Higher supermarket prices in the west mean people elsewhere are going hungry. War, extreme weather and rising input costs are exacerbating food insecurity. In China, a vast population relies on imports to survive.

Syngenta aims to reduce that dependence. Results out on Wednesday revealed that its Chinese seed and chemical business was flourishing.

ChemChina acquired the Swiss-based business to advance China’s agriculture in 2017. The owner now plans to list a 20 per cent stake in its subsidiary. The Shanghai stock exchange is reviewing an initial public offering plan, a sign that a deal may only be months away.

China’s growing dependence on food imports is a problem of success. Higher living standards have increased consumption, but China has just one-tenth of the world’s arable land.

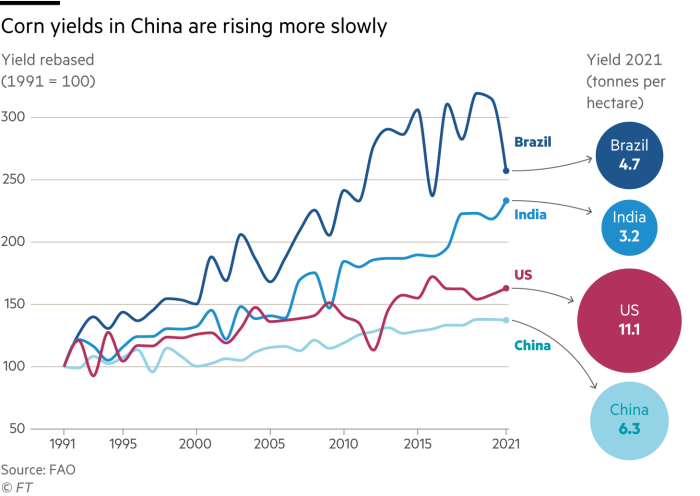

The nation meets about 35 per cent of domestic demand from imports, much of them from Brazil and the US, where geopolitical tensions are rising. China must urgently raise yields in crops such as corn and soyabean.

Syngenta’s strong position in China means it is outpacing peer companies within chemical conglomerates Bayer and BASF. Its sales rose 18 per cent to $33.4bn last year. The bulk of those are from core crop protection and seed businesses. Generic pesticides business Adama also sits within the group. Its ebitda margin of 13 per cent is below the 16.7 per cent total.

What might Syngenta be worth? US-listed Corteva is the best comparator. Shares have more than doubled since listing in 2019, valuing the specialist at 11.5 times expected ebitda. Assuming Syngenta’s growth moderates, that values the core business at $55bn including net debts. Separately listed generic pesticide business Adama adds a further $5bn of enterprise value.

Some global investors will shy away from the Shanghai-listed shares of a group indirectly controlled by the Chinese government. But if you can stomach that, Syngenta could be a good hedge against trends intensifying food insecurity across the world.

Lex recommends the FT’s Due Diligence newsletter, a curated briefing on the world of mergers and acquisitions. Click here to sign up.