Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Thames Water said its shareholders will no longer provide £500mn of fresh equity by the end of the month, intensifying fears over the future of the UK’s largest water company.

Shareholders, which include Chinese and Abu Dhabi sovereign wealth funds as well as UK and Canadian pension funds, fear that conditions imposed by industry regulator Ofwat had made the business “uninvestible”, Thames Water said following crisis talks on Wednesday night.

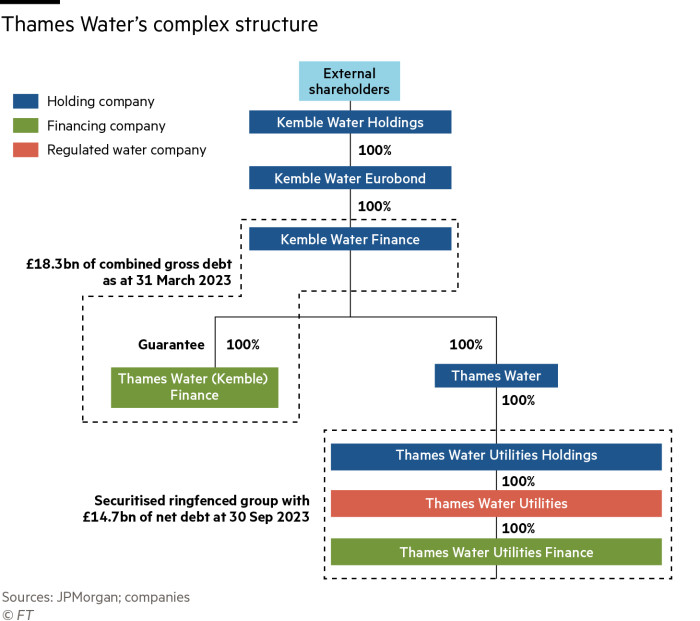

The £500mn was the first part of a commitment made by shareholders last July to inject £750mn this year into Thames Water, which is saddled with an £18.3bn debt pile, faces fines over sewage discharges and needs billions of pounds to overhaul its ageing infrastructure.

Thames Water has been lobbying Ofwat to agree to steep increases in water bills as well as concessions on regulatory fines and an agreement that it can continue to pay dividends.

The unwillingness of shareholders to provide fresh funds raises the prospect that Thames Water, which supplies about a quarter of the UK’s population, could be temporarily nationalised under the government’s special administration regime.

Chris Weston, the utility’s chief executive, told Radio 4 that special administration was “a long way off” and could be avoided if shareholders agreed to provide funds. The company said it had £2.4bn of cash and other financing facilities on hand.

In a sign of the stand-off between shareholders and the regulator, Ofwat on Thursday urged Thames Water to “pursue all options to seek further equity for the business to turn around the performance of the company for customers”.

Thames Water shareholders hit back at Ofwat, accusing it of failing to provide the “necessary regulatory support” for a business plan that would have “addressed the root cause of Thames Water’s challenges without the need for taxpayer funding”.

Privatised by Margaret Thatcher’s government in 1989, Thames Water has come under growing financial strain as higher interest rates add to the cost of servicing its debt.

The utility is under pressure to upgrade its ageing infrastructure, faces fierce public criticism and is wrestling with the challenges to its business from climate change.

Talks with Ofwat and other stakeholders were continuing, the company said, adding that it would pursue all options to secure new investment “from new or existing shareholders”.

Thames Water was plunged into turmoil last June when chief executive Sarah Bentley quit after a boardroom dispute over its turnaround plan. In December, Thames Water announced that Weston, a former head of British Gas, would be her permanent replacement.

The company said it still hoped to agree a business plan with Ofwat that was “affordable for customers, deliverable and financeable for Thames Water, as well as investible for equity investors”.

Thames Water has already received £500mn from shareholders in the form of a loan to its parent company, Kemble Water. Kemble Water said on Thursday that shareholders’ refusal to provide fresh funds means it would no longer be able to make further interest payments on a £190mn loan that is due by the end of April.