Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

EY Germany is planning to cut 40 partners and shed 380 staff as the Big Four firm attempts to improve profitability after the damage caused by the Wirecard scandal.

Most of the job cuts are aimed at reducing back-office costs at the German business, one of the largest in EY’s 150-country operations, four people familiar with the matter told the Financial Times.

The majority of the 40 partners heading for the exit are in the firm’s audit practice, accounting for about 5 per cent of the equity and salaried partners in the German business.

EY lost several big audit mandates in Germany, including Commerzbank, DWS and KfW, after its involvement in the Wirecard scandal, in which it failed to spot over several years that half of the payment group’s reported revenues and billions of euros of corporate cash did not exist. The fintech went bust in 2020 in one of Europe’s most spectacular accounting frauds.

The redundancy plan is the latest in a series of cost-cutting measures in the Big Four accounting firm’s international network as it responds to economic uncertainty and tries to boost the valuation of its global consulting business ahead of a split from its audit operations.

Five more stories in the news

1. Lockheed ready with F-16s Lockheed Martin, the largest US defence contractor, has said it stands ready to meet demand for its F-16 aircraft as some of Ukraine’s closest European allies revive efforts to provide fighter jets to Kyiv. The US-German decision to send tanks to Ukraine has reignited discussions, but both countries have ruled out sending the aircraft.

-

Opinion: Will Leopard 2 tanks actually boost Ukraine’s chances? This depends on training and the flow of western arms and ammunition, writes Franz-Stefan Gady of the International Institute for Strategic Studies.

Are the US and Germany right to supply tanks to Ukraine, or does the move risk further escalating Ukraine’s war with Russia? Tell us in our latest poll.

2. Musk says Tesla could sell 2mn Teslas Elon Musk said Tesla could deliver as many as 2mn cars this year after it dramatically cut prices to attract customers at the short-term expense of margins. The company’s chief executive sought to allay investor worries and said the electric vehicle maker was seeing orders at almost twice the rate of production.

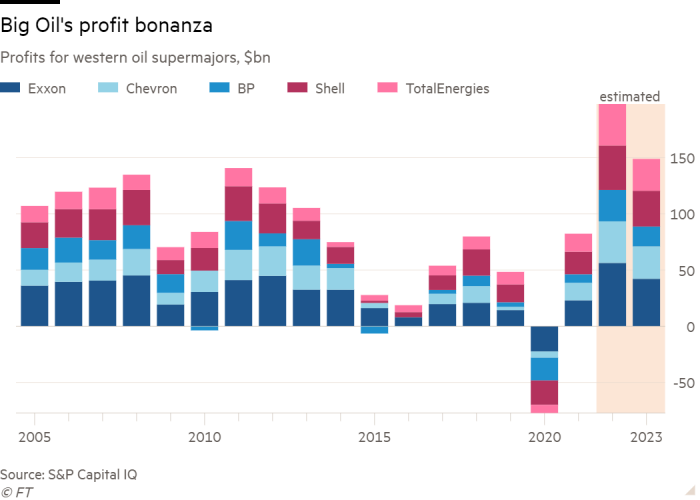

3. Big Oil profits set to slow Oil companies are forecast to earn tens of billions of dollars in fourth-quarter profits when they start reporting earnings this week, but the outlook is dimmer for 2023: early projections have the five western supermajors collectively earning $150bn, down from an estimated $200bn haul last year. Still, the 2023 forecast, if it pans out, would be the second-highest earnings ever recorded.

4. British car production at lowest since 1950s The number of cars manufactured in the UK fell 9.8 per cent to 775,014, marking the worst year since 1956. While the worldwide industry is still hamstrung by a global semiconductor shortage and sporadic parts supplies from China, several UK plant closures during the past two years have depressed the numbers further.

5. UK to make ‘failure to prevent fraud’ a crime Law firms, accountants and even casinos that do not do enough to prevent fraud, false accounting and money laundering will be targeted in an upcoming bill. For such white-collar crimes, prosecutors currently need to prove a “directing mind” at an organisation intended to commit the offence, but the new law may only require proving a lack of “reasonable” or “adequate” controls.

The day ahead

Economic data South Africa has its producer price index for December and results from its central bank’s monetary policy committee meeting. The US releases consumer spending figures and flash gross domestic product figures for the fourth quarter. The UK has labour productivity numbers for the third quarter, and Spain and Norway publish unemployment rates.

Corporate results Banco Sabadell, Comcast, CVS Group, Diageo, Fevertree Drinks, Foxtons, Intel, JCDecaux, JetBlue Airways, LVMH, Marsh & McLennan, Mastercard, Nokia, Northrop Grumman, Salvatore Ferragamo, Rank Group, SAP, St James’s Place, STMicroelectronics, Telia, Tate & Lyle, T Rowe Price, Visa, Volvo Group and Wizz Air report.

The FT will be holding its second annual Future of Business Education Series in February. This virtual one-day event will provide the opportunity for ambitious individuals looking to enhance their skill set, accelerate their careers and discuss what life after an MBA might look like. Register today.

What else we’re reading

Franklin Templeton tries to reinvent itself In 2020, Jenny Johnson, the fourth member of her family to run the California-based fund, had taken the reins of a business regarded as outdated and stodgy. Now, she is pushing the group quickly into new asset classes and technology to prove that an old-school, family-run stockpicker can still prove itself against industry behemoths such as BlackRock and State Street.

How will Google solve its AI conundrum? Microsoft threw down a direct challenge to the search giant with its multibillion-dollar investment in OpenAI this week. In the AI arms race, Google should be well-positioned, but with politicians and regulators breathing down its neck — and a hugely profitable business model to defend — the company may be hesitant to wield many of the weapons at its disposal.

Explainer: How Biden’s climate law provokes Europe The US president’s $369bn Inflation Reduction Act has delivered a big green bonus for climate experts and US business while infuriating Europe. EU governments have launched a litany of complaints, claiming it violates trade rules and distorts competition. Here’s why companies are excited — and America’s trading partners less so.

Opinion: Pros of China’s reopening outweigh cons Beijing’s reversal of its zero-Covid strategy will create a surge in consumption that boosts export demand elsewhere, but higher Chinese industrial production means more need for fuel and particularly LNG, possibly reinflating the energy cost shock. On balance though, the pros outweigh the cons, writes Alan Beattie.

-

🎧 Listen: Shanghai correspondent Tom Hale and global China editor James Kynge break down President Xi Jinping’s main goals and whether they are enough to jump-start the country’s economy in this episode of the Behind the Money podcast.

Opinion: Carelessness is killing Sunak’s efforts Carelessness — the excuse offered by UK Conservative party chair Nadhim Zahawi for his tax missteps — is becoming a defining trait of the Tories, writes Robert Shrimsley. Beyond Zahawi, Prime Minister Rishi Sunak, plagued by a series of mini scandals, is also starting to look weak.

Take a break from the news

Through the sensual and alluring medium of paint, women artists are delivering complex, individual narratives in a way that somehow also feels universal. HTSI explores how female artists are reinventing the nude.

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com