Stay informed with free updates

Simply sign up to the Oil & Gas industry myFT Digest — delivered directly to your inbox.

Qatar plans to further increase its liquefied natural gas (LNG) production capacity following the discovery of vast new gas reserves, as it looks to tap surging demand from China and other Asian nations.

The move, which comes on top of planned increases to output announced in recent years, will mean that its overall production capacity will rise almost 85 per cent from current levels before the end of the decade, according to an announcement on Sunday.

The plans mark a bet by the Gulf state that strong demand for the fuel will continue, with Asian economies switching from coal as part of efforts to cut carbon dioxide emissions. The move also comes as the US reviews its own LNG export plans to consider the impact on the country’s energy security and carbon footprint.

The plans will “take Qatar’s gas industry to new horizons”, said Saad Sherida Al-Kaabi, Qatar’s energy minister.

Qatar is already one of the world’s largest suppliers of LNG — gas cooled into liquid form so that it can be piped on to ships for export — competing with Australia and the US for the top spot.

It currently has capacity to produce about 77mn tonnes per annum (mtpa), but has announced plans in recent years to expand that to 126 mtpa by 2027.

State-owned QatarEnergy said it would add a further 16 mtpa before the end of the decade, taking total capacity to 142 mtpa, an almost 85 per cent increase on today’s levels.

It comes as Qatar raised the size of its gas reserves by about 14 per cent to 2 quadrillion cubic feet, after new discoveries at its vast North Field gasfield, and added that significant quantities were extractable on its west side.

“These are very important results of great dimensions,” said Kaabi, who is also chief executive of Doha-based QatarEnergy.

Demand for LNG climbed in the wake of Russia’s full-scale invasion of Ukraine in February 2022 as Europe tried to replace lost Russian pipeline volumes.

While Europe and the UK are trying to cut their reliance on natural gas to reduce carbon dioxide emissions, others are turning to the fuel as a lower carbon alternative to coal.

In a report this month, oil and gas supermajor Shell forecast global demand for LNG would climb by more than 50 per cent to reach 625mn to 685mn tonnes by 2040, and would continue to grow during that decade, as China and developing Asian nations switched from coal to gas.

“As we move into the early 2030s, there’s going be huge demand for gas from Asia, and I think QatarEnergy is squarely focused on that,” said Tom Marzec-Manser, head of gas analytics at commodity pricing and data company ICIS.

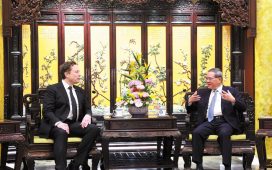

Qatar has secured two huge gas supply deals with China over the past 15 months. Last June, it agreed to sell 4mn tonnes a year of LNG to China National Petroleum Corporation for 27 years, following a similar deal with China’s Sinopec in November 2022.

Qatar’s expansion plans come as the US pauses approvals for new LNG terminals along its coastline while it takes a “hard look at the effects of LNG exports on energy costs, America’s energy security and our environment”, President Biden said in January.