Kristina Bluwstein, Sudipto Karmakar and David Aikman

Introduction

Inflation reached almost 9% in July 2022, its highest reading since the early 1990s. A large proportion of the working age population will never have experienced such price increases, or the prospect of higher interest rates to bring inflation back under control. In recent years, many commentators have been concerned about risks to financial stability from the prolonged period of low rates, including the possibility of financial institutions searching for yield by taking on riskier debt structures. But what about the opposite case? What financial stability risks do high inflation and increasing interest rates pose?

Maintaining financial stability means looking out for low probability high-impact events like financial crises and devising policies to prevent and mitigate these ‘tail’ risks from materialising. There is no simple method for measuring tail risks – but in recent years researchers have begun exploring an approach called ‘GDP-at-Risk’ as a financial stability metric. The idea in a nutshell is to model the relationship between indicators for the health of the financial system, including the strength of household and corporate balance sheets, and the probability of experiencing a very severe recession. A typical finding is that when the risk appetite in the financial system increases, the risks of a severe recession over the next three years or so also increase.

Our recent research paper present a novel model of GDP-at-Risk. We apply it to answer the question of how a fairly persistent rise in inflation would affect financial stability. Just to emphasise, this is a ‘what if’ scenario rather than the most likely outcome for the economy.

We find that higher inflation and interest rates increase financial stability risks in the near term, as higher rates put pressure on debt-servicing costs. This in turn means greater risk of ‘debt deleveraging’ by heavily indebted households and firms, who may be forced to reduce their spending in order to meet their debt obligations, potentially amplifying any recessionary effects. There is also a risk of higher loan defaults eroding banks’ equity capital, which could lead banks to tighten lending conditions. However, this effect is small in our model given the size of banks’ capital buffers. Interestingly, financial stability risks actually fall in the medium term, as the increase in Bank Rate allows for greater scope to cut interest rates in any future stress.

A model of GDP-at-Risk

We build a novel macroeconomic model with financial frictions to study the drivers of GDP-at-Risk. The model is grounded in the New Keynesian tradition: inflation dynamics are driven by the output gap and cost push shocks via a Phillips curve; monetary policy works by altering the real interest rate via an IS curve.

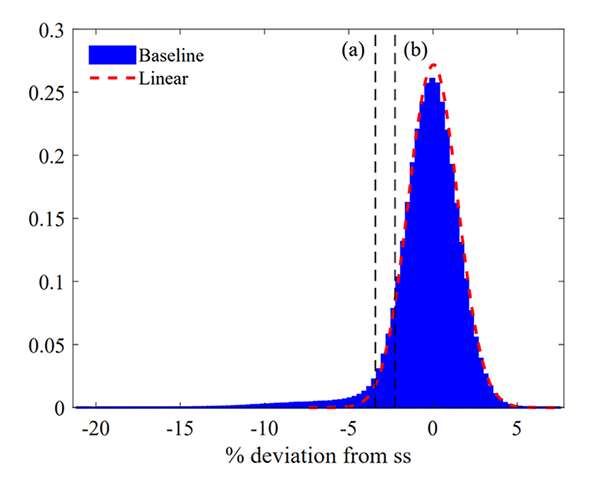

We augment the model to include nonlinearities associated with three occasionally binding constraints: (a) an effective lower bound on interest rates, which reduces the capacity of the central bank to cushion shocks; (b) a bank capital constraint, which creates the potential that banks may restrict lending sharply (ie a credit crunch) when their capital position becomes impaired; and (c) a debt-service constraint, where households and companies deleverage sharply when their debt-service burdens become too large. The model is calibrated to match salient features of the UK economy.

To characterise tail risk, we focus on the 5th percentile of the GDP distribution. To measure this, we simulate the model a large number of times, sort the predicted GDP outcomes according to their severity, and find the drop in GDP that is only exceeded in 5% of the simulations. This is akin to the concept of ‘value-at-risk’ used in financial risk management. We do this for different forecast horizons and focus especially on GDP-at-Risk at the 3–5 years horizon, as this provides policymakers with sufficient time to recognise risks and apply macroprudential tools to head off any build-ups in vulnerabilities found.

