Stay informed with free updates

Simply sign up to the World myFT Digest — delivered directly to your inbox.

Good morning.

Jeremy Hunt is considering slashing billions of pounds from public spending plans to fund pre-election tax cuts if he is penned in by tight finances in his March 6 Budget.

Treasury insiders say the UK chancellor is looking at “further spending restraint” after 2025, if official forecasts suggest he does not have enough fiscal headroom to pay for “smart tax cuts”.

Economists have warned Hunt’s current plans for a 1 per cent annual real-term increase in public spending until 2029 are a “fiction”, as they would imply serious cuts to some stretched public services.

But people close to Hunt said Treasury officials were considering going further and reducing projected spending rises to about 0.75 per cent a year, releasing £5bn-£6bn for Budget tax cuts. Here’s why the manoeuvre is being considered.

-

UK economy: Official data due today will reveal if Britain tipped into a technical recession at the end of last year, which could hand Labour a valuable propaganda weapon ahead of the coming election.

And here’s what I’m keeping tabs on today:

-

Economic data: The International Energy Agency publishes its oil market report, while the UK releases its preliminary gross domestic product.

-

Nato: The military alliance holds its defence ministers meeting in Brussels, chaired by secretary-general Jens Stoltenberg, after it reported defence spending by its members will hit a record $380bn this year.

-

Companies: NatWest’s board is due to approve interim boss Paul Thwaite as its permanent group chief executive at its meeting today. Airbus, Commerzbank, DoorDash, Pernod Ricard and Renault are among companies reporting results.

-

UK politics: By-elections are being held in Kingswood and Wellingborough, where Labour appears confident of overturning the Conservatives’ majority.

For the inside track on British politics, sign up for our Inside Politics newsletter by Stephen Bush.

Five more top stories

1. Vladimir Putin has said Joe Biden would be a better US president for Russia than Donald Trump and dismissed concerns over his counterpart’s age and acuity for the role. In his first foray into this year’s US presidential election, Russia’s leader said his American counterpart was “more experienced, predictable, an old-school politician”. Here’s more from his remarks.

-

Russian threat: The US has shared intelligence with Congress and European allies about a new Russian nuclear capability that could be used in space, according to people familiar with the matter.

2. Exclusive: JPMorgan is being sued by the chief executive of a fintech group it co-owns. Haris Karonis, who founded Greek payments company Viva Wallet in 2000, said he believes the Wall Street bank is trying to drive down the valuation of his business by blocking its entry into the US and new European markets, according to legal documents seen by the Financial Times. Owen Walker has more details from London.

3. Exclusive: Citigroup has started tracking calls its private bankers are making to clients, asking its employees to turn in call reports to record each conversation and what was discussed. People familiar with the matter said private bankers have been encouraged to contact each of their clients at least once every 90 days. Here’s how staff have reacted to the measures.

4. Exclusive: The world’s biggest solar panel manufacturer has warned western countries not to cut out suppliers from China, which account for more than 80 per cent of global solar manufacturing. An executive from Longi Green Energy Technology told the FT that Europe and the US risked slower decarbonisation of their economies if they restrict Chinese companies from their renewable energy supply chains. Read the full interview.

-

US-China trade: Thousands of Porsche, Bentley and Audi cars have been impounded in US ports after a supplier to parent group Volkswagen found a Chinese subcomponent in the vehicles that breached anti-forced labour laws.

5. Israel has warned that hostage talks will not advance until Hamas changes its position, in a sign that talks brokered by the US, Qatar and Egypt have struggled to make any breakthrough. In a statement released a day after Israeli spy chiefs held talks with CIA director Bill Burns in Cairo, Israeli Prime Minister Benjamin Netanyahu reiterated that he would not give in “to Hamas’s delusional demands”.

-

Houthi rebels: The Iran-backed group’s intervention in the Israel-Hamas war risks further hardship for Yemen’s long-suffering population.

-

Cross-border fire: Several Lebanese civilians were killed yesterday when Israel retaliated with air strikes for a suspected Hizbollah rocket barrage that had earlier killed an Israeli soldier and injured several others.

The Big Read

OpenAI’s revenues surpassed $2bn on an annualised basis in December, making it one of the fastest-growing technology companies in history. Since the launch of its viral chatbot ChatGPT in late 2022, OpenAI has become one of only a handful of Silicon Valley companies, including Google and Meta, to post revenues of $1bn within a decade of being founded. But the long-term viability of its revenue stream is under question.

We’re also reading . . .

-

Private equity: The investment chief of the California State Teachers’ Retirement System told the FT that the industry needs “to do a better job” in sharing profits with employees of the companies it buys.

-

War in Ukraine: Russian forces closing in on the town of Avdiivka are an early test for Kyiv’s new top general, as well as for an army running short of supplies and men.

-

European politics: Gains for the hard right in June’s EU parliament vote could weaken the centrist consensus and disrupt climate, migration and trade policies, writes Tony Barber.

-

Long Covid: With millions unwell, scientists fear that the condition’s range of symptoms and link to chronic diseases will have a lasting impact on health systems.

Chart of the day

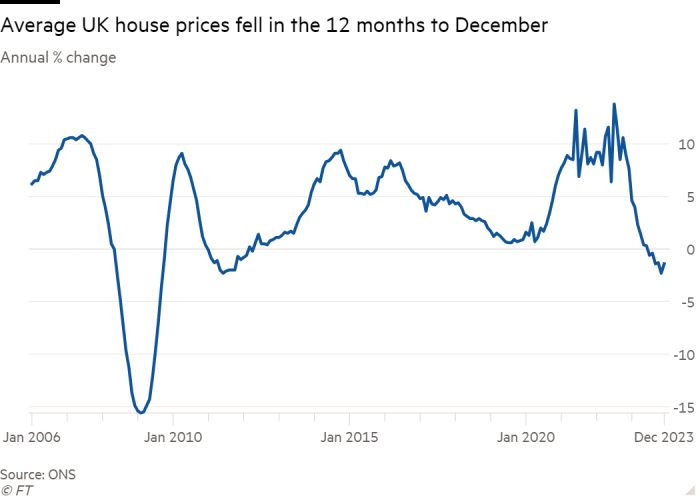

UK house prices fell for the sixth month in a row in December, according to official data, driven by weakness in the London market and underscoring the continuing pressure of higher borrowing costs.

Take a break from the news

Fastelavn used to mark the beginning of the Lent period of fasting in Denmark. Catholicism did not stick, but the holiday did, and as did fastelavnsbolle, the sweet treat associated with the festival. FT Magazine’s Imogen West-Knights explores how the normally poised residents of Copenhagen go mad for the cream-filled buns every February.

Additional contributions from Benjamin Wilhelm and Gordon Smith