Food producers are taking up record volumes of warehouse space in the UK, as the industry looks to prevent shortages such as those of fruit and vegetables that left supermarket shelves bare earlier this year.

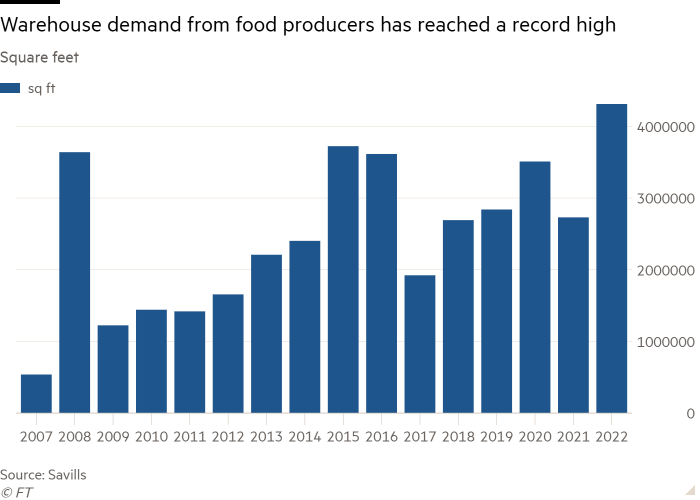

Although their efforts failed to prevent that breakdown, demand from food manufacturers for shed space increased 58 per cent to a record 4.3mn square feet last year, according to Savills. The property group said it was the biggest take-up since it first started collecting data in 2007.

Food businesses have been acquiring warehouses to use as slaughterhouses and indoor farms as well as for storage as worries rise over food supplies. In March many supermarkets were forced to ration vegetables with the shortages caused in large part by cold weather in continental Europe and Africa.

Climate change and the Ukraine war, which hit grain imports from eastern Europe, have prompted concerns in many countries about food security. However, Kevin Mofid, logistics property researcher at Savills, said he suspected efforts to use suppliers closer to home had been “much more pronounced” in the UK, where trade with Europe had been complicated by Brexit. About 70 per cent of the UK’s food and animals are delivered from the EU.

“Increased paperwork [has created] delays in a time-sensitive supply chain . . . so you have to add an extra step,” Mofid said.

The move by food producers is also an example of how some businesses now wish to manufacture more locally after the Covid-19 pandemic hit supply chains, he added.

Clive Black, an analyst at Shore Capital, said fast-growing retailers, such as supermarkets Aldi and Lidl, as well as Amazon’s food business, have been eager to acquire more distribution centres.

He said growing demand for space could be a “knee-jerk reaction” to recent food security issues, or it could reflect a “realisation that outside of the EU, the UK needs a more solid logistics base”.

Savills said recent warehouse deals included a Rochdale facility acquired by pork producer Danish Crown and a distribution centre that US-listed avocado business Mission Produce expects to start using in April.

Paul Frowde, managing director of European sales at Mission Produce, which plans to use the facility in Dartford to ripen avocados from South America, said it would help support UK food supplies.

“The rather interesting [UK shortages of] peppers and cucumbers have brought [food security] to attention,” he added.

The move by food producers bucks the trend for overall demand for warehouse space, which dropped 13 per cent to 48mn square feet last year as falls in consumer spending prompted retailers to cut back on storage.