Stay informed with free updates

Simply sign up to the Global Economy myFT Digest — delivered directly to your inbox.

Today’s top stories

-

US President Joe Biden called for tariffs to triple on Chinese steel and aluminium from the current average of 7.5 per cent in an attempt to boost support among trade union members.

-

The booming demand for power-hungry data centres to power artificial intelligence is threatening global electricity supplies. Amazon, Microsoft and Google parent Alphabet are investing billions of dollars in computing infrastructure as they seek to build out their AI capabilities.

-

UK inflation fell less than expected to 3.2 per cent in March, hitting hopes of early interest rate cuts from the Bank of England.

For up-to-the-minute news updates, visit our live blog

Good evening.

The US fiscal deficit posed “significant risks” to the global economy, the IMF warned today, while markets are becoming increasingly nervous about the possibility of a widening conflict in the Middle East.

The fund said in its Fiscal Monitor report that it expected the US to record a deficit of 7.1 per cent next year — more than three times the average for other advanced economies. It also raised concerns over Chinese government debt as Beijing copes with weak demand and a housing crisis.

The fund said the US and China — as well as the UK and Italy — needed to “address fundamental imbalances between spending and revenues”.

The warning comes as investor concerns grow that 2025 could be a crunch year for US fiscal policy. If Donald Trump becomes president, he has pledged to make his 2017 tax cuts permanent, while Democrats are accused of spending too much on healthcare and social security.

The importance of the US to the global economy was further underlined yesterday in the IMF’s World Economic Outlook, which suggested it would be the key driver of global growth this year with an increase of 2.7 per cent, double the rate of any other G7 country.

The IMF did, however, warn that stickier than expected inflation could slow Federal Reserve plans to reduce interest rates, a point acknowledged by Fed chair Jay Powell yesterday.

Bumper retail sales data this week also fuelled the idea that the Fed might cut rates this year by less than previously thought, sending ripples in financial markets across the world. European stock markets yesterday suffered their worst day in nine months.

Markets are also starting to sense danger over events in the Middle East. We report today that the Vix index, a measure of volatility dubbed Wall Street’s “fear gauge”, has hit its highest level since the aftermath of the Hamas attack that triggered Israel’s war in Gaza.

A widening of the conflict would have huge consequences for global stability, particularly in energy and commodity prices, notes chief economics commentator Martin Wolf in his latest column.

“The biggest victims of such mayhem would, as usual, be the poorest,” he concludes. “We may have managed shocks better than expected. But we are walking on eggshells and must tread carefully.”

Need to know: UK and Europe economy

UK chancellor Jeremy Hunt raised the possibility of further tax cuts before the next general election “if we can”. The IMF, however, put a question mark over that ambition as it urged the UK to curb rising debt. The fund also downgraded its forecast for UK growth to 0.5 per cent this year, the second slowest in the G7 after Germany.

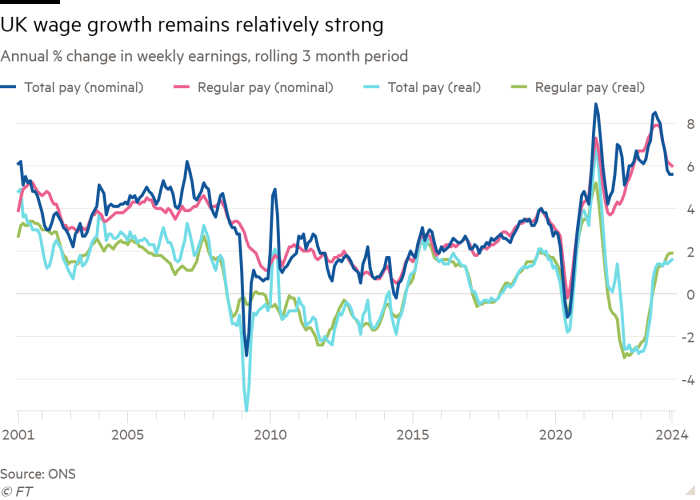

UK wage growth was higher than expected in the three months to February, remaining stuck at 5.6 per cent. The unemployment rate ticked up to 4.2 per cent.

Shortlived former UK prime minister Liz Truss revealed in her new book that she considered sacking Bank of England chief Andrew Bailey as part of her attempt to dismantle an “economic establishment” that she says helped to bring her down after her disastrous “mini” Budget. Her successor Rishi Sunak hit out at Truss in parliament.

Need to know: Global economy

The US and EU are preparing fresh sanctions on Iran’s missile-and-drone programme in response to its attack on Israel, but the UK and European governments are resisting pressure to designate the elite Revolutionary Guards a terrorist organisation.

Economic growth in China hit a more than expected 5.3 per cent in the first quarter as Beijing looks to manufacturing for a revival. The cliched image of Chinese industry being sustained by knocking out cheap copies needs to be put to bed, writes Shanghai correspondent Thomas Hale. The prime example, he argues, is electric vehicles, where intense regional competition poses a growing challenge to international businesses. Beijing is also reforming state-owned enterprises to win back investors.

Since the financial crisis of 2007-08 regulators have engaged in the biggest push to de-risk the global financial system since the 1930s. An FT Big Read assesses progress and details the overlooked threats.

Economic forecasting is little more than performance art, writes former Bank of England chief economist Andy Haldane, describing it as “largely performative, typically opaque, nine parts art to one part science”. The recent review of BoE forecasting by Ben Bernanke, former chair of the US Federal Reserve, is unlikely to alter the situation, Haldane argues.

Haiti named members of a transitional council expected to take over government and try to deal with a deepening security and humanitarian crisis. Acting PM Ariel Henry has pledged to resign as violent gangs thrive in the power vacuum.

Need to know: Business

Microsoft is investing $1.5bn in Abu Dhabi artificial intelligence group G42 in its latest big bet on the emerging technology. G42 recently severed its links to Chinese hardware suppliers, which had been the subject of scrutiny by US lawmakers.

Morgan Stanley first-quarter profits rose 14 per cent to $4.3bn, thanks to strong performances in trading and wealth management. Bank of America profits fell on loan losses and reported a stalling in new loan growth.

The owner of the UK’s Royal Mail postal service rejected a takeover approach by Czech billionaire Daniel Křetínský. Royal Mail was privatised between 2013 and 2015 but has been grappling with the difficulties of maintaining its expensive delivery network in the face of a sharp decline in its traditional letter-delivery business.

ASML, the Dutch manufacturer of lithography machines for chipmaking, said the semiconductor industry would recover in the second half of the year even as its first quarter disappointed investors.

LVMH, the world’s largest luxury group, reported its weakest quarterly sales growth since the pandemic recovery as Chinese demand subsided and champagne sales fell.

Sex workers hit out at UK banks for waging “war” on their jobs by refusing them bank accounts. Although soliciting sex work and brothel-keeping are illegal in England and Wales, selling and purchasing sexual services between consenting adults is permitted.

The World of Work

Why are young workers quitting their jobs and making a song and dance about it on social media? The Working It podcast speaks to a “Quit-Toker” to find out.

Some good news

After a flood of bad news on the foul state of UK rivers comes a welcome development: restoration efforts have led to Atlantic salmon returning to the Derwent for the first time in 100 years.

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at disruptedtimes@ft.com. Thank you