as one that matures in 2026, with a coupon of 12.5p.

A rush of money from private investors into gilts comes as the yield — the annualised return delivered if the bond is held to maturity — on the two-year gilt has risen from about 4 per cent to 4.4 per cent since the start of the year, reflecting the fall in bond prices.

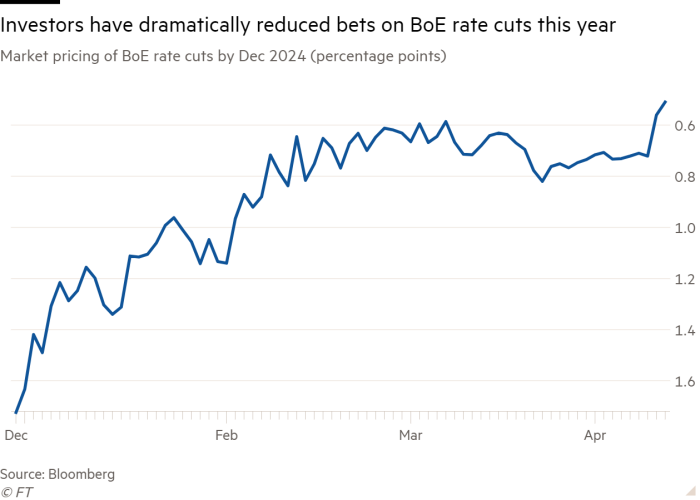

Traders in swaps markets are now betting that the Bank of England will deliver only two quarter-point cuts to the interest rate by the end of this year from a current level of 5.25 per cent, down from an expected six or seven cuts at the start of the year.

Analysts said a growing conviction that bond yields were likely to stay “higher for longer” was also pulling investors into other corners of fixed-income markets, a trend they expected to continue.

“The appeal of bonds for retail investors has shot up as yields have risen,” said Sam Benstead, fixed-income specialist at Interactive Investor. “While more money flowing into gilts made up the bulk of this increase, investors also added cash to corporate bond funds across a range of sectors.”

Amundi, Europe’s largest asset manager, said in a report published this week that over the next 10 years bonds have the potential to “regain the role as a key performance engine in asset allocation”.

The fund group forecast that gilts would deliver an average annual return of 3.7 per cent over the next decade, compared with 4.4 per cent for Italian government bonds and 2.2 per cent for German Bunds.