Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. Cocoa has gone parabolic. Futures prices broke $10,000 yesterday after trading in the $2,000 range a year ago, driven by climate, disease and under-investment in plantations. Unhedged, a publication powered by peanut M&Ms, has begun hoarding supply. If we are forced to downgrade to Fig Newtons, expect writing quality to suffer. Email us your chocolate alternatives: robert.armstrong@ft.com and ethan.wu@ft.com.

Reddit and the limits of equity analysis

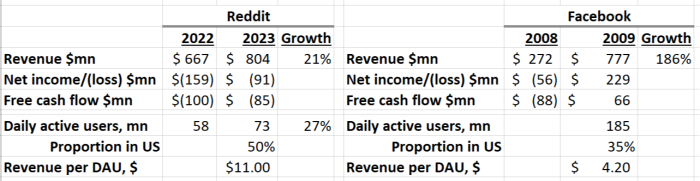

Here is a not especially useful comparison:

That’s Reddit in the past two years, compared with Facebook when it was roughly the same size in revenue terms. One might notice a lot of interesting differences. Facebook was already generating cash profits in 2009, and its growth rate was much higher, but Reddit is generating many more dollars per user than Meta was back then. Adding more details to the comparison would uncover other suggestive points of difference. You might also bring in valuation, noting that Reddit is trading at 13 times trailing revenue, right where Meta was after its 2012 IPO, and so on.

None of these details will matter much. I remember working as an analyst during Google’s IPO in 2004 and a financial journalist during Meta-née-Facebook’s IPO eight years later. I remember some of the things I said about each company. But I’m not telling you what they were, because it would embarrass me to do so. Suffice it to say that when Facebook IPO’d, the big worry in the analytic establishment was whether it could monetise on mobile devices. That did not turn out to be a problem:

That is Meta back when it was Reddit’s current size compared with today. It has compounded free cash flow at more than 50 per cent a year. The only possible response to this is awe.

It is possible to build a model that estimates what Reddit’s number of active users, revenue per user and cost base will be in five or 10 years. Lots of people are doing this now. Somebody’s model may turn out to be almost right. But in an important sense there is only one question that matters, and it’s not about numbers: can Reddit become a global phenomenon on the model of Meta, or even close? If so, its current $10bn valuation is a bargain.

Or will Reddit end up like Twitter/X and Snap, which are big but not as big as Meta, and have struggled to turn users into money as efficiently as Meta has? What, broadly, has made the difference? I confess that I do not know how to answer those questions — which are not financial questions in any meaningful sense — in a disciplined way. And I’m slightly sceptical that anyone else knows how to do it, either. But I’m open to suggestions.

The Trump Spac looks a little expensive

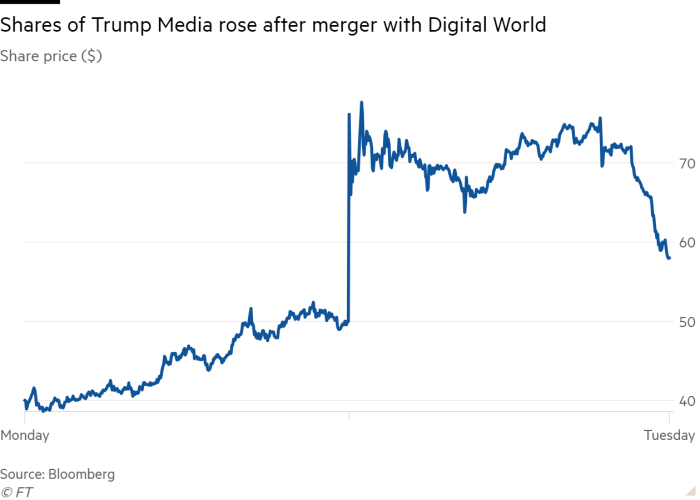

Donald Trump’s media company, Trump Media & Technology Group, began public trading yesterday after shareholders blessed its merger with a special-purpose acquisition company. The share price rose before tailing off at the end of the day:

A price of $60 implies equity value of $12bn, for a company with current revenues of just a few million. Over at Lex, our colleague Sujeet Indap notes the contrast with Reddit, with a $10bn market cap against $1bn of revenue. He writes: “TMTG looks like a rightwing meme stock combined with the classic pathologies of the Spac bubble”.

