US regional bank shares and Apple led a rebound for Wall Street stocks on Friday, while government bond prices sank after strong jobs data revived concerns the Federal Reserve would keep interest rates higher for longer.

Shares in PacWest bank rose 82 per cent in New York after tumbling sharply in the previous session on renewed concerns about the sector’s health.

After a sell-off on Thursday, the benchmark S&P 500 stock index rose 1.9 per cent, but finished the week 0.9 per cent lower. The tech-heavy Nasdaq Composite closed 2.3 per cent higher and was virtually flat for the week. The KBW Regional Banking index gained 4.7 per cent, reversing losses in the previous session.

“I don’t see significant catalysts for calm across regional banks other than a general narrative that perhaps the crowded consensus trade went too far,” said Derek Holt, head of capital markets economics at Scotiabank.

Despite strong gains on Friday, US stocks were pressured this week after Fed chair Jay Powell on Wednesday stressed that it would take some time for inflation to return to the central bank’s 2 per cent target and dismissed hopes that interest rate cuts could be on the horizon.

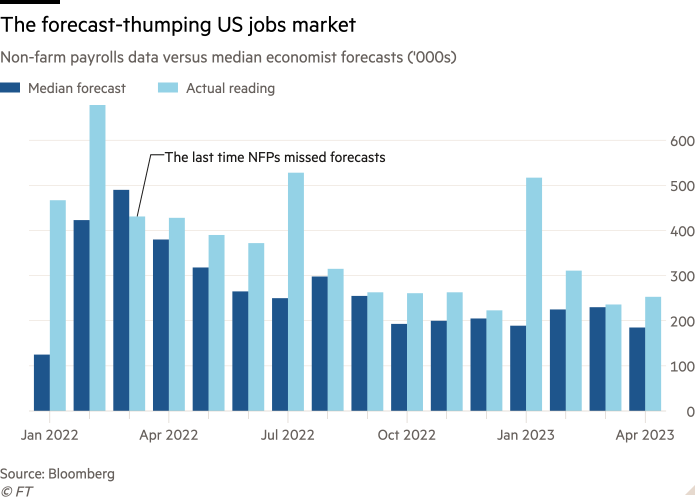

As bank stocks stabilised, data showed the US economy added 253,000 jobs in April, far more than the 180,000 expected by economists polled by Reuters, and the unemployment rate slid to 3.4 per cent. Hourly wages rose more than expected, signalling “there is still a long way to go before we see wages decelerate to levels consistent with 2 per cent inflation, even if job growth slows further”, said Thomas Simons, US economist at Jefferies.

Investors had been watching the numbers for signs that the US economy was slowing, raising doubts over whether the Fed will begin to cut interest rates as soon as had been expected.

The strong figures would only add to concerns that “the US economy is likely still too hot in the eyes of the Federal Reserve”, said Richard Flynn, managing director at Charles Schwab UK.

US government debt sold off sharply, with the yield on interest rate-sensitive two-year Treasuries rising 0.19 percentage points to 3.91 per cent.

In Europe, the region-wide Stoxx Europe 600 advanced 1.1 per cent and London’s FTSE 100 gained 1 per cent. Sterling strengthened 0.6 per cent against the dollar to $1.265, its highest point since May last year.

Germany’s Dax rose 1.4 per cent, pushed higher by a 8.9 per cent gain for sportswear maker Adidas, even after figures showed that German factory orders fell 10.7 per cent in March from the previous month, a much bigger drop than economists had expected. That raised concerns about a sharp slowdown in Europe’s biggest economy.

The European Central Bank on Thursday raised interest rates by a quarter of a percentage point, a slowdown from previous increases, but warned that the fight against inflation was not yet won. The ECB’s main deposit rate has climbed from minus 0.5 per cent to 3.25 per cent in 11 months, its fastest-ever tightening cycle.

Some analysts think rates are close to peak levels. “For all the resilience of the euro area banking sector, the US experience is calling for caution,” said Frederik Ducrozet, head of macroeconomic research at Pictet Wealth Management. “We would expect the ECB to stop hiking rates by the summer.”

In commodity markets, the price of crude oil rose 3.9 per cent to $75.30 a barrel while WTI, its US counterpart, added 4.1 per cent to $71.34 a barrel. Gold prices moderated, falling 1.7 per cent to $2,017 an ounce on Friday after surging 10 per cent since the beginning of March.