Marko Melolinna

Input/output networks are important in propagating shocks in an economy. For understanding the aggregate effects of shocks, it is useful to know which sectors are central (ie, providing a lot of inputs to a lot of other sectors) and how the central sectors are affected by and propagate the shocks to other sectors. In a new Staff Working Paper, my co-author and I build a structural model incorporating key features of the sectoral production input/output network in the UK, and then use the model to help us understand UK productivity dynamics since the global financial crisis (GFC). We find that the slower productivity growth rates since the GFC are mainly due to negative shocks originating from the manufacturing sector.

We build a model to accommodate production networks…

In our paper, we first highlight some key facts on the production network of the UK economy to motivate our structural model. We show that the UK production network, in terms of the input/output linkages of different sectors, has significant asymmetries. This means that a small number of sectors are very central in the network. We also show that the network changes over time, and there tends to be a positive correlation between real sectoral output and centrality (measured by the so-called ‘weighted outdegree’ (for a precise definition, see Acemoglu et al (2012))) for most sectors. In other words, as sectors become bigger, they also tend to become more central.

Inspired by previous research (see, for example, Atalay (2017) and Acemoglu et al (2012)), we then set up a structural model that could explain these key empirical features of the data. The model includes utility-maximising households and profit-maximising firms. The production network in the model arises because firms in the model can source intermediate inputs from other sectors.

A crucial, and novel, feature of our model is its ability to explain the positive empirical size-centrality relationship mentioned above. Our model is able to do this, because we introduce demand-side shocks in addition to supply-side technology shocks into the model. A positive technology shock to a sector causes output prices of the sector to fall (price effect) and real output to rise (quantity effect). Typically in these types of models, the price effects dominates the quantity effect, implying a negative effect of the technology shock on centrality, and hence a negative correlation between real output (size) and centrality. This goes against the real-world fact mentioned above. However, we show that including a demand shock in the model, we can reconcile the model outcome with the data for most sectors in the UK economy. This is because the demand shock implies positive effects on prices and on real output and hence a positive size-centrality relationship.

…and then use the model to study UK productivity growth by sector

In addition to analysing the empirical and model-implied relationship between size and centrality, we also study the UK’s productivity growth slowdown following the GFC of 2008–09. We do this by casting the slowdown into a production network context in which producer size and centrality play a role. Previous work has focused on decomposing the UK productivity growth ‘puzzle’ in an accounting sense (see, for example, Riley et al (2015) and Tenreyro (2018)). While insightful, such analyses do not identify the underlying shocks, nor do they distinguish idiosyncratic as opposed to common shocks as potential drivers of the growth puzzle. In other words, does the slowdown in UK productivity growth reflect shocks originating from specific sectors, or do they reflect common shocks? In an empirical application of our model, we aim to shed light on this question. We do this by using sectoral value added and employment data. We can filter out model-implied idiosyncratic sectoral shocks as well as a common shock component over time, and then study the contributions of these shocks to aggregate productivity dynamics in the UK.

The UK experienced relatively strong productivity growth prior to the onset of the GFC, with a clear slowdown of productivity growth post-crisis. Many authors have referred to this slowdown as the UK’s productivity growth puzzle. A convenient way to understand the growth puzzle is to think of it as the difference between average post-crisis and pre-crisis growth. Treating the period from 1999 Q1–2007 Q4 as ‘pre-crisis’, and 2010 Q1–2019 Q4 as ‘post-crisis’, we can calculate the size of the growth puzzle to be -0.26 percentage points. In other words, on average, UK productivity growth has been 0.26 percentage points per quarter slower after than before the GFC.

