Hello and welcome to the latest edition of the FT Cryptofinance newsletter. This week, we’re taking a look at the future of the bitcoin mining industry.

The quadrennial bitcoin halving is fast approaching, an event that slows the circulation of new bitcoins on the market and, in theory, promises long-term upswings for the world’s biggest cryptocurrency.

It’s a particularly big deal for bitcoin miners, so much so that industry watcher TheMinerMag labelled the halving “this year’s most important bitcoin event”, surpassing even the arrival of spot bitcoin exchange traded funds on Wall Street.

Mining companies are bracing for a 50 per cent drop to the financial rewards they earn in exchange for securing and validating transactions on the bitcoin network. In the next 24 hours or so, those rewards fall from 6.25 bitcoins to 3.125 bitcoins, or from $408,000 to about $204,000 by current prices.

Companies such as Marathon Digital, CleanSpark and Bitfarms have been stockpiling near-record amounts of coin in a bet that future increases in the token’s price will blunt the halving’s impact on their revenue.

The strategy may pay off in the short term, but miners are facing a far more fundamental, even existential problem. Halvings happen every four years, and by 2140 will totally eliminate the rewards miners earn for validating bitcoin transactions.

That means that unless mining companies come up with an alternative revenue stream to secure their business into the future, the sector will one day stop being economically viable. As Moody’s Rajeev Bamra tells me, the halving prompts a “thorough reassessment of mining economics”.

Other than the rewards they earn for validating transactions, miners also gain income from transaction fees on the network itself. Save for short-lived periods of trading frenzies, this source of revenue has played second fiddle to block rewards.

So if you read my story earlier this week, you will know that miners are already betting on the future price of bitcoin the asset, but their biggest bet is really on the future adoption of bitcoin the network.

The more transactions taking place on the network in the future, the better equipped mining companies’ businesses will be to fend off future halving events.

“Block rewards were intended to subsidise mining activities initially, but ultimately, it is adoption of bitcoin for transactions that will generate revenues needed to make mining profitable in the long run,” said Andrew O’Neill, managing director of S&P Global’s Digital Assets Research Lab.

The biggest driver of that adoption has been, for the past year, the advent of bitcoin Ordinals, the network’s answer to non-fungible tokens — or NFTs — traded on rival blockchains such as ethereum and solana.

Ordinals debuted on the bitcoin network in January last year. The protocol allows users to apply unique identifiers on to individual satoshis — the smallest denominations of bitcoin — thus making each divisible unit of the cryptocurrency unique, or non-fungible. In other words, users can create and trade NFTs on the bitcoin blockchain, without having to migrate to another network.

According to numbers shared by industry data provider CCData, transaction volume on the bitcoin network has rocketed since the arrival of Ordinals.

In January last year, the network experienced roughly 250,000 transactions per day. Fast forward to the latest figures and the network is frequently processing more than 500,000 transactions. In comparison the ethereum blockchain handles roughly 1mn transactions per day.

“Ordinals are to the bitcoin blockchain what bitcoin ETFs are to bitcoin the cryptocurrency,” said CCData researcher Jacob Joseph.

The concern for bitcoin’s supporters is if crypto’s more innovative corners like decentralised finance or NFTs ever take off, it could push the old and clunky bitcoin network into obscurity. DeFi projects are built on more flexible systems like ethereum and solana. The launch of Ordinals provides one possible response from the bitcoin network to this problem.

Still, it doesn’t look like a problem for now. Since January 2023, bitcoin’s market dominance has increased from 38 per cent to 52 per cent, consolidating its powerful hold on the crypto sector and leaving rivals ether and solana to watch from the sidelines.

Today’s numbers are promising, but at the risk of committing a journalist’s cardinal sin, it is simply too early to tell whether Ordinals — or any other project built on bitcoin — will sustain the mining sector to the point where it can survive in the long term.

If the broader NFT market’s record is anything to go by, the outlook suddenly doesn’t look good.

Within the space of a couple of years, NFTs went from breaking through mainstream culture on The Tonight Show Starring Jimmy Fallon to making headlines for all the wrong reasons, like blinding people in Hong Kong.

What’s your take on the bitcoin halving and the outlook for the mining sector? As always, email me at scott.chipolina@ft.com.

Join me and fellow colleagues at the FT’s flagship Crypto and Digital Assets Summit on May 8-9 in London. Hear from some of the leading figures in the industry including Julia Hoggett, chief executive, London Stock Exchange, Bim Afolami, economic secretary to the Treasury and City minister, UK Government, Michael Sonnenshein, CEO, Grayscale Investments, and many more. Secure your seat now at crypto.live.ft.com

Weekly highlights

-

In case you missed it, I looked at whether UK investors should have easier access to bitcoin. Unlike the US, Britain — a self-proclaimed “hub for digital assets” — doesn’t let its citizens buy spot bitcoin ETFs, even if exchange traded notes for professional investors are on the way.

-

I fought the law and the law won. A New York jury this week convicted Avi Eisenberg of fraud. The crypto trader made headlines in December 2022 after being charged in connection with attempts to steal more than $100mn from the decentralised Mango Markets crypto exchange.

Soundbite of the week: CFTC under the spotlight

Former FTX chief Sam Bankman-Fried was sentenced to 25 years in prison last month but some people still aren’t letting the matter lie.

This week Senators Elizabeth Warren and Chuck Grassley wrote to Rostin Behnam, chair of the Commodity Futures Trading Commission, over his relationship with Bankman-Fried. The senators are requesting an account of all meetings and correspondence between the two men. The senators wrote:

“Safeguarding the savings and retirements of Americans requires Congress and market regulators like the CFTC to determine how this multi-billion-dollar crime was allowed to happen.”

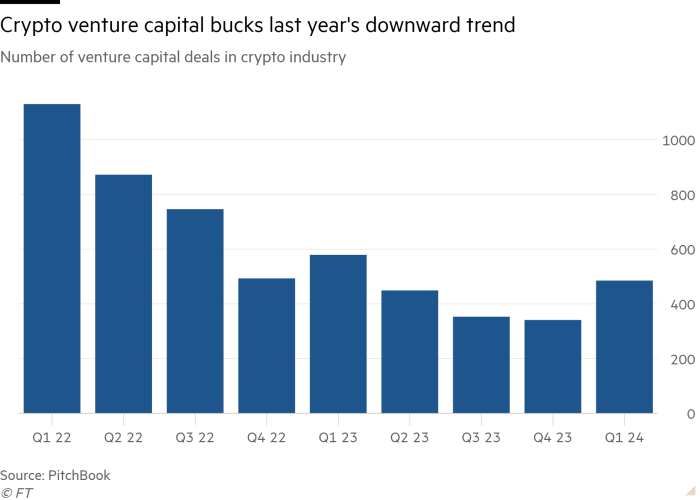

Data mining: Crypto venture capital opening the year strong

This year the crypto market has welcomed the approval of spot bitcoin exchange traded funds and a fresh all-time high for bitcoin. And the world of venture capital appears to have bought into the hype, again.

According to latest data from capital markets data provider PitchBook, the first quarter of this year saw 485 deals worth $2.5bn, a big upswing from the 341 deals worth under $2bn in the fourth quarter of 2023.

FT Cryptofinance is edited by Philip Stafford. Please send any thoughts and feedback to cryptofinance@ft.com.