Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Goldman Sachs’ profits rose 28 per cent in the first quarter, as a strong performance by its trading business helped it surge past analysts’ estimates.

The US bank said net income for the first three months of the year was $4.1bn, up from $3.2bn a year earlier and almost $1bn ahead of analysts’ forecasts compiled by Bloomberg.

The performance will help draw a line under a challenging 12 months for Goldman in which its results were hit by losses tied to its pullback from its foray into consumer lending.

Chief executive David Solomon, who last year faced criticism for his management of the bank, said the first-quarter results reflected “the earnings power of Goldman Sachs”.

Goldman’s stock was up 3.7 per cent in pre-market trading.

Goldman’s equity and fixed income trading businesses defied analysts’ predictions that revenues would fall, with both reporting 10 per cent increases in the latest quarter.

Trading has been a bright spot in recent years for Goldman, buoyed by market swings during the coronavirus pandemic, Russia’s full-scale invasion of Ukraine and central bank interest rate rises. Goldman said it had benefited in the first quarter from higher revenues in mortgages, currencies and credit trading.

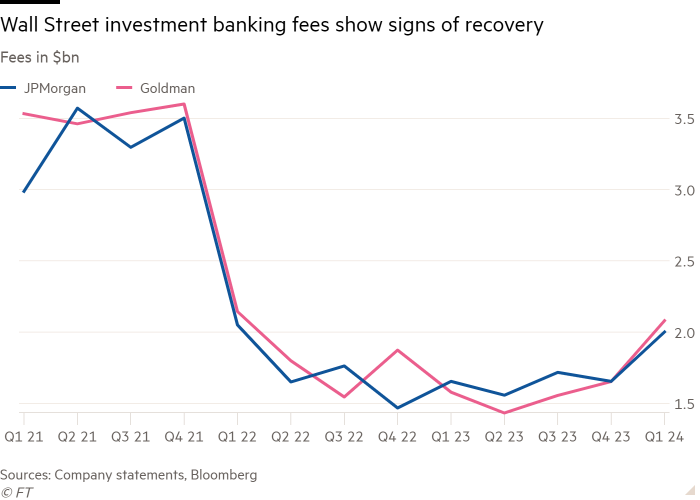

Investment banking had its best quarter in two years, with revenues of $2.1bn. This was up 32 per cent from a year earlier, although still well below the peak achieved during the pandemic-era boom in dealmaking.

Goldman’s asset and wealth management division, the cornerstone of Solomon’s efforts to diversify the Wall Street bank away from volatile investment banking and trading, reported revenue of $3.8bn. That was an 18 per cent increase from a year ago.