Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Excessive bank regulation is for the birds, reckons the European Banking Federation. At least that is what an avian-themed cartoon on the report’s cover suggests. The trade body wants the EU to recognise it as a “strategic sector”, ensuring that European lenders remain globally competitive. This might ruffle some feathers.

Every company wants fewer restrictions on its operations. Banks no doubt would like to lighten the load of extra capital held against the various assets they have on their balance sheets. This can mean less of a payout — dividends and share buybacks — for their investors. But to be fair, this is not the sector’s immediate complaint.

The EBF is calling for a more consistent set of rules across the EU. Recent ad hoc efforts for bank windfall taxes at the country level, such as in Italy, to raise funds for depleted government coffers don’t help, for instance. Banks complain that local, politically driven measures aren’t assessed in terms of their competitive effects.

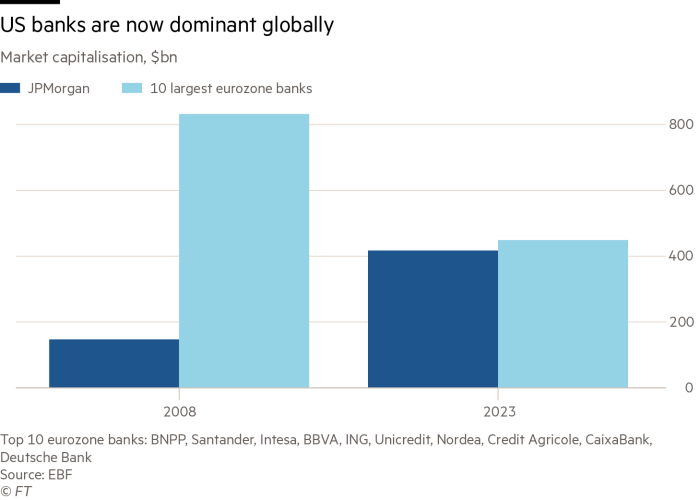

One illustration is how the market perceives Europe’s banks: not well. In January 2008 the market capitalisation of JPMorgan made up less than 18 per cent of that of the top ten European banks together. Today, JPMorgan’s value represents well over 90 per cent of the European leaders.

This isn’t just a matter of regulation, though. Investors will have correctly questioned whether European lenders were decent stewards of capital given the amount of equity they have raised since the financial crisis. Santander’s share count has increased 85 per cent; UniCredit by nearly 11 times. All had their reasons. But while JPMorgan had to rescue ailing institutions such as mortgage lender Washington Mutual, it could still reduce its share count since 2008 by 27 per cent.

Banks everywhere, including the powerful US lobby, moan that they are hobbled by burgeoning rules and regulation. True, the lack of a proper banking union is a genuine problem in Europe, hence the EBF’s appeal to legislators and not just watchdogs. The group points to the decline in the region’s share of global capital markets activity in Europe, from 18 to 10 per cent, since 2008. But the US had shed a similar chunk of share in that time.

This is understandable, if typical, lobbying to level the playing field with global peers. But it comes just as European bank profitability (and share price performance) has improved markedly, helped by the tailwind of higher interest rates. Dressing this up in strategic status, a non-existent designation with unclear benefits, just feels a little cuckoo.