Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

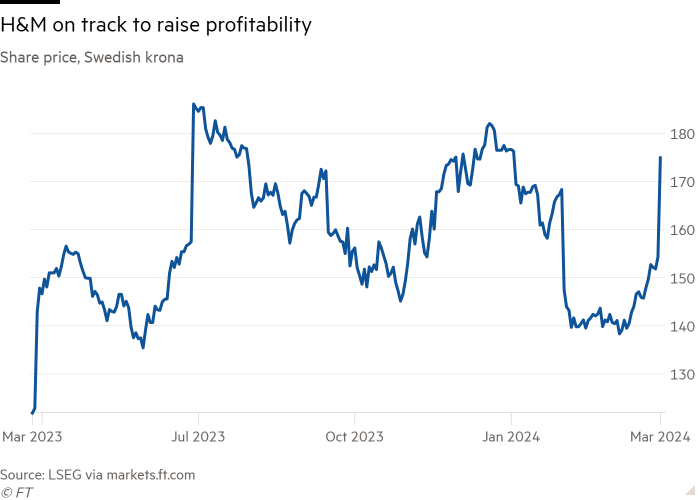

Shares in fashion retailer H&M rose more than 13 per cent in early trading on Wednesday after it reported rising profits, signalling to investors that it is on track to hit its new higher targets.

In its first set of quarterly results since Daniel Ervér took over as chief executive last month, the Swedish company reported operating profit of SKr2.1bn in the three months to the end of February, compared with SKr725mn in the same period a year ago.

Net sales in the period were SKr5.4bn (€4.7bn). The 2 per cent fall compared with last year was less than analysts had expected.

The company, which has previously struggled to compete with lower-cost rivals as well as Inditex’s Zara, aims to raise its operating profit margin to 10 per cent this year — up from 6.2 per cent last year.

Talking to the FT in January, Ervér, who joined H&M in 2005 and took over from Helena Helmersson this year, said he believed the company could thrive despite competition from lower-cost producers.

“I am confident that we have a very good direction for where we’re heading. Cash flow and profitability are improving, which allows us to invest further,” he said.

But some analysts sounded a note of caution, saying that although H&M had beaten its first-quarter operating profit forecasts, sales remained below pre-pandemic levels. The group has been working to reduce its inventory and analysts at Citi noted levels had fallen, as well as improvements in “supply chain efficiencies”.

But they also flagged weak performance in the Americas, where sales were down 5.9 per cent year on year, compared with a 2.2 per cent fall for the group overall.

The company, three-quarters of which is owned by the Persson family, has been trying to improve its environmental sustainability scores, including through an initiative to use more recycled polyester.