This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Today’s top stories

For up-to-the-minute news updates, visit our live blog

DT is taking a long weekend and will be back in your inboxes on Wednesday May 10

Good evening.

Prospects for the airline industry look a whole lot brighter this week after Europe’s three big carrier groups — IAG, Lufthansa and Air France-KLM — displayed growing optimism as the post-pandemic travel boom picks up pace.

IAG, owner of British Airways, Iberia, Aer Lingus and Vueling, this morning lifted its profit forecast on the resurgence in passenger demand and a drop in fuel costs. Customers also seem undeterred by higher ticket prices.

Air France-KLM reported a boost from the numbers of wealthier passengers flying business class to Paris, which is gaining momentum in the race to become Europe’s top financial hub. It did, however, lower its forecast for returning to pre-pandemic capacity from 100 per cent this year to 95 per cent. It said it had now repaid all the state aid it received during the Covid-19 crisis.

Lufthansa also said it was expecting a summer boom as well as a new record in traffic revenue for the year as a whole.

Travel industry optimism is also growing in Asia. Authorities this week said domestic tourist spending in China had passed pre-pandemic levels for the first time. Outbound air travel abroad is recovering more slowly but Chinese airlines at least are being allowed to expand their flights to the US.

Meanwhile, travel groups Expedia and Booking yesterday reported strong demand for accommodation, notching up record sales figures as international travel took off, boosted by post-pandemic reopening in Asia.

The one region where optimism for the holiday season is a little more tempered is the US, where carriers hope not to repeat two costly summers of chaos with swaths of cancellations and delays, leaving passengers fuming.

Summer is always a testing time at US airlines as higher volumes of flights and passengers come up against the possibility of thunderstorms, wildfires, hurricanes and extreme heat, meaning carriers need to build slack in the system, for example by putting extra crew on standby, driving up costs and leading to higher fares or a dent in profits.

Need to know: UK and Europe economy

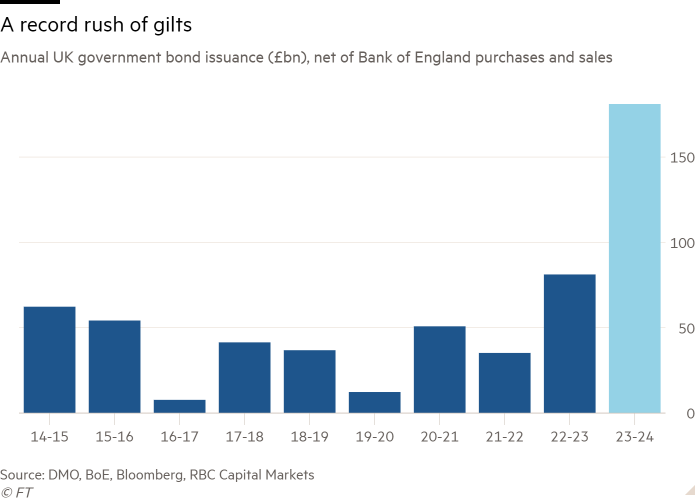

UK borrowing costs are being driven up by a flood of bond sales without the Bank of England stepping in to suck up supply. Bond yields in most large economies shot up over the past 18 months before falling back, but in the UK they remain at elevated levels. The Bank of England makes its decision on interest rates next Thursday.

UK retailers and pubs are hoping for a boost this weekend from the coronation of King Charles after three years of subdued consumer demand, with thirsty Brits forecast to down an extra 17mn pints.

Germany is planning subsidies of 80 per cent to cover power-hungry industries’ electricity costs. The move is likely to spark a backlash from fellow EU states.

Eurozone retail sales fell by a bigger than expected 1.2 per cent in March as inflation and rising borrowing costs took their toll on consumers. The biggest decline was in Germany, where they dropped 2.4 per cent. Separate data this morning showing plummeting German factory orders has raised new fears about an economic slowdown.

The European Central Bank yesterday raised interest rates by quarter of a percentage point but its president, Christine Lagarde, warned that the fight against inflation was not yet won. Economists do believe, however, that the rate-tightening cycle may be nearing its end.

Recep Tayyip Erdoğan, Turkey’s leader for the past two decades, faces his toughest fight yet in the presidential election of May 14, with opposition leader Kemal Kılıçdaroğlu hot on his heels.

Need to know: Global economy

The US Federal Reserve on Wednesday increased interest rates by a quarter of a percentage point, warning that the recent banking turmoil could affect economic activity. Fed chair Jay Powell raised expectations that a pause in the rate-tightening cycle was on the horizon.

A fresh period of banking jitters is good news for gold as investors look to safe havens and drive the price towards an all-time high. The yellow metal has undergone a resurgence in the past 18 months, underpinned by record amounts of buying by central banks.

In recent years, sanctions have become western countries’ foreign policy tool of choice to deal with hostile international actors. But, according to academic Francisco Rodríguez, they also have a dramatic effect on the living standards of the vulnerable.

Need to know: Business

US regional banks remain under pressure. Western Alliance in Arizona said yesterday it was exploring a potential sale, while California’s PacWest also sought a financial lifeline as its shares dived 50 per cent. Activist investor Nelson Peltz called on Washington to stem the crisis.

AP Møller-Maersk, the world’s second-largest container shipping line, warned of a “radically changed business environment” as profits plunged. The industry enjoyed an extraordinary boom after the first wave of the pandemic, with the industry making more money in three years than in the previous six decades.

Shell reported better than expected profits of $9.6bn for the first quarter and announced a $4bn share buyback. The FT revealed details of the unknown Indian company Gatik Ship Management, which has been shipping millions of barrels of Russian oil.

Most of us have implicitly traded access to our data in exchange for marginal digital conveniences, but what do you do when you find out you’re being spied on? The FT’s Cristina Criddle writes for the FT magazine on being surveilled by TikTok.

Science round-up

The Wellcome Trust, Britain’s biggest biomedical charity, is tripling the size of its genome campus near Cambridge in one of the largest investments in UK research infrastructure.

As we noted in Wednesday’s Disrupted Times, regulation of AI is rising up the agenda. The UK yesterday launched a review of the market, while the White House has called in tech leaders for a “frank discussion” of AI risks. FT sister publication Sifted reports on how researchers gave AI superhuman memory.

Been itching to understand what all the quantum computing hype is about? Check out our new visual guide.

Pairs of satellites, nicknamed Tom and Jerry, have been observing major developments triggered by climate change during their 21 years in orbit. We explain how they do it.

The co-founder of vaccine maker Moderna has called on US politicians and judges to stop questioning established science and sowing public confusion that damages people’s health.

Commentator Anjana Ahuja discusses the attempt to harness the environmental gold dust that is whale poo and the implication that the profit motive could be the most successful way to protect the world’s natural resources.

Could this be the Shazam of smells? A Californian start-up has developed a device to sniff out substances such as drugs, explosives and viruses. Watch the FT’s Patrick McGee as he takes a trip to the lab.

Some good news

Eli Lilly is applying for US regulatory approval of Alzheimer’s drug donanemab after trials showed it could slow the progress of the disease in the early stages. The results of the trial mark the second significant breakthrough in a year for a drug aiming to treat a disease with about 50mn sufferers worldwide.

Something for the weekend

Try your hand at the range of FT Weekend and daily cryptic crosswords here.

Interactive crosswords on the FT app

Subscribers can now solve the FT’s Daily Cryptic, Polymath and FT Weekend crosswords on the iOS and Android apps

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. Please share your feedback with us at disruptedtimes@ft.com. See you next Wednesday!