Mark Tucker has built a reputation as a decisive and determined executive who usually gets what he wants.

But in the seven years since becoming chair of HSBC, Tucker has struggled with one key facet of his job: succession.

The bombshell announcement on Tuesday that chief executive Noel Quinn is leaving HSBC after five years in the role has once again thrown Europe’s largest bank into uncertainty with no successor in place.

As Tucker embarks on his third CEO search in less than a decade, both his legacy and the future of HSBC are at stake.

Tucker is approaching the end of his own tenure in 2026. Unless investors grant an extension to the usual nine-year time limit, he has one last chance to shape his legacy as the first outsider to chair the bank in its 159-year history, said a former senior executive at the bank.

Tucker’s record at the bank is so far mixed. The 66-year-old has received credit for helping HSBC navigate through the coronavirus pandemic and a bruising battle with the bank’s largest shareholder, Ping An, the Chinese financial conglomerate that wanted the lender to spin out its Asia division.

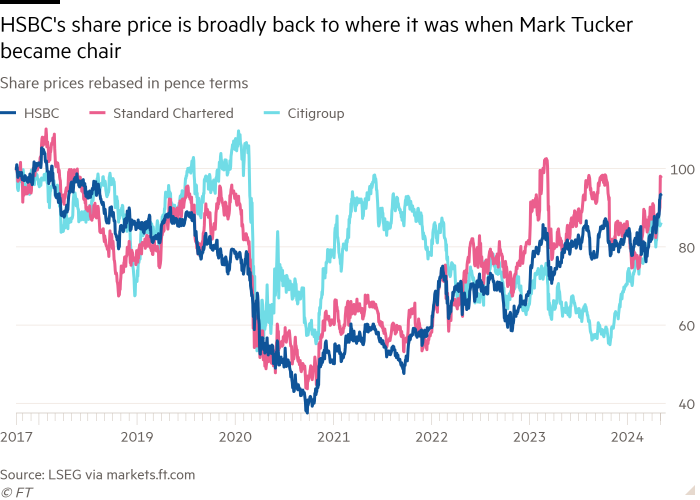

But there has been little movement in HSBC’s stock price. It is once again trading at near the £7 mark that shares were at when Tucker became chair in 2017, despite the lender being a major beneficiary of higher interest rates with its vast deposit base.

“There should have been an uplift in the share price,” one former banker said.

Some investors argue Tucker and management have diversified the bank to ensure it is less vulnerable to falling rates.

“There’s a feeling that as interest rates come down, HSBC will come down with it,” said Iain Pyle, fund manager at Abrdn, a long-standing HSBC shareholder. “But management have worked hard to reduce that [rate sensitivity] and lock in the benefit of higher rates. There are areas of the business like wealth management where they’ve shown pretty good growth.”

HSBC reported this week a drop in net interest income of almost 3 per cent in the first quarter to $8.7bn.

But Tucker is mainly under the spotlight over the CEO role, which is in flux for the second time under his reign.

When the British businessman became HSBC chair in October 2017 after leading AIA Group, he already knew who would replace Stuart Gulliver as the bank’s chief executive. Tucker stuck with the tradition of promoting from within the lender’s walls, handpicking HSBC “lifer” John Flint in 2018.

Tucker ousted him just 18 months after Flint took the top job. Quinn became temporary chief executive while Tucker tried to find Flint’s replacement. His failure to lure Jean Pierre Mustier away from UniCredit led to Quinn’s permanent appointment.

“He went through the first CEO very quickly,” said Gary Greenwood, analyst at Shore Capital. “Noel’s out sooner than we would have expected. It’s still incredibly political and bureaucratic at the top of HSBC.”

The handling of Flint’s departure and Quinn’s shock exit has led to questions over Tucker’s leadership style, which people close to him have described as very hands-on.

“He is demanding, exacting, intense — but he gets the best out of people,” Sir Jonathan Symonds, deputy chair of HSBC until 2020, told the Financial Times. “People are really loyal to him”.

Others are more critical, saying he can be “ruthless.”

“It’s like you’re playing chess with him, he’s constantly thinking many steps ahead of you,” said an executive who worked closely with Tucker.

A former professional football player for Wolverhampton Wanderers and an ardent Chelsea fan, Tucker is best-known among his peers for his competitiveness and relentless work ethic. “Somebody once described him to me as ‘Gordon Brown with emotional intelligence’, which is reflective of that huge, absolutely untameable work ethic that he’s got,” said a former colleague.

Tucker, who spends a substantial amount of time in his home in New York, has overseen HSBC through a significant retrenchment from overseas operations. The bank has axed a string of international businesses deemed non-core to the Asia-focused group, including Canada, French retail banking, and Argentina.

At the same time, Tucker and Quinn have doubled down on Asia, allocating more capital to China. Although this strategy could position the business for future growth, it has left HSBC in the crosshairs of geopolitical tensions between the East and West. HSBC generates 75 per cent of its profits from Hong Kong.

“The cold war between the US and China has gotten a lot colder,” said one former HSBC executive. “That, along with the Chinese economy slowing, US fund managers reluctant to invest in Chinese shares and the US government stopping China getting access to most advanced semi- conductors . . . It isn’t an immense success story.”

Despite Tucker’s reputation as a tough chair working with the bank’s management team to make bold business calls, from closing overseas operations to culling staff, those close to him describe him as a fiercely private person who values home life.

Tucker’s legacy, though, now hinges on successfully appointing a chief executive who can steer the bank through its next growth phase in Asia, in his final roll of the dice before his own tenure at the helm draws to a close.

Even with Quinn’s departure, there is an element of strategic manoeuvring.

The normal sequence of events in corporate succession would typically dictate that Tucker leaves before Quinn, who would stay until a new chair is installed and has had the chance to choose a successor. Instead, Tucker will get his third CEO pick just before he leaves.

“The most important decision [a chair can make is deciding] who the CEO is. This is who sets the direction of the company,” another former senior HSBC executive said “All of this is about Mark’s attempt to right history, choose the next CEO and to also be involved in the decision over the next chair.”