Under chief executive Jim Farley, Ford is competing in two races: to cut costs in the short term and to position the company for the future. In both, the oldest carmaker in the US faces an uphill journey.

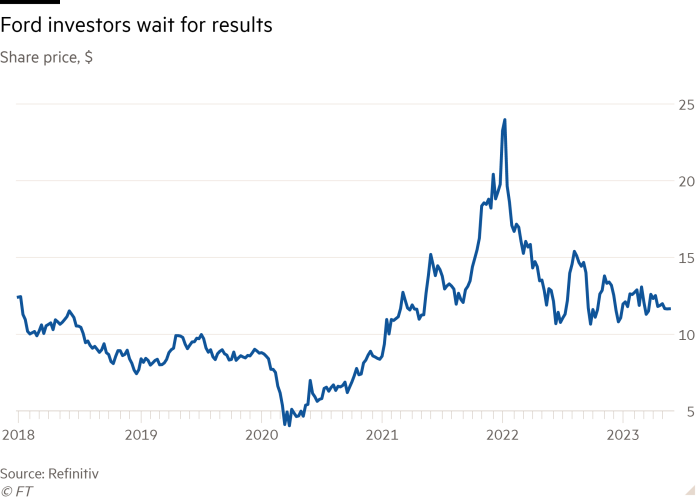

As Farley pitched his vision — fewer vehicles, higher margins, and profits from services — to investors on May 22, shares in the US carmaker barely moved.

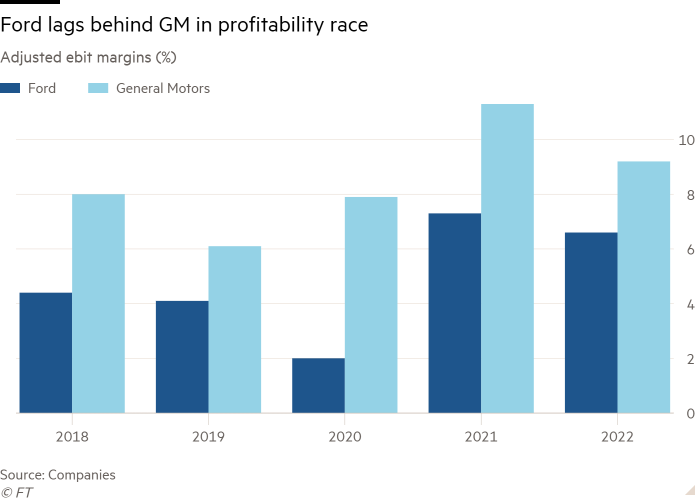

Investors were “sceptical following years of sub-par financial metrics”, said Philippe Houchois, an auto analyst at Jefferies.

“The efforts are truly laudable,” said Dan Levy, analyst at Barclays. “However, we believe the transformation will take longer, and results are likely to come in lower, than what Ford has communicated, . . . making this quite the ‘show-me’ story.”

Devoid of the usual glitzy long-term targets often rolled out by carmakers, the investor day was intended to be a show-me event. It focused on a detail-heavy explanation of how Ford can meet its previously announced 10 per cent target for adjusted earnings before interest and taxation by 2026.

Key to hitting this figure is cutting $7bn of costs from its engine-driven vehicles, and nursing its lossmaking electric vehicle division to an 8 per cent profit margin.

“We know [cost] is our biggest issue,” said chief financial officer John Lawler, acknowledging the carmaker’s past underperformance. “We’ve talked about this for years. You’re not going to believe us until we start delivering it . . . Because we’ve told you this before. That’s the truth. We have, and we haven’t delivered. So we have to prove it.”

The race to reduce costs, pare models and generate profits from digital services is critical if Ford is to succeed in the second race, one that will drive carmakers still further into the territory of technology groups.

The company has to learn to “use the data off the vehicle”, Farley told the Financial Times in an interview shortly before the investor event.

Using information produced by sensors within the car will keep its vehicles at the cutting edge in an era where software will be as important for winning customers as hardware. “If you use the data off the vehicle, then you won’t be competing with Apple and Google, and you will make the vehicle better every day,” said Farley.

The company is already making some small steps towards this. When testing its lane-keeping Blue Cruise system, engineers found that air from passing lorries would push the cars out of lane, and force the system to disconnect, thrusting the driver back in control.

Using data from the cameras to see lorries approaching, the group was able to recalibrate so that its vehicles would remain in control.

The result was that Ford’s hands-free system is among the first to be certified for use in Europe, a market that remains less open to such systems than the US.

Ford is pitching cars and trucks to appeal to customers new to the brand, what the industry calls “conquests”. That means “you design the vehicle very, very differently than if you want your existing customers to feel comfortable”, Farley said.

One element of the new design includes a focus on aerodynamics, helped by Ford’s upcoming Formula 1 partnership with Red Bull. Adrian Newey, Red Bull Racing’s chief technical officer, helped Ford sculpt its future models to avoid drag, which the carmaker believes could help it reduce battery sizes and save costs on consumer models.

“That guy can see air,” said Farley. “The first EVs look a lot like [engine] vehicles, just better looking. The second ones will not look like that.”

The hunt for new customers needs to succeed because in its drive to reduce costs, the company is quitting segments. In Europe, for instance, it is ceasing production of the small, cheap Fiesta models, which used to bring in young drivers before they moved up the range to Focus and eventually the larger Mondeo or S-Max vehicles, a tactic also deployed by Volkswagen, Peugeot and Toyota.

Yet Ford’s blue-sky plans hang on whether it can make money in an increasingly competitive industry.

Its plan to generate cash to invest in connected and electric vehicles “banks on improving the profitability” of Ford Blue, the carmaker’s division for cars and trucks powered by petrol and aimed at consumers, said Steve Brown, analyst at Fitch Ratings.

“Could they continue to make investments [in EVs and connected vehicles] if they don’t get the full $7bn?” he said. “Probably. But in terms of the overall plan and getting to the margin targets they laid out . . . it all kind of works together.”

Kumar Galhotra, president of the business, pledged that engineering, manufacturing and supply chain management would all improve. The company is testing cars and trucks more rigorously, which “will lower our warranty and recall costs”, a long-running struggle for Ford.

The company has also worked to “stabilise” operations at 125 suppliers and is promising to cut loose those who repeatedly disrupt Ford’s operations. At the same time, Ford is looking to pay less for parts: It has found more than $500mn in savings so far.

The carmaker wants to reduce vehicle complexity and the options available to consumers. In the past two years, it has slashed the number of possible combinations a buyer can order for the Ford Explorer, a sport utility vehicle, from 1,900 to 23.

Reducing complexity would raise quality while lowering both material costs and overhead, Galhotra said, because having fewer parts meant “fewer parts to engineer, fewer parts to tool, fewer parts to test, fewer parts to sequence. It means reducing engineering facilities, tooling and manufacturing costs.”

Ford also is betting that its rich history of making commercial vehicles, from the Transit van range to the F-series and Super Duty pick-ups, will allow it to sell high-margin services to business customers.

“Today, we had nearly 400,000 paid software business subscriptions for solutions like telematics and managed charging software,” said Ted Cannis, head of Ford Pro, the commercial vehicle arm formed when Ford reorganised last year. He expects this to grow three-fold by 2026, and for services to account for a fifth of Ford’s profits by then.

The group believes it can convince business owners to pay up to $5,000 per vehicle for a variety of services including smart insurance and hands-free driving.

But at the same time, Ford is acutely aware that it must deliver on its big promises.

“They’ve put targets out there that the Street is going to be holding them to,” said Fitch’s Brown. “It’s all a matter of executing that stuff now.”