The Individual Savings Account is 25 next month. It may seem like a simple tax wrapper, used to shelter savings and investments from taxes on income and growth, but over its lifetime the Isa has played a big role in the UK’s personal finances by introducing millions of Britons to the world of investment and saving.

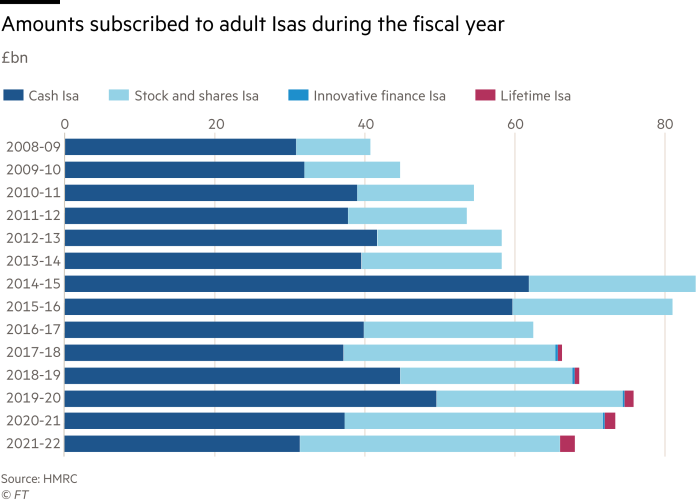

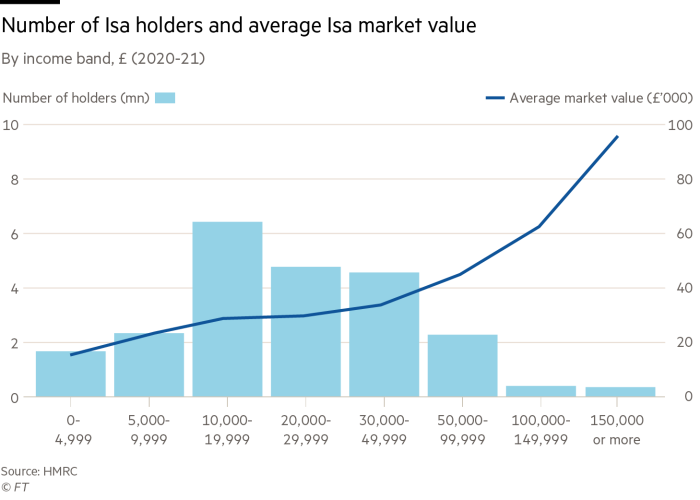

Over 22mn people have Isas, of which 14.9mn hold a cash Isa, 3.9mn hold a stocks and shares Isa, and 3.4mn hold both, according to the latest available HM Revenue & Customs’ data. To some, it’s a success story, with the Isa firmly embedded into the UK’s investment landscape. It is certainly a survivor: nine chancellors have made or proposed changes to the Isa rules since 1999.

Sarah Coles, head of personal finance at Hargreaves Lansdown, says: “There’s a reason why Isas are so popular, and have attracted £741.6bn (by April 2022). They’re a brilliant tax-saving solution for the vast majority of investors and a lifeline for many savers — particularly as savings rates have risen and pushed more people over the personal savings allowance. They’re set to save us an estimated £6.7bn in tax this tax year.”

However, many point to the detailed and constantly evolving Isa rules as a barrier to understanding and take up. Jeremy Hunt’s Budget this month, in which he proposed a new UK Isa, has attracted criticism for adding an extra layer of complexity.

Laith Khalaf, head of investment analysis at AJ Bell, says: “While Isas have undoubtedly been a terrific success story in the 25 years they have been around, many people still aren’t tuned into their benefits, particularly when it comes to stocks and shares Isas.”

Invest and save tax free

Today’s Isa range comprises five types: cash Isas, stocks and shares Isas, the Innovative Finance Isa, the Lifetime Isa and Junior Isas. Together, they help us save money on taxes that we would otherwise pay on our savings and investments. Netwealth, a wealth manager, estimates an additional rate taxpayer investing £100,000 in a stocks and shares Isa would save £44,000 in taxes over 10 years, assuming a gross average annual return of 5.9 per cent, net of fees.

How much could an Isa be worth today?

If an individual had maximised their annual stocks and shares Isa limit since 1999, they would have made contributions of £306,560. But the effect of investment growth and compounding over 25 years means the number of Isa millionaires is growing.

