Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Almost 30 per cent of shareholders of carmaker Stellantis rejected a €36.5mn pay package for chief executive Carlos Tavares, although the controversial remuneration deal was voted through.

Tavares’s pay has increasingly drawn attention in recent years as his combined salary and bonuses linked to long-term performance targets have attained levels comparable to that of US peers. He was paid four times more than Volkswagen’s chief for 2023.

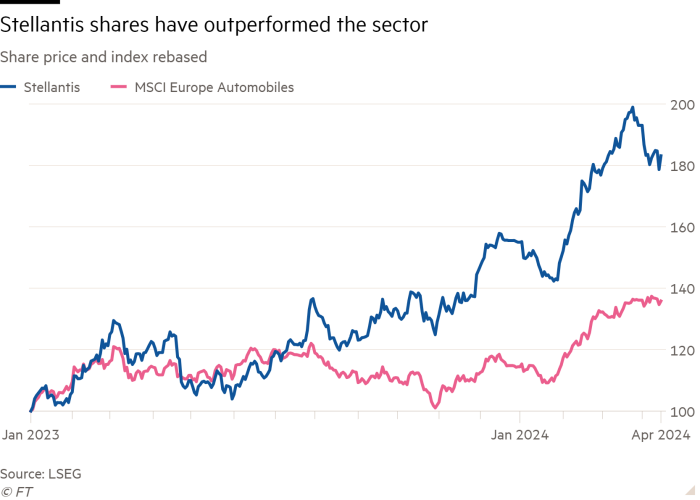

The 56 per cent pay rise for the Portuguese executive came as Netherlands-based Stellantis reported an 11 per cent rise in net profit to a record €11.8bn last year and operating margins of 12.8 per cent.

“Like a football player or a Formula One driver, there’s a contractual dimension here,” Tavares said earlier this week when asked about pay, adding that 90 per cent of his wages were determined by the company’s performance.

While the 70 per cent approval rate for Stellantis’s pay report in a non-binding vote was lower than the 80 per cent a year ago, it still showed investor support compared with an outright rejection of Tavares’s pay in 2022.

Nevertheless, the jump in Tavares’s remuneration follows the car group’s tough pay negotiations with US unions and staff cuts that have sparked a wave of criticism from proxy advisers as well as some French unions.

Institutional Shareholder Services had recommended investors vote against the package, saying it recognised Stellantis’s strong post-merger performance but the chief’s “pay is considered excessive even in this context”.

ISS singled out a €10mn bonus linked to certain transformation targets, saying that even without the payment “the existing package is not considered uncompetitive and should already aim to retain and reward the CEO”.

Glass Lewis, a rival proxy adviser, also questioned some of the bonus awards and said the ratio of the chief’s remuneration to that of the average Stellantis employee had increased.

With a large business in the US through brands such as Jeep, Stellantis has argued that its chief’s pay levels are normal, especially as Tavares has also hit profitability targets that have eluded many rivals. The company was formed in early 2021 through the merger of France’s PSA, the maker of Peugeot, and Italian-US peer Fiat Chrysler.

Overall for 2023, Tavares’s fixed salary of €2mn remained unchanged and he was awarded bonuses of €11.5mn, linked to targets such as free cash flow — €1.4mn less than a year earlier. But as well as the €10mn transformation bonus, he was given €13mn in long-term incentives. It compares with a €23mn pay package in 2022.

By contrast in Europe, Oliver Blume, chief executive of Volkswagen, was awarded a €8.7mn pay package for 2023.

Some US peers have yet to publish details for their chiefs’ pay for 2023, although Ford’s Jim Farley received $26.5mn, which represented a 26 per cent increase. In 2022, GM boss Mary Barra was awarded almost $29mn.