Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Paying for everyday transactions with a tap, swipe or click of a card or phone is convenient. But it is not cost-free.

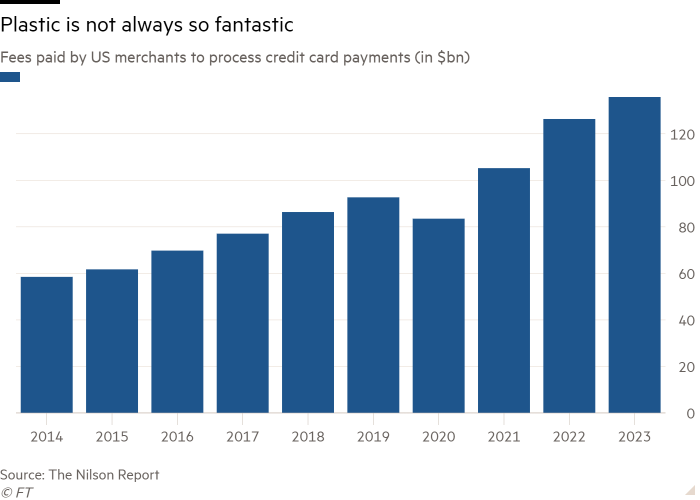

In the US, merchants paid a record $172bn in processing fees to accept $11.2tn in card payments last year, according to the Nilson Report. The bulk of those so-called swipe or interchange fees — about 79 per cent — was from credit cards.

A landmark class action settlement this week wants to change that. Visa and Mastercard — the country’s two biggest card payment processors — have agreed to lower the fees that merchants pay to accept credit card payments. Under the proposed deal — which must be approved by a judge — these fees will be reduced by at least 0.04 percentage points for a minimum of three years and capped for five years.

Retailers say the settlement would save them $30bn over five years. But investors in Visa and Mastercard can rest easy. Their high-margin business model remains intact.

Visa and Mastercard set interchange rates, which can average between 2-4 per cent of the transaction amount. But they only get a small slice of this. In a $100 purchase, for example, a shop might pay 2.5 per cent — or $2.50 — in fees to accept a credit card payment. Of this, Visa or Mastercard, which operate the networks that connect cardholders with banks and merchants, collect perhaps 20 cents. The lion’s share of that fee — about $1.80 — goes to the bank that issued the credit card that is being used. Another 50 cents is collected by the merchant acquirer, or companies such as Block or Stripe that provide the shop’s point-of-sale service system.

The settlement does not specify from whose cut the 4 bps decrease in interchange fees will come. The odds are it will be coming from card-issuing banks such as JPMorgan, Citigroup or Bank of America rather than Visa or Mastercard.

Banks have plenty of ways to offset lower interchange fees. They can make up the revenue shortfall by raising annual card membership fees and interest rates, or roll back rewards for cardholders.

Under the settlement, merchants are not required to pass on the savings from lower fees to consumers. They can also charge different prices to consumers based on which credit card they use. Credit card holders accustomed to fancy perks are in for a rude awakening. They end up paying for all those card points, miles and cashback — one way or another.