Investment provider Vanguard identified all global large cap funds, via Morningstar, available to UK investors in April 1999 when the Isa was first launched. It then removed all fund mergers and closures over the past 25 years, refining the sample from 300 funds to just 50. It then calculated the investment returns on an Isa that has met the maximum limit each year over the 25-year period (taking into consideration the changing tax-free allowance over time).

Invested in a Global Stock Index fund, net of fees, that £306,560 would have grown to £723,357. By contrast, if an equivalent amount had been invested in cash over that period, it would now be just £355,592.

James Norton, head of financial planners, Vanguard Europe, says: “That inflation is expected to be higher in the future only makes the case for investing more compelling going forwards.

“But investing doesn’t have to be complicated. An investor that had simply contributed every year to a globally diversified index fund, and held on, would have done extremely well.”

Payments into an Isa account are made from after-tax income, and the account is then exempt from income tax and capital gains tax on the returns. No tax is payable on money withdrawn from the scheme. In the case of the Lifetime Isa, which can only be opened by adults aged under 40, the government will add a 25 per cent bonus to savings, up to a maximum of £1,000 per year.

While Isas can be used for short and medium-term investment goals, such as saving for a special holiday or a deposit on a property, they are also used in millions of investment portfolios for retirement savings alongside pensions. Many use Isas to enable early retirement or scale back work. The potential inheritance tax benefits of pensions mean Isas are often drawn on first, with pensions held in reserve.

But some investors, particularly the self-employed, prioritise Isas above pensions. Krishan Patel is 33 and lives in London, where he is a self-employed technology consultant. He says: “I have minimal pensions from a previous employer and try to maximise my Isa contributions instead. It’s nice to have everything in one place and I like having Isas because it removes the tax issues.”

Patel invests in single stocks and thematic exchange traded funds, accessing India and green energy in his Isa, held with Interactive Investor, while he holds passive investments in major indices such as the S&P 500 within another Isa held with Vanguard.

While the innovative finance Isa has been something of a damp squib, with low subscriptions and calls for it to be merged with the stocks and shares Isa, those who use it can be passionate about their holdings.

Christine Muller is 31 and lives in York, where she works as an occupational therapist at the local authority. Her main investment is in an innovative finance Isa with Triodos, through which she funds Thera Trust. This creates homes designed for the needs of people with learning disabilities. This type of care is lacking, she says, and she wanted to put her money towards supporting positive change. “Earning less through something that is ethical is preferable to earning more in things like fossil fuels that I don’t agree with,” she says.

This year, the investing public needs to use Isas more than ever. A major consideration is the personal savings allowance (PSA), which enables savers to earn a set amount of interest before tax charges apply. This has remained the same since 2016, so is more easily eclipsed by returns from the higher bank savings rates of recent times. It means savers outside Isas are more likely to be liable for tax charges when earning a much lower level of interest.

Allowances slashed

But investors also face the lowest ever capital gains allowance and dividend allowances from April 6. Khalaf says: “There are plenty of investors who hold shares outside an Isa, and could be about to be knocked sideways by a wave of unexpected taxation.”

They can still take evasive action using the curiously named “Bed and Isa” facility offered by investment platforms, which involves selling shares and buying them straight back in an Isa. This does crystallise any capital gains to date, so to avoid a tax charge, care needs to be taken to stay within the annual capital gains allowance.

Over the past 25 years, the tax-free allowance for capital gains increased from £7,100 in 1999-2000, peaking at £12,300 in 2020-21. But the government has slashed it to £6,000 in the current tax year, and the allowance is set to be halved to £3,000 in 2024-25).

A higher-rate taxpayer investing their full £20,000 Isa allowance every year for 10 years from the start of the new tax year could save £18,534 in capital gains tax over 10 years if no withdrawals are made, according to investment platform Interactive Investor. This assumes the CGT allowance and tax rate remain unchanged over the period and a 7 per cent annual rate of return.

Charlotte Kennedy, a chartered financial planner at Rathbones Group, says: “Isas are also an important source of tax-efficient income for many people, including those who have retired. With the annual tax-free dividend allowance falling from April 6 2024, saving in an Isa can help to mitigate the impact of this reduction.”

