Stay informed with free updates

Simply sign up to the US equities myFT Digest — delivered directly to your inbox.

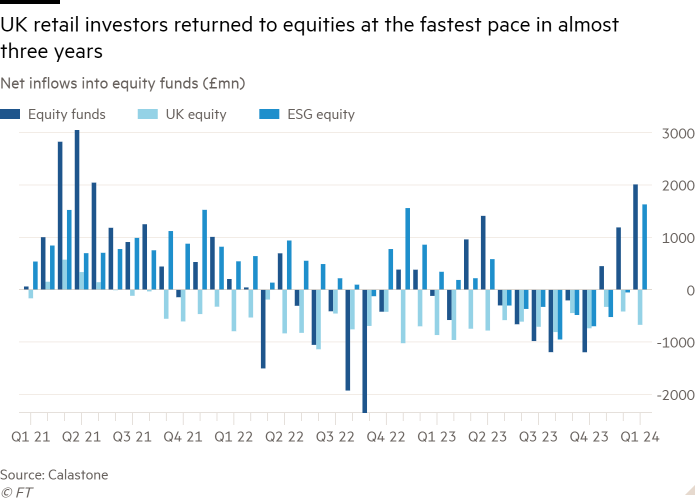

UK investors are putting money into equities at the fastest rate in almost three years, seizing on a global market rally amid optimism that central banks will slash interest rates this year and the US will narrowly avoid recession.

Retail investors have rushed back into riskier assets, with net inflows to equity funds of £2bn, including record inflows of £1.4bn into US equities, according to data from funds network Calastone.

“The markets are convinced that disinflation will bring rate cuts earlier and faster than previously expected, especially in the US,” said Calastone’s head of global markets, Edward Glyn.

“This has driven an equity market rally, particularly among the US tech stocks whose share prices benefit most from lower bond yields.”

Calastone’s figures are not comprehensive but are widely seen as offering a useful snapshot of investment fund flows.

The company said the inflows to equity funds were at their highest level since April 2021, while European funds had the third best month on record with inflows of £470mn.

The S&P 500 has started the year up almost 5 per cent, while the Nasdaq 100 is 6 per cent higher since January 1.

Bullish equity investors nevertheless remained sceptical over the UK equity market, with net outflows reaching £673mn, worse than the average monthly flows in 2023.

The FTSE 100 is down by roughly 1 per cent since the start of the year. UK investors sold down around £12bn of London-listed equities in 2023.

Asia-Pacific equities also saw a ninth consecutive month of outflows, according to Calastone, with the continued decline in confidence in Chinese equities driving investors away. More than 40 per cent of those surveyed at a recent Goldman Sachs conference in Hong Kong said they saw Chinese equities as “uninvestable”.

Abrdn-owned Interactive Investor, one of the UK’s largest investment platforms, said January 2024 was the busiest month for purchasing international shares in almost two years.

“The tech boom of 2023 and into 2024 has encouraged more investors to diversify their portfolios, and demand for US stocks continues to recover,” said its head of equity strategy, Lee Wild.

Hargreaves Lansdown, the country’s largest trading platform, said its investors’ most-bought funds in January 2024 included a Jupiter fund focused on India and global and US indices.

“Sentiment has rebounded since November, with the HL investor confidence index reaching levels not seen since March 2023,” said the platform’s head of money and markets, Susannah Streeter.

“Investors clearly feared missing out on the wave of demand for artificial intelligence products and services,” she added.

“With valuations sky high, the longer-term trajectory of AI is hard to map, and uncertainty about when interest rate cuts will come [means] investors should be braced for some volatility ahead.”