Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

UniCredit’s Andrea Orcel likes to keep his audience guessing. A delay to full-year results last month stoked expectations that a deal announcement was imminent.

Instead investors had to settle for a knockout set of numbers this week that sent shares up by as much as a tenth. Capital returns rather than risky acquisitions are a proven crowd pleaser. Peers at Intesa and Monte dei Paschi followed suit, the latter paying its first dividend in 13 years.

Italian banks, once the laggards in a generally troubled European sector, are back thanks to higher interest rates and government-led efforts to clean up balance sheets over the past decade. Under Orcel, UniCredit is prospering: shares have more than doubled since the start of last year. Shovelling capital back to shareholders seems a muted ambition for the former UBS dealmaker.

Yet Orcel pushed back against a tie-up with MPS in 2021. A deal with Banca Popolare di Milano fell through last year. Orcel has quashed speculation about smaller local peer Banca Popolare di Sondrio.

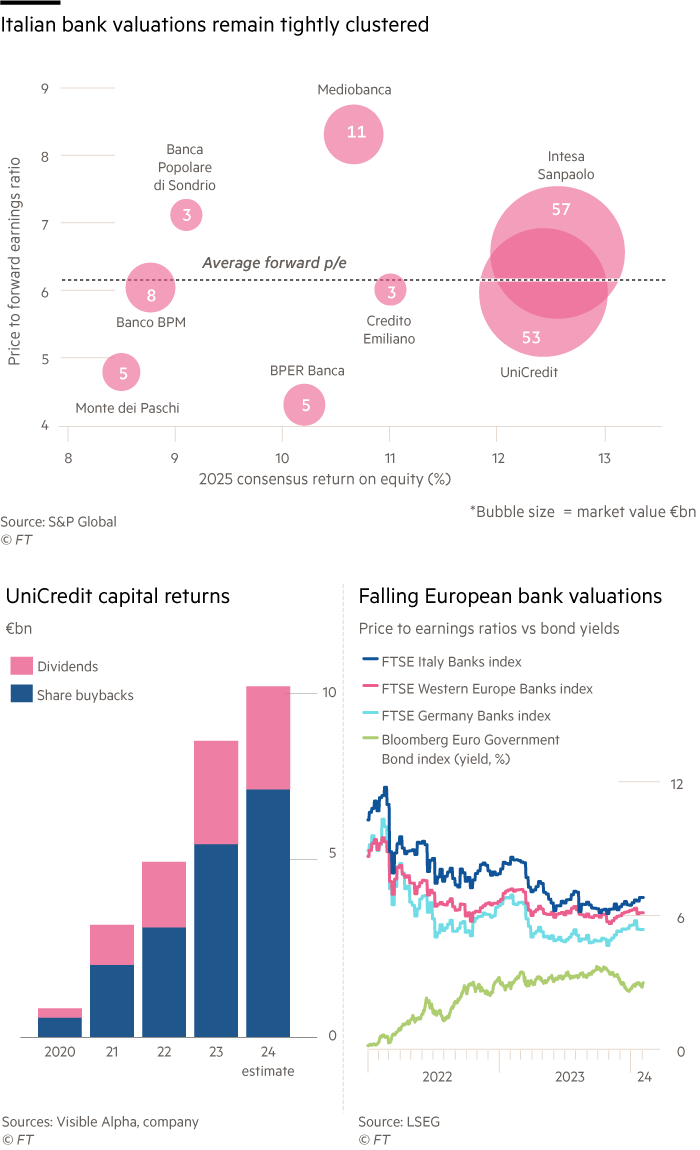

One problem is the tightly-clustered valuations of Italian and, indeed, European banks. For something to happen, a reshuffling into potential predators and prey is needed, as fortunes diverge.

Investors currently seem to be taking a wait-and-see approach across the board. Profits across the sector have soared with higher interest rates, yet price-to-earnings multiples are stuck at the mid-single-digit levels of past crises. UniCredit trades at 6 times this year’s earnings and a 20 per cent discount to tangible book value. If Orcel does hand another €10bn to investors this year, a fifth of the current market value, there is plenty of room to re-rate higher.

The pieces appear to be in place this year: capital returns are higher; costs are expected to remain flat; fee income will grow. Coverage for bad loans looks better than domestic peers.

UniCredit has the firepower in place. Its common equity tier 1 ratio ended the year at 15.9 per cent, against the top of management’s target range at 13 per cent. Basel IV rules should trim 0.8 percentage points off that. But that still leaves extra capital of about €6bn for Orcel to put towards a potential acquisition.

Banco BPM or Monte dei Paschi both remain options for UniCredit’s domestic expansion. International growth could involve Greece’s Alpha bank, which UniCredit took a 9 per cent stake in at the end of last year.

Even bolder would be a deal with Commerzbank. The often-mooted target offers savings in Germany and greater exposure to eastern Europe. There is a gap in future returns: UniCredit’s expected return on equity is 60 per cent higher than the German lender’s. But the pair are stuck on the same earnings multiple.

Importantly, until clear valuation gaps open up, bank deals (especially using shares) will remain speculation — in Italy and beyond.

Lex is the FT’s concise daily investment column. Expert writers in four global financial centres provide informed, timely opinions on capital trends and big businesses. Click to explore