As chancellor, George Osborne introduced a dividend allowance of £5,000 in 2015 to protect small shareholders. However, Philip Hammond reduced the allowance to £2,000 from April 2018. Rishi Sunak then increased dividend tax rates from April 2022, and Jeremy Hunt followed up with a cut to the dividend allowance to £1,000 this tax year and to £500 from April 2024.

Khalaf says: “The result is a tax policy which initially provided a reasonable tax shield for small shareholders and which now affords the most modest of fig leaves instead.”

A new Isa

Some advisers welcome the chancellor’s proposed additional £5,000 UK Isa allowance. The UK Isa will “ensure that British savers can benefit from the growth of the most promising UK businesses as well as supporting them with the capital to help them expand,” Hunt said.

However, critics point out that it may skew investment portfolios by introducing a home bias that may be unsuitable.

Self-employed investor Patel says he would have preferred to see a rise in the main Isa allowance to match inflation rather than an additional allowance which would further expose him to the UK economy. “I don’t want my job and savings at risk at the same time,” he says. “It’s the opposite of diversifying.” And principled investor Muller says: “There would have to be an ethical UK Isa to get me interested.”

Jason Hollands, managing director of Bestinvest, says: “The risk is that the British Isa becomes a cuckoo in the nest and that over time, future governments will focus on increasing this allowance and letting the core one continue to wither on the vine in real terms. Worse still, could there even be a temptation to reduce the core allowance to dragoon more investors into UK equities via the British Isa?”

Several big investment players have argued for Isa simplification, so getting them on board with further Isa complexity may prove difficult.

For example, Hargreaves Lansdown says three products can be rolled into existing Isas while maintaining effective choice: child trust funds (now discontinued) into junior Isas; Help to Buy Isas (closed to new applicants) into the Lifetime Isa; and innovative finance Isas into stocks and shares Isas. The investment platform’s data shows a significant home bias among Isa investors, so it argues increasing the £20,000 allowance would automatically channel more funding into UK-listed investments without any needless complication of the Isa range.

In the end, industry negativity or a change in government may kill the UK Isa proposal.

But in the meantime, lack of enthusiasm for the UK Isa should not deter investors from considering UK equities for their existing Isas. Hollands says: “UK stocks are incredibly cheap currently, yields are attractive — yet payout ratios are quite modest — and increasing buybacks by UK companies could help spur improved shareholder returns.”

Changes to the Isa rules

Since launch in 1999, there have been 15 increases in the annual Isa limits — eight of which were to the overall annual Isa limit. This started at £7,000 and is now £20,000. The proposed additional £5,000 UK Isa limit would take it to £25,000.

Over 25 years, four new Isa variations have been introduced, and four Isa variations have also been killed off. The insurance Isa was scrapped in April 2006 and mini and maxi Isas ditched in April 2008. They were replaced with an overall Isa limit and a cap on how much of it could be held in cash. The Help to Buy Isa was closed to new entrants in November 2019.

The big change coming on April 6 is that savers will be able to pay into multiple Isas of the same type in a single tax year. Current rules only allow money to go into one of each type of Isa every year. The change aims to incentivise competition among cash Isa providers.

Savers who subscribed to a fixed-rate cash Isa last year may have regretted their purchase as the rates climbed higher. So, saving into another cash product midway through the tax year would have been useful. Some cash Isa customers may also want to mix fixed-rate deals and easy-access savings for greater flexibility.

But multiple Isas could also be a recipe for further confusion, as savers will be responsible for making sure they don’t breach the £20,000 total limit with their multiple subscriptions.

Other changes to the Isa rules coming on April 6 2024 are:

-

Partial transfers: savers can transfer part of an Isa account balance from one provider to another, rather than having to transfer the whole balance.

-

Innovative Finance Isa: the range of permitted investments will expand to include long-term asset funds and open-ended property funds with extended notice periods.

-

Cash Isa age limit: the minimum opening age for adult Isas will be harmonised at 18 across the board, meaning the age limit for cash Isas will rise from 16 to 18.

The government has also promised to consult on making fractional shares a permitted Isa investment, though there is no timeline for this change. The adjustment would enable retail investors to access high-value stocks much more cheaply.

Myron Jobson of Interactive Investor says: “For larger investors who may be able to commit a full £20,000 Isa subscription in one go this is less of an issue. However, for retail investors who might be saving less than £100 a month, it becomes very difficult for them to invest directly in shares while also building a properly diversified portfolio.”