Non-linearities lead to a fat-tailed GDP distribution

Chart 1 plots the distribution of GDP (relative to trend) from this model. The distribution is asymmetric and has a pronounced left tail. The point (a) is the GDP-at-Risk in our baseline model, while (b) represents the GDP-at-Risk in the linear model. The fat tail reflects the possibility of one or more of the three occasionally binding constraints amplifying the effects of negative shocks, triggering a deep recession. This fragility of the model is absent in standard, linear New Keynesian and Real Business Cycle models, meaning that standard models underestimate the risk of a large recession.

Chart 1: Model implied GDP distribution

In some situations, the constraints in the model interact with one another to make recessions particularly severe – these are the circumstances in the far left-hand tail of the GDP distribution in the chart. For instance, when interest rates are very low, banks are less profitable and find it harder to replenish their equity capital making the financial system prone to bank credit crunch episodes. Similarly, when indebtedness is very high, debt deleveraging episodes will be more common and the deflationary consequences of these episodes makes it more likely that monetary policy will be trapped at the lower bound.

Inflation and tail risks: a thought experiment

To understand how inflation affects GDP-at-Risk in our model, we perform a thought experiment: we feed in a persistent inflation shock into the model, which results in inflation of 8% at the end of 2022, 5%–6% in 2023–24 and remaining at target through mid-2026. The monetary policy response is modelled very stylistically via a simple Taylor Rule, which responds to inflation by increasing the policy rate substantially in 2023. We then draw other shocks randomly and use these to simulate the model. Given the simplicity of the model and the purely hypothetical assumptions about the path of inflation, this should be viewed as a ‘what if’, illustrative scenario rather than the most likely outcome for the economy.

The predicted impact of this scenario on GDP-at-Risk is shown in Chart 2, which plots the 5th percentile of GDP in the scenario compared to a baseline where the economy is growing at trend. Overall, high inflation is unambiguously bad news for financial stability risk over the next 2–3 years. The model predicts a significant decline in the 5th percentile of GDP, compared to prevailing conditions, in the next 4–8 quarters. While around half of this would be captured by standard macroeconomic models (dark blue bars), the rest is amplification from the risk of higher interest rates pushing some borrowers’ debt burdens into unsustainable territory leading to abrupt ‘belt tightening’ (green bars). Banks do little to amplify this shock because their capital buffers can absorb the increase in defaults without triggering concerns about their solvency (yellow bars, barely visible). Eventually, by 2025 GDP-at-Risk is back to baseline – and even improved – as these recessionary forces are offset by the benefit of having more monetary policy headroom to cushion other adverse shocks in the future (light blue bars).

Chart 2: GDP-at-Risk forecast decomposition following a persistent inflation shock

Policy implications

Our model is highly stylised and its quantitative predictions should be treated with caution. There are, however, some insights from this exercise that will be of potential interest to policymakers concerned with addressing financial stability risks in the period ahead.

First, the banking sector does little to amplify the effects of an inflation shock in our model. This reflects the build-up in capital ratios over the past decade via Basel 3, stress tests and other measures, which means that banks appear resilient to inflationary shocks. Given this, there would be little additional benefit to raising bank capital requirements further in our setting. This channel would matter more, however, if banks’ ‘usable’ capital buffers were smaller than we assume.

Second, our model highlights that the main downside risks from a persistent inflation scenario stem from debt deleveraging by borrowers facing increased debt-servicing costs alongside a broader cost of living squeeze. This is a particular issue given the large outstanding stock of private sector debt. These risks will need to be monitored closely in the period ahead.

Kristina Bluwstein works in the Bank’s Monetary and Financial Conditions Division, Sudipto Karmakar works in the Bank’s Financial Stability Strategy and Projects Division, and David Aikman works at King’s College London.

If you want to get in touch, please email us at bankunderground@bankofengland.co.uk or leave a comment below.

Comments will only appear once approved by a moderator, and are only published where a full name is supplied. Bank Underground is a blog for Bank of England staff to share views that challenge – or support – prevailing policy orthodoxies. The views expressed here are those of the authors, and are not necessarily those of the Bank of England, or its policy committees.