This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. On Friday I wrote that “if the jobs report comes in much stronger than the consensus estimate of 195,000 new jobs, there might be a bit of a market freak out.” The number came in at 339,000, and the market freaked out. To the upside. The S&P rose 1.5 per cent, its biggest daily gain since April. Maybe the debt ceiling agreement the day before mattered more to investors than the threat of more rate increases? Maybe the market took solace from the decline in hourly wages, coming as it did on top of large downward revisions to the wage component of first-quarter GDP? Maybe it was bearish positioning? Or maybe Armstrong just plain got it wrong. In any case, email me: robert.armstrong@ft.com.

Subprime auto debt & junky junk bonds

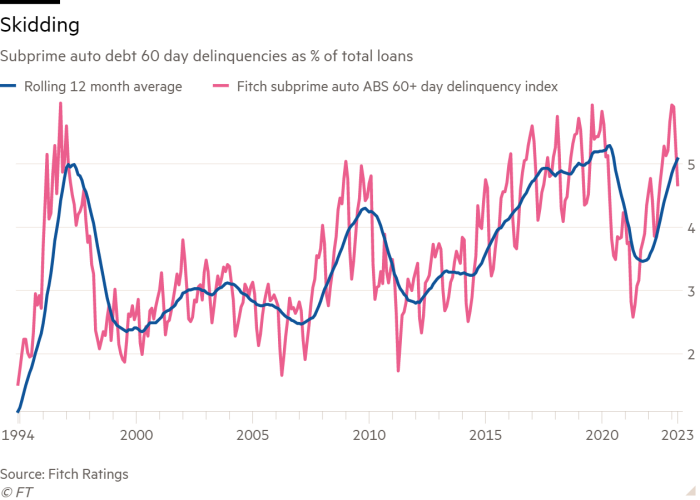

There is, as Unhedged has pointed out recently, something amiss with the low-end US consumer. And if the trouble is going to spread it seems likely that it might spread to auto credit — the kind of debt that many Americans in the lower income deciles have little choice but to carry. The closest thing to timely data on subprime auto debt we’ve found is Fitch’s index of 60 day delinquencies in the subprime auto-backed securities they rate. The numbers go through April:

Delinquencies are now running along at pre-pandemic highs and the trend is sharply up. Jenn Thomas, portfolio manager at Loomis Sayles and Unhedged’s favourite consumer debt expert, tells us that the stress in subprime auto is concentrated in the more recent vintages — loans taken out in 2020 and 2021.

While the trend has gotten a little better recently, this is because the borrowers in these vintages who got into the worst trouble have defaulted on their loans and been removed from the asset-backed securities’ underlying loan pools. Rather than defaults reaching recessionary levels, Thomas says, what we are seeing is borrowers “playing games again”: falling into early delinquency but paying just enough just in time to avoid repossession, and so on. But demand for subprime auto ABS remains very strong, she says: “It is hard not to like over a 5 per cent yield for two year paper.”

We’ll be watching the delinquency numbers closely. Meanwhile, is something similar happening with the lowest-quality corporate bonds? Well, maybe — just. Bank of America’s Oleg Melentyev reports that 10 US high yield issuers defaulted on $7.2bn in bonds in May, a 7.3 per cent annualised default rate and a notable acceleration from the 2.3 per cent default rate over the past year (according to Moody’s, there were 20 defaults in the entire first quarter). Here, from Melentyev’s team, is a chart of the default rate through the end of March. Notice that the ex-energy default rate (the brown line) is still below the levels of 2016-2018:

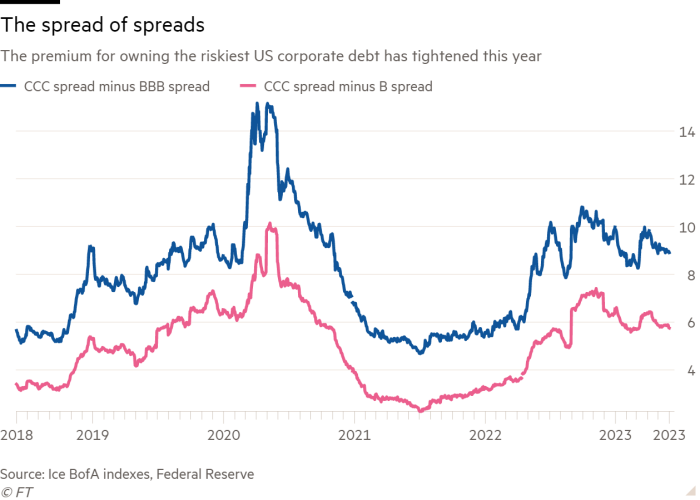

Melentyev also notes that yield dispersion (defined in high yield as the percentage of bonds that are trading 4 percentage points or more away from the benchmark index yield) has been rising. Over 50 per cent of CCC (the riskiest junk) bonds now trade that far off the index, up from a low of under 20 per cent in 2021. The market is discriminating more between “good bad junk” and “bad junk”. Finally, recoveries (the amount bondholders receive in case of a default), at about 30 cents on the dollar, are “near historical lows”.

Is the market responding to these stress signals by demanding bigger discounts to own the riskiest debt? Bloomberg reports that, looked at on a global basis, it is:

The riskiest corporate bonds are dropping as signs of economic weakness spread, raising the spectre of more defaults and distress.

Debt from companies rated CCC — the lowest tier of junk — fell by the most in eight months in May, led by a 23% plunge in Chinese bonds. It’s expected to remain under pressure from rising interest costs, declining earnings and dwindling access to capital as the economies of Europe, China and the US sputter.

“Buying CCCs now is playing with fire,” said Hunter Hayes, portfolio manager of the Intrepid Income Fund.

This is emphatically not happening in the US, however. US CCC spreads over treasuries narrowed over the last several months. Furthermore, the difference in spread between US CCC debt and both single B (slightly less risky junk) and BBB (the lowest rung of investment grade) debt has been narrowing since late last year. In other words, the premium for owning the very riskiest US debt is narrowing:

The US corporate debt market does not appear to be pricing in much recession risk. This may be because the market is under supplied with bonds, as my colleague Harriet Clarfelt has written. Melentyev thinks that the market is stuck where it is in part because, in a highly disperse junk bond market, the “good stuff is already tight [expensive]; and difficult stuff gets no bid.” All the same, the pattern of fundamentals weakening at the margin while prices stay firm is similar to what we see in equities. There is risk appetite out there.

Shadow banks in Europe

Usually Unhedged keeps its attention squarely on the US. But even for US investors, the European Central Bank’s financial stability report, and in particular the section on shadow bank risks, is worth reading.

The basic points made in the report are familiar enough. Non-bank financial institutions — investment funds, pension funds, money market funds, insurers — are growing much faster than banks. With higher interest rates, there is a possibility they will face withdrawals and liquidity shortfalls, especially since shadow banks increased exposure to illiquid assets like real estate during the low-rate era.

Importantly, the report notes, there are significant links between the non-bank financial system and banks — in particular, the former owns a lot of the latter’s non-deposit liabilities, including almost all of European banks’ convertible bonds. “Significant outflows from such investment funds may trigger sales of securities issued by banks and other financials. This could amplify the negative impact of price pressures on bank funding markets.”

The risks are not theoretical: we have already seen micro-crises where some combination of leverage and illiquidity at non-bank institutions have set off tremors in wider markets. The ECB provides this handy table, which serves as a sort of glossary of how things can go wrong:

Ian Harnett at Absolute Strategy Research — who was kind enough to point out the ECB report to us over the weekend — notes that essentially all the growth in financial asset holdings since the crisis has happened outside of the banking system. Non-banks now hold well over half of Euro area financial assets. This makes the ECB report, in his words, “uneasy reading.” The next European financial mess is unlikely to start at a bank.

One good read

Germans are eating a lot less sausage.