Climate change and the war in Ukraine are set to keep food prices at far higher levels than before the Covid-19 pandemic, despite signs of moderation in global commodity markets, economists and agriculture experts have warned.

Wholesale food prices have stabilised over recent months, raising hopes that the surge in the retail cost of staples such as rice, bread and milk seen in the past two years would diminish in 2023.

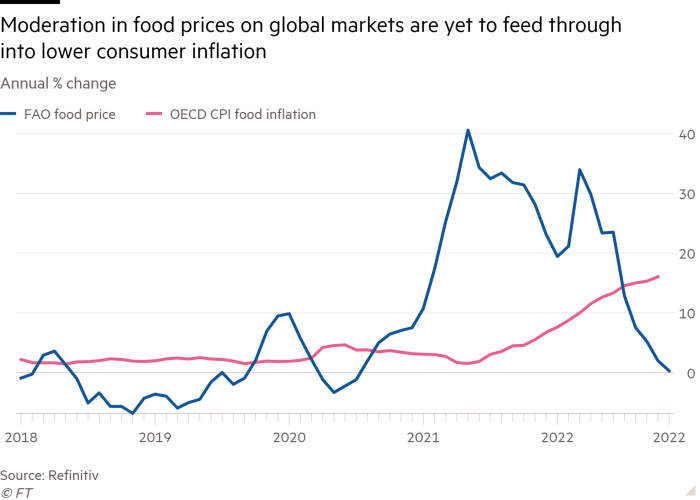

The latest update of the food price index of internationally traded agricultural commodities, compiled by the UN Food and Agricultural Organization (FAO), published on Friday, posted its eighth consecutive monthly decline in November since peaking in March. The November index showed prices were just 0.3 per cent higher than a year earlier.

However, the stabilisation in international markets is yet to translate into lower inflation for households around the world.

Even if this does happen over time, costs are likely to remain well above pre-pandemic levels as the war and weather events limit producers’ ability to take advantage of higher prices by increasing supply.

“Normally the cure for high prices is high prices,” said Carlos Mera, senior analyst at Rabobank. “We do see weakness in demand, but production has not been very elastic.”

After several years of bumper crops thanks to favourable weather conditions, grain prices firmed during the pandemic because of hoarding by consumers, companies and governments. Even before Russia’s February invasion of Ukraine, which caused prices to spike because of the importance of both countries in producing commodities such as wheat, persistent droughts in key growing regions had pushed prices higher.

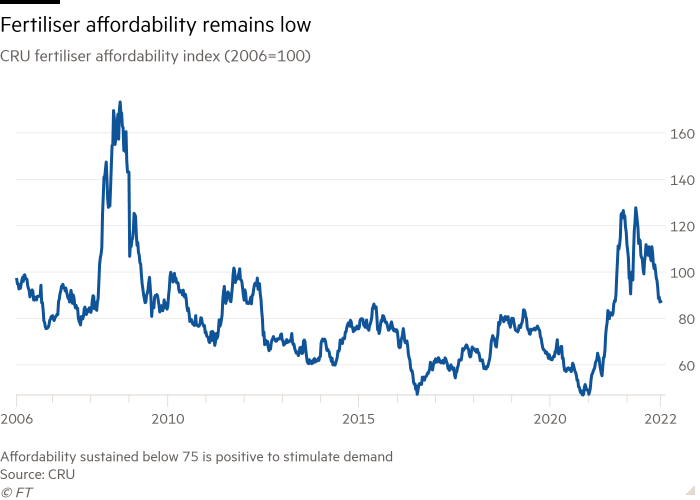

Both the Ukraine conflict, which has raised the cost of fossil fuels and energy-intensive fertiliser production, and the third year of the La Niña weather phenomenon — the cause of severe droughts in the US, Argentina and Europe — have hit farmers, curbing their ability to increase output.

“The supply response has been slow. Farmers around the world are applying less fertiliser, and in places such as Africa, this will lead to lower production,” said Josef Schmidhuber, deputy director of trade and markets at the FAO, which expected grain production to be lower next year than in previous years.

The FAO is also concerned that there could be a global rice shortage next year if producers fail to find enough fertiliser.

“A fall in global cereal production for the current agricultural year, and input cost pressures, will keep food prices elevated in the near future,” said Ervin Prifti, senior economist at the IMF.

Fertiliser prices started soaring even before the war as Russia curtailed supplies of gas, the main feedstock, to Europe last year. Prices of potash jumped after Western governments imposed sanctions against Belarus, one of the world’s largest producers of the crop nutrient, after Minsk violently quashed anti-government protesters.

Although costs have fallen back from the peak, prices remain high by historical standards and data from consultancy CRU show fertiliser remains unaffordable for many.

Russia’s invasion has affected three Ukrainian crop cycles so far. The 2021 harvest was prevented from leaving the country once the war broke out. The 2022 crops faced harvest and infrastructure issues, with key areas becoming war zones. Next year’s crop yields are expected to fall sharply.

“That’s equivalent to three back-to-back droughts,” said Joseph Glauber, senior research fellow at food security think-tank IFPRI and former chief economist at the US Department of Agriculture.

The prospect of higher global wholesale food prices comes as most countries around the world are struggling with increased consumer food price inflation. Across the G7, food costs for consumers have risen by 12.7 per cent on average over the past year. Many middle income and developing countries have reported even higher numbers — from more than 40 per cent in Hungary to nearly 100 per cent in Turkey.

“It may take up to two more quarters before we see reductions in domestic food inflation,” Prifti said.

Katharine Neiss, chief European economist for PGIM Fixed Income, a fund manager, said lower wholesale prices would not feed through into retail costs quickly as food production was very energy intensive, with the impact of higher oil and gas prices resulting from Russia’s invasion of Ukraine lingering.

Consumers in emerging markets and developing economies, who typically spend a relatively large proportion of their income on food, are particularly exposed.

Many countries in Africa and the Middle East are reliant on the Black Sea region for imports and tend to have weaker and more volatile currencies. Most global food commodity transactions are priced in dollars, potentially amplifying the effect of higher costs on domestic food prices.

Although the extension in November of the Black Sea grain deal between Russia and Ukraine, which ensures at least some of the country’s food commodities reach international customers, has lowered the risk of further price spikes, geopolitical conditions remain precarious.

Meanwhile, measures used by economists and traders to assess the availability of commodities, such as the stock-to-use ratio, indicate supplies of wheat at the lowest level in more than a decade.

“I don’t think we’re out of the woods yet,” said Glauber.

Prifti agreed. “It remains uncertain how the combination of harvest disruptions, energy prices, and monetary policy will play out,” he said. “However, things could get worse before they get better.”

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here