Chinese retail sales rose less than expected last month, official data showed Friday, showing demand in the world’s number two economy remains sluggish a year after strict Covid containment measures were lifted.

The 10.1 percent on-year increase was short of the 12.5 percent forecast in a survey of analysts by Bloomberg, even compared with a low base from last year when health policies shut down much of the economy.

Retail sales have rebounded in recent months following a precipitous drop in the second quarter, but a host of data including accelerating deflation have highlighted the difficulties officials face in rekindling growth.

The figures come after Beijing’s top leadership said this week that China was confronting “difficulties and challenges” to its economic recovery.

An ongoing debt crisis in the property sector is one of the biggest sources of worry.

In November, home prices fell month-on-month in major Chinese cities, the National Bureau of Statistics (NBS) said, and investment in property development was down 9.4 percent on-year.

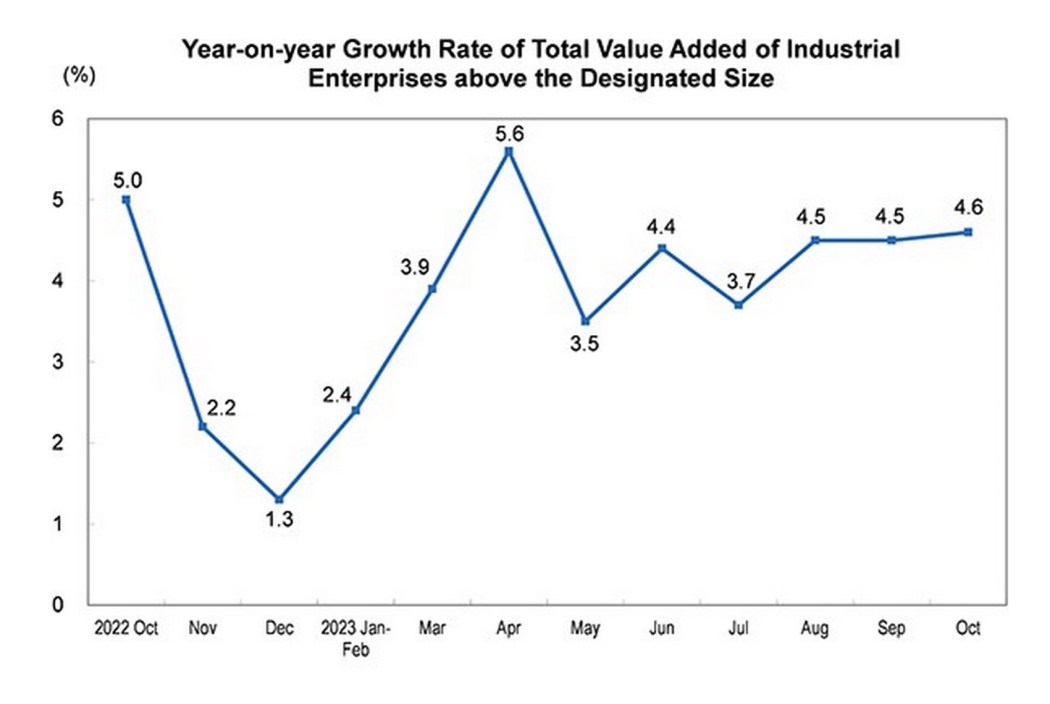

However, industrial production improved 6.6 percent, compared with 4.6 percent growth logged in October, according to the NBS data, beating Bloomberg analysts’ predictions.

Urban unemployment stayed flat at 5.0 percent.

Unemployment data no longer includes a breakdown for 16 to 24-year-olds, after it hit a record high in June.

“November activity data painted a mixed picture,” analysts at Goldman Sachs said in a note on Friday, adding that the retail sales figure reflected “still-subdued private demand and weaker-than-expected CPI inflation”.

They said in a separate note that they expected “more housing easing measures in coming months, including more relaxation of home purchase restrictions in large cities”.

Beijing has rolled out a series of measures aimed at boosting the economy, including the issuance of sovereign bonds worth 1 trillion yuan (US$137 billion) in October.

“Macroeconomic regulatory policies have continued to be effective, production and supply have risen steadily, and employment and prices have been generally stable,” the NBS said in a statement on Friday.

It added that food and beverage sales in particular soared 25.8 percent in November from a year ago — an unsurprising figure with most restaurants and bars in the country forced to abide by Covid restrictions last winter.

Figures released earlier this month showed exports rose in November for the first time in seven months, though a surprise drop in imports highlighted weak consumer activity at home.

Dateline:

Shanghai, China

Type of Story: News Service

Produced externally by an organization we trust to adhere to high journalistic standards.

Support HKFP | Policies & Ethics | Error/typo? | Contact Us | Newsletter | Transparency & Annual Report | Apps

Help safeguard press freedom & keep HKFP free for all readers by supporting our team