Investors are pulling record levels of bitcoin from crypto exchanges as the collapse of Sam Bankman-Fried’s FTX stirs fears over the safety of their assets.

FTX, once the darling of the crypto industry, filed for bankruptcy protection in mid-November after an $8bn hole emerged in its balance sheet.

New chief executive John Ray described a lack of basic risk management and Bankman-Fried has admitted to poor internal controls. Its rapid descent has alarmed investors who keep and trade their assets on other centralised crypto exchanges, leading to record levels of withdrawals of bitcoin, the most widely traded crypto token. FTX failed last month with potentially more than 1mn creditors, including many who had left assets on the exchange.

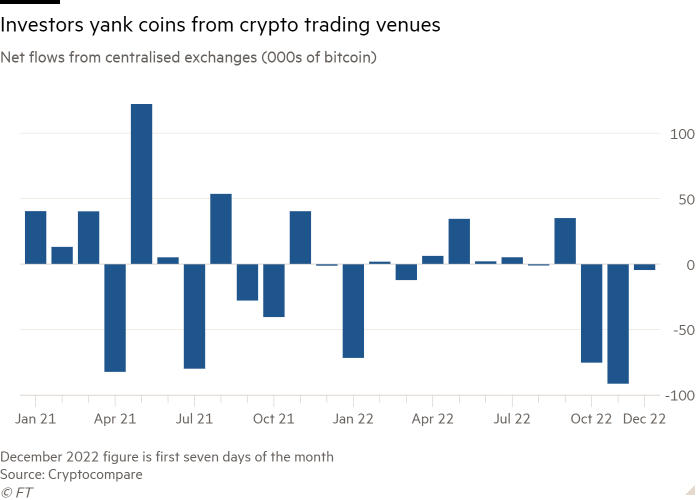

Last month investors pulled 91,363 bitcoin, worth a total of close to $1.5bn based on the November average price of around $16,400, from centralised exchanges including Binance, Kraken and Coinbase. That marked the largest bitcoin outflow on record, according to data from CryptoCompare.

It is unclear whether the coins are being sold or moved to private wallets.

The rush for the exit comes as the price of bitcoin has plunged 64 per cent this year and is currently trading around $17,000.

Withdrawals in October were also high, at 75,294 bitcoin, as crypto traders pulled their funds following a crisis-laden summer, which included the collapse of digital asset lenders Celsius and Voyager Digital.

Rival exchanges have rushed to distance themselves and their practices from the chaos inside FTX in an effort to ease customers’ nerves and limit potential market contagion.

However, the record outflows highlight investors’ wariness of bitcoin as the digital asset industry faces increased scrutiny from global regulators.

In the first seven days of December, 4,545 bitcoin were withdrawn from centralised exchanges, compared with inflows of 3,846 bitcoin in the same period last year, according to CryptoCompare.

In a sign of the detrimental impact of FTX’s collapse on its once-rival exchanges, credit rating agency Moody’s placed US-listed Coinbase’s bond rating on review for downgrade in late November, citing “the increasing likelihood of sustained declines in trading volumes and client engagement, two essential revenue drivers”.

“Falling crypto asset prices will restrict businesses’ ability to raise funds and depress customer demand,” Moody’s analysts wrote this week. They added that markedly lower crypto prices “will deteriorate the credit quality of centralised finance companies”.

“While the bitcoin sell-off decelerates, the damage has been done,” wrote Eric Robertsen, global head of research at Asia-focused bank Standard Chartered, this week.

He predicted that the pain for crypto investors will continue well into 2023. “More and more crypto firms and exchanges find themselves with insufficient liquidity, leading to further bankruptcies and a collapse in investor confidence in digital assets.”