Stay informed with free updates

Simply sign up to the World myFT Digest — delivered directly to your inbox.

Good morning.

Pension funds are piling into UK corporate bonds, encouraging some French and German companies to issue sterling debt for the first time.

The UK’s £1.4tn “defined benefit” pensions industry has been switching to corporate debt for its higher yields and to prepare the schemes for potential sales to insurers, analysts said.

The share of European corporate bond sales denominated in sterling has risen to 8.4 per cent from 6.8 per cent at the beginning of 2023, the busiest start to the year in a decade for investment-grade issuance from non-financial companies.

The demand has helped push a number of continental European companies to issue sterling debt for the first time in recent months, including German real estate company Vonovia, German truck manufacturer Traton and French luxury goods group Kering. Read the full story.

-

UK taxes: Capital gains in the UK are highly concentrated in a small and wealthy set of parliamentary constituencies, suggesting most voters would not be hit by higher taxes on the profits, according to research.

Here’s what else I’m keeping tabs on today:

-

Bank of England: MPs in the UK Parliament’s Treasury committee will question governor Andrew Bailey on inflation and interest rates.

-

Julian Assange: The WikiLeaks founder will appear in the UK’s High Court to appeal against his extradition to the US, where he is wanted on espionage charges.

-

Results: Barclays, InterContinental Hotels Group and Carrefour report.

The FT has launched its new US Election Countdown newsletter. Join the FT’s Washington reporter Steff Chávez for your essential guide to the twists and turns of the most significant election in decades. Sign up here.

Five more top stories

1. Exclusive: Europe’s development bank has pumped $890mn into chicken farms and other large Ukrainian food businesses since Russia’s full-scale invasion. The cheap exports have recently helped swell farmer protests in Poland, France, Germany and a dozen other countries, prompting Brussels to set caps on Ukrainian imports of meat and sugar from June. Read the full story.

2. Exclusive: One of the cryptocurrency industry’s highest-profile hedge fund firms has been accused of “criminal” mismanagement and raided by a Swiss prosecutor, in a dispute with an investor over losses suffered following the collapse of FTX. Geneva-based Tyr Capital Partners is alleged to have ignored an internal risk limit and investor warnings over its exposure to the crypto exchange. Here’s more from legal documents seen by the Financial Times.

3. The US is circulating a UN Security Council resolution warning Israel against a “major ground offensive” into Rafah, the city in Gaza near the Egyptian border where about 1.5mn people are sheltering from the conflict in the enclave. The move represents rare criticism of Israel by the US at the UN, reflecting President Joe Biden’s growing frustration with the Israeli government’s war in Gaza and high death toll among Palestinian civilians. More details from the draft resolution.

-

The Hague: The International Court of Justice has begun hearings into the legality of Israel’s 56-year occupation of the Palestinian territories, including whether the expansion of Jewish settlements violates the Geneva Conventions.

-

Israel’s economy: The country’s gross domestic product shrank almost 20 per cent in annualised terms in the final quarter of 2023, official data showed.

-

Middle East tensions: It is time for Biden to deploy his political capital to drown out Israel’s far-right voices and give Arab diplomacy a chance, writes Kim Ghattas.

4. Bad commercial real estate loans have overtaken loss reserves at the biggest US banks, including JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, Goldman Sachs and Morgan Stanley. The sharp deterioration took place in the last year after delinquent commercial property debt for the six big banks nearly tripled to $9.3bn. Here’s how much loan loss provisions have thinned.

-

US banks: Capital One has agreed to buy rival Discover Financial for $35.3bn, uniting two of America’s largest credit card lenders in one of the industry’s biggest deals since the 2008 financial crisis.

5. Container shipping lines are struggling to cope with congested ports and shortages of ships as the crisis in the Red Sea drags into a third month, one of the sector’s most senior executives has warned. Jeremy Nixon, chief executive of Japan’s Ocean Network Express, said vessels were frequently arriving at ports unscheduled after having to reroute because of the Houthi attacks. Read his full interview with the FT.

The Big Read

The Next Generation EU fund came into force in February 2021 at the height of the Covid-19 pandemic. Member states unanimously agreed to jointly underwrite €800bn of debt for what European Commission president Ursula von der Leyen described as a unique opportunity “to invest in a collective recovery and a common future”. But as the fund counts down to its 2026 deadline, initial successes have given way to doubts over the rescue plan’s ability to deliver higher growth in the long term.

We’re also reading . . .

-

EU defence: Europe must stand on its own two feet and not use the US as a crutch for its security, writes US Republican senator JD Vance, author of Hillbilly Elegy.

-

Chinese corporate militias: China’s state-owned enterprises have begun setting up in-house reserve military units, a legacy of the Mao Zedong era. Here’s why.

-

UK universities: The government needs to retain global interest in one of the country’s few globally competitive sectors before it is too late, writes former universities minister Jo Johnson.

-

Alexei Navalny: With her husband’s death, Yulia Navalnaya has vowed to take on the late opposition activist’s struggle after two decades of shunning the limelight.

Chart of the day

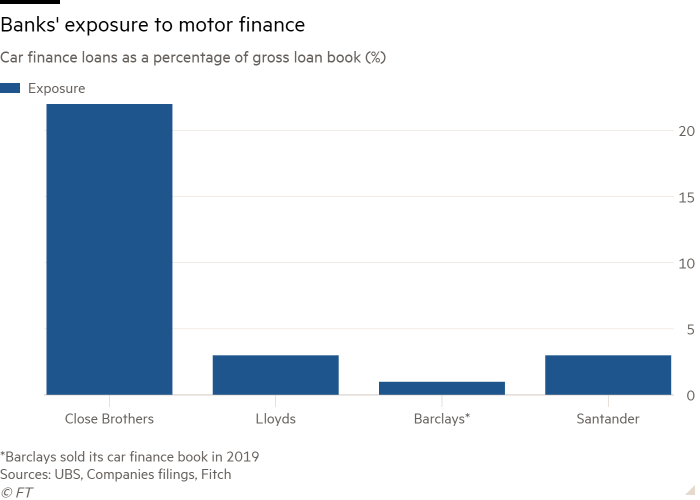

A probe into motor finance deals after a spike in consumer complaints has put struggling UK banks under further pressure as they prepare to make provisions for redresses that analysts estimate could reach as much as £16bn.

Take a break from the news

It is the perfect Austrian ski resort. With a picture-postcard setting, plentiful high-altitude snow and a location close to the Grossglockner, the highest mountain in the country, Heiligenblut should be thriving. So why is it fighting for survival?

Additional contributions from Benjamin Wilhelm and Gordon Smith