Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The “squeezed middle” refers to British middle-income households that are too wealthy to access state support yet not affluent enough to survive recessions unscathed. The mid-market of UK fashion retailing is suffering a similar squeeze.

Ted Baker said in a notice to the High Court this week that it intended to call in administrators. It is not alone. Other mid-market brands forced into administration in recent years include Cath Kidston, Joules and Jack Wills.

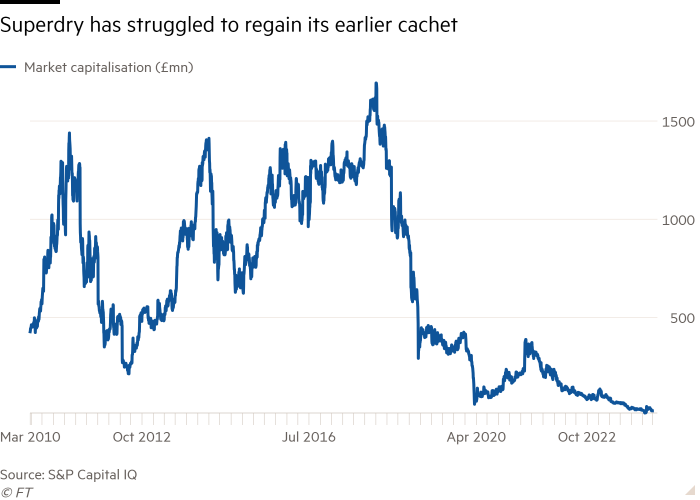

London-listed Superdry is also struggling. Once worth nearly £1.7bn, Superdry’s market capitalisation is a mere £24mn. Founder Julian Dunkerton is hoping to drum up backing to take it private as he tries to engineer a turnaround.

Many mid-market retailers are caught between the reasonably priced, fast-fashion names such as Zara at one end and the luxury sector at the other. They face an uphill battle unless they can attract support from the likes of Next.

Next, the UK’s retail darling, has also become the consolidator of choice in recent years. It bought Joules out of administration and the intellectual property of Cath Kidston. It has also acquired equity stakes in other mid-market retailers that are not distressed, including Reiss and FatFace.

Next is able to plug these brands into an infrastructure product, which takes the hassle out of dealing with IT and warehousing. These suck up costs and create complexity for smaller retailers; handing them over frees up management to focus on design. The “total platform” product was intended for third parties but instead is acting as a useful acquisitions tool for Next.

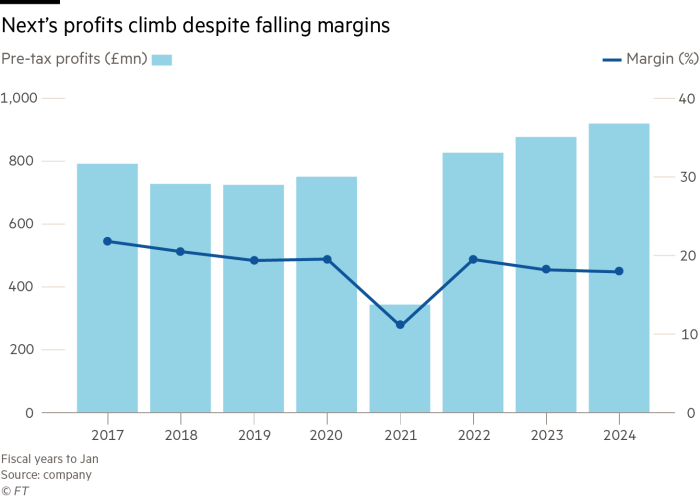

Investors shouldn’t mind. In combination, the platform and Next’s equity investments in other brands are an additional source of profitable growth. Platform profits, small last year at £42.8mn, are expected to grow to £77mn this year. That should help to push pre-tax profits to a fresh record of around £960mn. Next has been a consistent outperformer, justifying its premium over rivals such as Marks and Spencer, which trades on just under 10 times forward earnings, versus 14.8 times for Next.

Boss Simon Wolfson expects there will be more brands Next can hoover up. The mid-market names that struggle tend to offer “one look”, says PwC’s Kien Tan. Once that particular style has lost its cachet, it can be hard to recover on a standalone basis. That’s a problem of which Superdry, with its reliance on clothes featuring Japanese characters, is no doubt well aware.

Lex is the FT’s concise daily investment column. Expert writers in four global financial centres provide informed, timely opinions on capital trends and big businesses. Click to explore