The Indian markets regulator has put seven firms in the group led by billionaire Gautam Adani on notice for regulatory violations, stock exchange filings show.

The Securities and Exchange Board of India began probing the Adani conglomerate in January 2023 after Hindenburg Research alleged improper use of tax havens and stock manipulation by the group.

On Thursday, the group’s flagship firm Adani Enterprises said the regulator had sent it two notices in the January-March quarter of this year, saying it had not complied with provisions for listed companies and had violated disclosure rules on some related-party transactions.

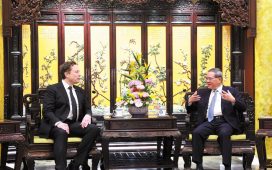

Also on AF: ‘Hello China, Goodbye India’: Musk’s Trip Seen As Snub To Modi

The company did not give details of the alleged violations or the parties involved.

However, it said that management believed the notices had no “material consequential effect” for relevant financial statements and there was “no material non-compliance of applicable laws and regulations”.

Other firms of the group that received notices in the first quarter include Adani Green Energy, Adani Power, Adani Total Gas, Adani Energy Solutions, Adani Wilmar, and Adani Ports.

Shares of Adani Green and Adani Energy were up 0.9% and 0.7%, respectively on Friday, while the other companies’ shares were down between 0.1% and 2%.

Adani Power said the notice it received stated that some third-party transactions had not been reported in the relevant years’ financial statements or annual reports, and the requisite review and approvals of such transactions had not been sought.

Adani Wilmar, Adani Total and Adani Green said their SEBI notices concerned the validity of a so-called peer review certificate of their auditor for a previous financial year.

Typically such violations attract monetary penalties or management can be barred from capital markets for a certain period. Such actions are based on the seriousness of the allegations. Reuters could not ascertain the seriousness of the allegations.

Auditors for Adani Ports, Adani Power and Adani Enterprises have also issued a so-called qualified opinion because of the SEBI investigations.

Pending the outcome of the investigations, the auditors said they were unable to comment on the possible consequential effect on any periods presented in the financial statements and whether the company had complied with applicable laws and regulations.

- Reuters, with additional editing by Vishakha Saxena

Also read:

US Lends $553m to Adani Colombo Port JV Amid China Rivalry

Indian Regulator Seen Probing Adani’s Ties With Gulf Asia Fund

Adani Family Partners ‘Used Opaque Funds to Buy Stocks’

India Regulator Warns Against Hasty End to Adani Group Probe

All Eyes on India Market Regulator Amid Adani Share Sale Probe

Probe Into Some Adani Offshore Deals for Disclosure Violations

Indian Protesters Say Modi Favoured Adani as Losses Top $110bn

Dow Jones Drops Adani Enterprises