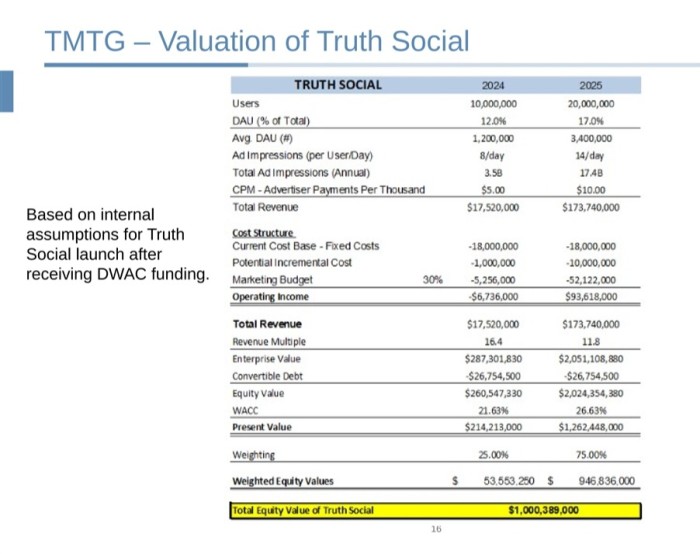

Sounds about right. But it got us wondering: what hypothetical financials would justify a $60 stock price? As a starting point, we had a look at a December 2023 investor presentation prepared for the Trump Spac, which includes this helpful valuation exercise for Truth Social, the social media network owned by TMTG:

Even this $1bn equity value figure — a 12th of the current market value — requires strong assumptions. The company doesn’t release user numbers (“adhering to traditional key performance indicators . . . could potentially divert [our] focus”, it says). Similarweb puts Truth Social’s monthly active user count at less than 1mn; the table above assumes average daily active users top 1mn this year, and nearly triple that in 2025. CPM, how much an advertiser pays per thousand ad impressions, is projected to hit $10 in 2025. According to Gupta Media, an ad agency, a $10 CPM is higher than TikTok or YouTube has received in the past three years, and in line with the highest CPMs Meta has recently earned.

But still, the above valuation is nowhere close to a $60 share price. We’ve reproduced TMTG’s valuation exercise — adding its separate $319mn equity value projection for Truth+, a not-yet-launched conservative streaming service that the company expects will reach $312mn in revenue by 2026. Adding $1bn for Truth Social to $319mn for Truth+ and dividing by the fully diluted share count of 205mn gets you to $6.44 per share.

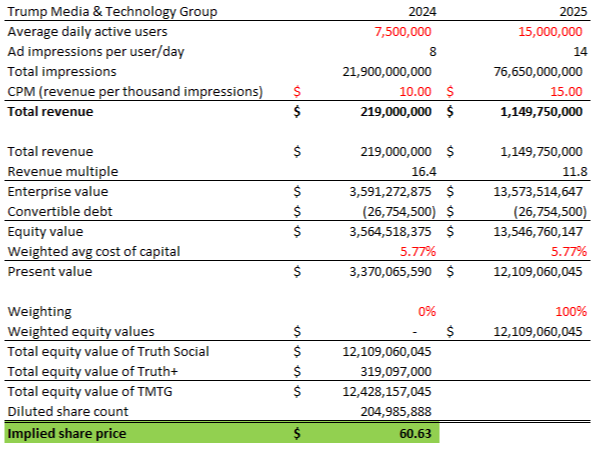

To get to $60, we must be bolder:

-

Similarweb reports that Truth Social’s total website visits hit 5mn last month. Let’s assume every single monthly site visitor became a daily active user, and then the DAU count more than doubles the following year. That pushes 2024 revenue to $73mn and 2025 revenue to $639mn. But the implied share price remains at just less than $20.

-

Next, suppose that by 2025 Truth Social manages to charge advertisers 50 per cent higher CPMs than Meta did at its recent peak. Assuming a $10 CPM in 2024 and $15 CPM in 2025 gets you to a $30 share price.

-

Getting rid of the company’s 25/75 weighting of 2024 and 2025 results, and shifting all weight to 2025, boosts the share price a bit, to $36.

-

Donald Trump, famously, hires only “the best and most serious people.” So perhaps his TMTG management team is chock full of world-class fundraisers. Assume, then, that TMTG’s weighted average cost of capital falls from more than 20 per cent to 5-6 per cent, the S&P 500’s average WACC. Even then, we’re only at $51.

At this point in the exercise, Unhedged was struggling to come up with further tweaks (which is why we’re in financial journalism, not the sell side). So we just let user growth rip. Assuming that average daily active users reaches 7.5mn by the end of the year and doubles again in 2025, CPMs are higher than Meta’s and capital is dirt cheap, we finally arrive at today’s $60 share price. The table below shows deviations from the company’s initial projections in red:

FT Alphaville put it well in a recent note to clients on TMTG stock: “To some commentators, a valuation of 1,000 times trailing revenue looks optically challenging. We consider it a reflection of the quality within the shareholder base.” (Ethan Wu)

One good read

In other Trump-related matters, his “big, fluffy and loveable” campaign spokesman.

FT Unhedged podcast

Can’t get enough of Unhedged? Listen to our new podcast, hosted by Ethan Wu and Katie Martin, for a 15-minute dive into the latest markets news and financial headlines, twice a week. Catch up on past editions of the newsletter here.