Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Rio Tinto’s board has approved the world’s biggest mining project in west Africa, chief executive Jakob Stausholm said as he outlined the company’s ambition to produce iron ore from the $20bn development as soon as 2025.

London-listed Rio Tinto will invest $6.2bn in the mine, rail and port project in the Republic of Guinea, in a partnership with at least seven other companies, including five from China.

“The board yesterday sanctioned the biggest mining project in the world,” Stausholm told the Financial Times.

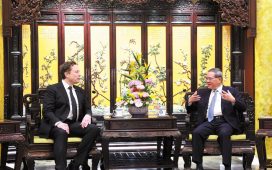

Rio’s state-owned Chinese partners, including Chinalco, the world’s largest aluminium producer, and Baowu, the world’s biggest steel producer, still need final investment approval from Beijing, but Stausholm said he was “very confident” this would happen soon.

Baowu last month raised Rmb10bn ($1.4bn) from a bond issue in China intended to help finance the project, he said, adding that the Chinese government was discussing funding with each state-owned company, which was “the last part of the process”.

The project involves the construction of a 552km rail line to transport high-grade iron ore from two new mines in the Simandou mountains — one to be built and operated by Rio Tinto — to a new deep water port on Guinea’s Atlantic coast.

“Early November I was out there. I flew over the rail line, the mines and the port in a helicopter, it is amazing what has happened,” Stausholm said, adding that tunnels along the rail corridor had already been prepared and materials ordered.

Stausholm spoke to the FT as the company reported underlying earnings before interest, tax, depreciation and amortisation of $23.9bn for 2023, in line with market expectations and down 9 per cent from 2022.

In 2021, Rio Tinto reported pre-tax earnings of $37.7bn and returned $16.8bn to shareholders, then the second-biggest payout in UK corporate history. Metals prices have since retreated from those record levels. It trimmed its dividend for 2023 to $4.35 per share, down 12 per cent from the previous year.

The total payout of $7.1bn represents 60 per cent of Rio Tinto’s underlying profit of $11.8bn.

Despite lower prices for its critical commodities, it produces iron ore, aluminium, copper and lithium, Stausholm argued he had strengthened the company in his three years as chief executive. “I am very pleased that we as Rio Tinto can now, in a more unconstrained way, grab the opportunities in this world.”

In addition to the Simandou project, Rio Tinto is ramping up production at the Oyu Tolgoi underground copper mine in Mongolia, aiming to produce 500,000 tonnes a year of the metal from 2028.

Stausholm said the demand outlook was improving for copper and aluminium, while China’s appetite for iron ore, which is the crucial ingredient for steel making, was undimmed.

“The reality is the China we are facing, the physical economy of China is growing,” he said. “Steel mills are running flat out, demand is strong and you see a pick-up in demand in copper and aluminium from the very massive development of renewable energy and electrical vehicles [in the country].”

Stausholm added that Rio had not given up hope of developing the Jadar lithium project in Serbia, after the government revoked the company’s licences in 2022 following environmental protests. “It goes without saying, you both need government approval, and you need to have social licence in terms of community acceptance.”