Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Yield-curve inversion is the most fun recession indicator. This is mostly because of the still-inexplicable fact that 2019’s inversion was followed by a recession caused by Covid-19, the blackest of black swans.

Also because whenever the yield curve inverts, academics and Wall Street strategists come up with increasingly baroque reformulations of the classic 2s10s curve, meant to 1) be more accurate and 2) say everything is probably OK. The Federal Reserve, for example, came up with a way to measure inversion that flashes red when interest-rate cuts are expected in one quarter.

Both the basic yield curve and the fancy yield curve have been inverted for more than a year now, and yet no recession has arrived.

Now TS Lombard’s Steven Blitz is proposing his own version, and it’s less baroque (no adjusting “shadow rates” for “financial repression” or anything) and rather . . . real-er.

Instead he points to the “real yield curve”, or the inflation-adjusted curve. Unlike the nominal yield curve, the US’s real yield curve has only been inverted for about a month. From Blitz’s Thursday note, with his emphasis:

In sum, the inverted yield curve has yet to deliver a recession because the real curve has only just inverted. This is, in many ways, a repeat of the policies that led to the 1969 recession and, in turn, the great inflation of the 1970s. Then, the real curve only turned negative after the nominal curve had been inverted for 13 months — against a backdrop of increased procyclical fiscal spending. The real curve is now inverting after 12 months of a nominal inversion, and I expect some further slowdown in credit extensions. Credit issues are now coming to the fore, notably CRE. This sector has, however, been more impaired by shifting work patterns than the level of interest rates, real or nominal.

The history of the real-yield curve heading into recession is pretty interesting as well:

The eerie 2019 inversion aside, Blitz points out that the yield curve predicts recession through a pretty clear mechanism. It’s the same simple logic that explains how rate hikes are transmitted through the economy: lenders and investors have less reason to take risks when they can be compensated for holding safe short-dated assets.

He explains:

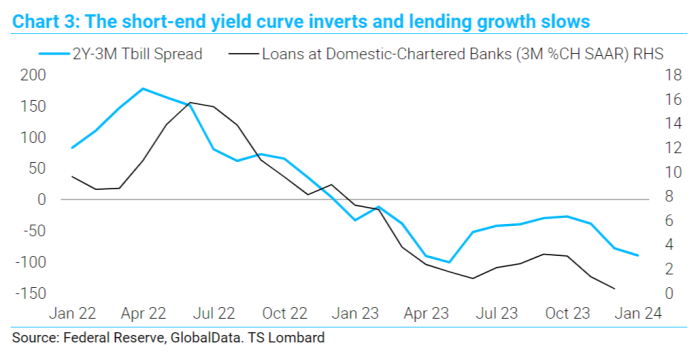

Inverted yield curves slow the economy into recession by increasingly compensating investors and intermediaries not to take risk — it is not magic. Banks, for example, slow lending as the return on reserves and T-bills increasingly outpaces yields on two-year Treasurys (Chart 3) (Pre 2008 it was the cost of funding versus the return on lending, now that reserves pay a market yield, it is a risk free asset that competes with the return on loans.) The current nominal inversion has slowed lending growth, perhaps loan growth turns negative now that the real yield curve is inverted.

… and shows that US bank lending has slowed since the nominal yield curve inverted:

So why are market watchers just noticing this now?

Well, it’s pretty rare historically that the inflation-adjusted/real yield curve inverts after the nominal yield curve. Usually the real yield curve inverts first. (They inverted at the same time in 1980.)

Also from TS Lombard, with our scribbled emphasis:

He cites the 1969 example as a cautionary tale for policymakers, as Fed officials were “trying to reverse inflation without creating a recession.”

His takeaway:

If the inverted real curve stands, a recession will occur — but the curve may yet need to invert more as the real funds rate rises (passively, at first). As for inflation, the Fed is right to be concerned that current disinflation could prove somewhat illusory if growth continues apace. In short, real yields and the curve are finally restrictive enough to lead the economy to recession sometime in the next 7 to 12 months.