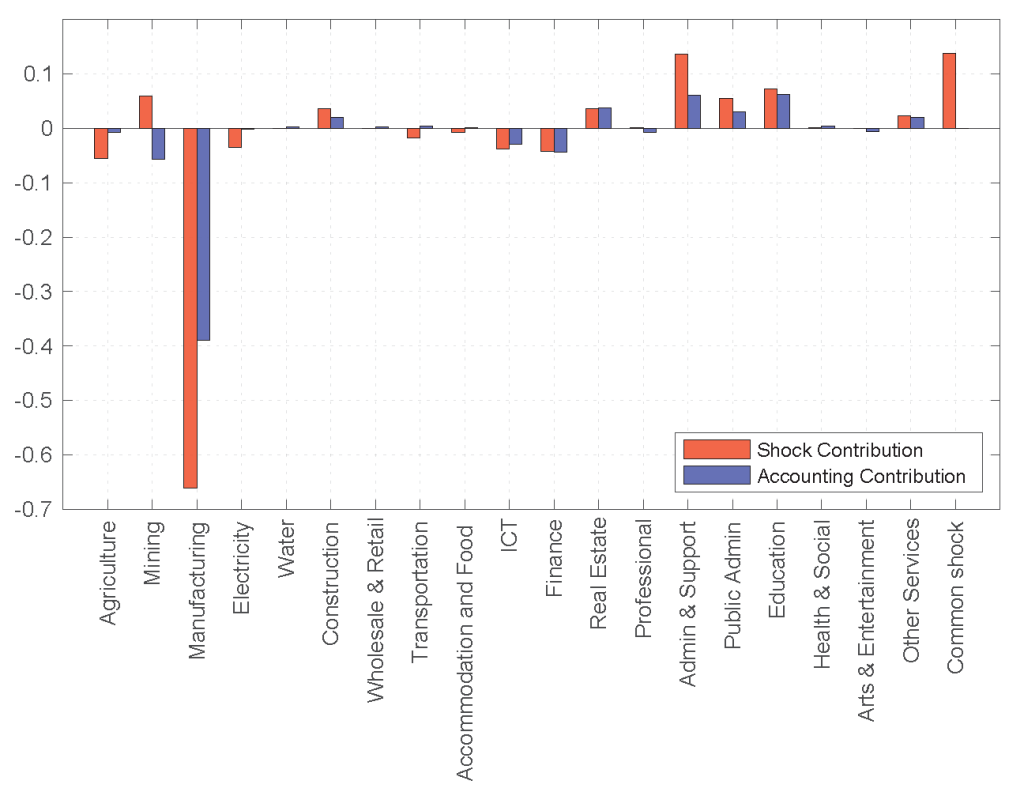

We can carry out an accounting exercise, where we calculate the contribution of each sector to the productivity growth puzzle, depending on the size of the sector and its productivity dynamics. When we do that, we find that the growth puzzle is to a large extent driven by the manufacturing sector (blue bars in Chart 1). Although they are significantly smaller, the negative contributions from finance and ICT sectors are also non-negligible. But importantly, these contributions reflect potentially all underlying shocks, be it industry specific or common. In other words, they do not take into account the propagation in the input/output networks in our model.

In contrast, our model allows us to decompose aggregate labour productivity growth into the contributions from the underlying shocks, including any common shocks. So the total contribution of the idiosyncratic shock to, say, finance will include its effect on aggregate labour productivity via potentially all industries, not only finance.

When we carry out this exercise with our model, we can compare the contributions of idiosyncratic and common shocks to the growth puzzle, to those from the accounting exercise. Overall, our results suggest that industry-specific shocks have been the main drivers of the slowdown seen in UK productivity growth since the GFC, up to 2019. By far the largest negative shock has been seen in the manufacturing sector, which, according to our model, more than explains the aggregate growth puzzle. The red bars in Chart 1 show that the drag from more negative manufacturing-specific shocks post-crisis has been large, at -0.65 percentage points per quarter. The manufacturing sector has made particularly large negative contributions since 2016. In contrast, some sectors, most notably, administrative and support services activities (Admin & Support in Chart 1) and mining and quarrying (Mining) have experienced significantly more positive shocks post-crisis relative to pre-crisis than their accounting contributions (reflecting possibly all shocks) would suggest. We can also see from the chart that according to our model, common shocks have made a positive contribution since the GFC.

Chart 1: Contributions to the growth puzzle: sectors versus shocks (percentage points)

We also study UK productivity dynamics during the Covid-19 (Covid) pandemic by extending the sample to 2020–21. When we look at the contributions of shocks, our model suggests that the initial sharp downturn in 2020 as well as the subsequent jump in the growth of aggregate productivity are primarily attributable to a common shock. This result is intuitive given the nature of the underlying pandemic shock, which entailed broad-based restrictions on social and economic activity. However, given the extreme size of the shock and the volatility in the data, our results for this episode should be interpreted with caution.

In conclusion, our analysis highlights the importance of thinking about linkages between sectors and firms when studying the aggregate impacts of economic shocks. For example, shocks to prices and output in the crude oil extraction industry can have significant consequences for the petroleum production industry, and propagate further to the transport sector. Our model allows us to measure the aggregate effects of such shocks. When we use the model to look at the recent productivity growth puzzle in the UK, we find the role of the manufacturing sector to be much more important than other sectors. Based on the model, common shocks have not been important drivers of the puzzle, although they have driven all the volatility in productivity growth seen during the Covid pandemic.

Marko Melolinna works in the Bank’s Structural Economics Division.

If you want to get in touch, please email us at bankunderground@bankofengland.co.uk or leave a comment below.

Comments will only appear once approved by a moderator, and are only published where a full name is supplied. Bank Underground is a blog for Bank of England staff to share views that challenge – or support – prevailing policy orthodoxies. The views expressed here are those of the authors, and are not necessarily those of the Bank of England, or its policy committees.