Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Europe’s solar industry should be basking in sunshine. Solar is central to the EU’s hopes to generate 45 per cent of its electricity from renewable sources by 2030.

Since August, however, eight European solar supply chain companies have either filed for bankruptcy, paused production, warned of factory closures or restructured debts, according to SolarPower Europe. Domestic companies cannot compete with a glut of cheaply-priced imports from China, the global leader.

Switzerland’s Meyer Burger Technology typifies the crisis: its shares are down 87 per cent in the past year. It announced last week it would close a module production site in Germany, one of Europe’s largest, and hoped to raise up to SFr250mn via a rights issue to fund expansion in the US.

Pressure is now on Brussels to intervene by imposing strict tariffs or other measures to support the domestic solar industry. There are few easy options: trade restrictions on manufacturers are hated by their customers, the solar developers. Having already lost its position as the world’s largest solar-panel maker to China in the early 2000s, Europe’s much hoped-for solar manufacturing renaissance looks unlikely.

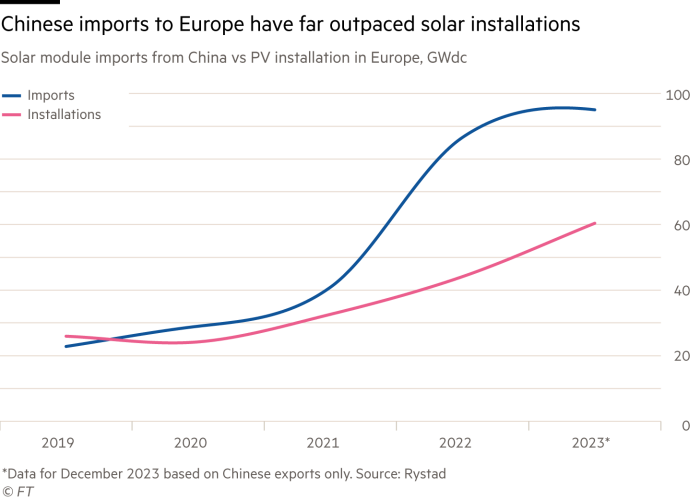

The forces behind the crisis are multiple. Chinese solar manufacturing capacity has outpaced domestic demand, particularly as companies have built production lines for new technologies while simultaneously producing older models. This led to record overseas exports in 2023 that far exceeded installations in markets such as Europe.

Utilities and wholesalers, burnt by pandemic supply chain problems, have taken advantage of falling prices to build up stockpiles as Europe works towards green targets.

European installations, while up significantly, have undershot some of the more bullish forecasts. Growth is expected to slow this year as strong residential demand moderates. Restrictions on Chinese imports elsewhere, including the US, have diverted shipments to Europe, says the European Solar Manufacturing Council.

Europe’s smaller manufacturers can’t compete on price: Chinese-made panels can be produced for as little as half the cost of European-manufactured equipment. The gap between imports and European solar installations should fall this year, reckons Rystad’s Marius Mordal Bakke, but this spread remains well above normal levels.

Even if funding solutions can be found to avoid further insolvencies, the European industry’s small scale will remain problematic.

Europe is trying to beef up domestic supply chains by promising power auctions where local content, not just price, determines winning bids. But these will be in the minority. There is little to persuade investors that Europe’s solar panel industry has a hope of reaching sunlit uplands.

Lex is the FT’s flagship daily investment column. If you are a subscriber and would like to receive alerts when Lex articles are published, just click the button “Add to myFT”, which appears at the top of this page above the headline