Stay informed with free updates

Simply sign up to the Exchange traded funds myFT Digest — delivered directly to your inbox.

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

Investors pulled in their horns in April as diminishing prospects for near-term US interest rate cuts drove a broad aversion to risk, global data on exchange traded fund flows indicate.

However, there were still signs of animal spirits in some corners of the global market with solid demand for some cyclical assets, such as European and Japanese equities and emerging market debt.

Overall, net flows into ETFs slid from a punchy $126.5bn in March to a “muted” $68.5bn in April, according to data from BlackRock. Equity buying fell even more sharply from $106.3bn to $40.7bn as demand for fixed income ETFs — an inherently lower-risk asset class — ticked up to $27.4bn despite the near-halving of overall ETF flows.

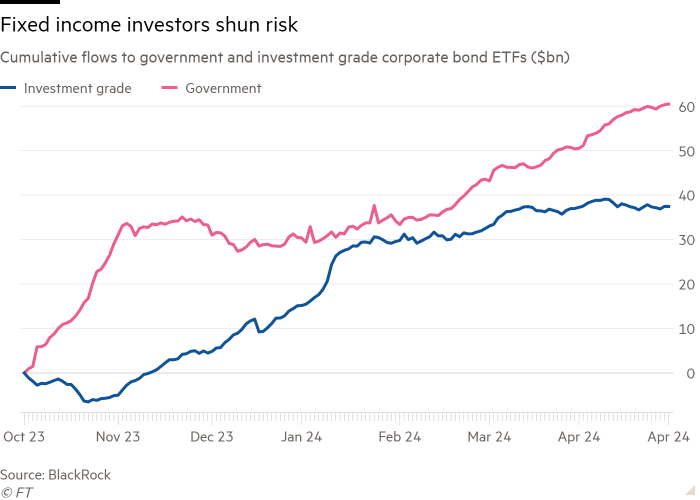

An aversion to risk was evident even within these fixed income flows, with government bond ETFs — again more of a safe haven than corporate bonds — pulling in $10.1bn, the highest figure since October.

Moreover, even this government bond demand was redolent of a safety-first vibe, with flows to US-listed short-term (up to three years) Treasury ETFs turning positive for the first time since October and “intermediate” (three- to seven-year) funds mopping up most of the rest.

“We have more inflows going into the front end, and also intermediate, than further out the [yield] curve,” said Karim Chedid, head of investment strategy for iShares in the Emea region at BlackRock.

“It’s a case of carry. You can get good yields in the front end and belly [due to the Treasury yield curve being inverted] and are less exposed to the volatility of rates,” he added.

Chedid summed up the mood in April as “muted risk rather than risk off” as markets fell amid a further ratcheting back of expectations of Federal Reserve easing.

“On a broad level [the flows data] is definitely weak for equities. It wasn’t a great month for risk assets in terms of equity performance. We had significant pushback on rate expectations, especially from the Fed,” said Chedid, who nevertheless saw early signs of improving sentiment in May.

Scott Chronert, global head of ETF research at Citi, noted that in the US, fixed income ETFs actually pulled in more money that equity ones in April, at $15.2bn versus $14.1bn.

“US-listed ETF flows decelerated this month against a generally risk-off backdrop. Underlying trends also pointed to more cautious positioning,” Chronert said. “Fixed income led all asset classes, but the gains were skewed towards core products, shorter durations and Treasuries”.

Matthew Bartolini, head of SPDR Americas research at State Street Global Advisors, again focused purely on the US ETF market, noted that corporate bond ETFs saw net outflows in April (of $3.3bn) for the first time this year.

Globally, there were bright spots, however. Flows to ETFs focused on emerging market debt — at the higher risk end of the fixed income spectrum — turned positive for the first time this year, according to BlackRock, with $2.7bn of net buying.

“We have been seeing persistent outflows but it has started to turn,” Chedid said. He believed EM debt could provide meaningfully higher yields without some of the traditional attendant downside risks, arguing that the emerging world is less vulnerable to swings in US monetary policy than during the infamous “taper tantrum” of 2013.

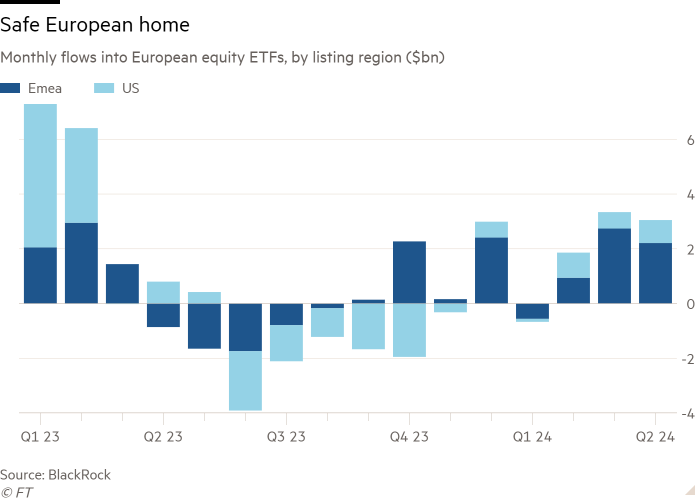

European equities also saw solid demand, with a third straight month of net inflows, of $3.1bn, bucking the trend witnessed for most of the past year.

Chedid believed the turnaround in sentiment was driven by expectations that the European Central Bank could start to cut rates before the Fed, which has helped European equities outperform their American peers so far this year.

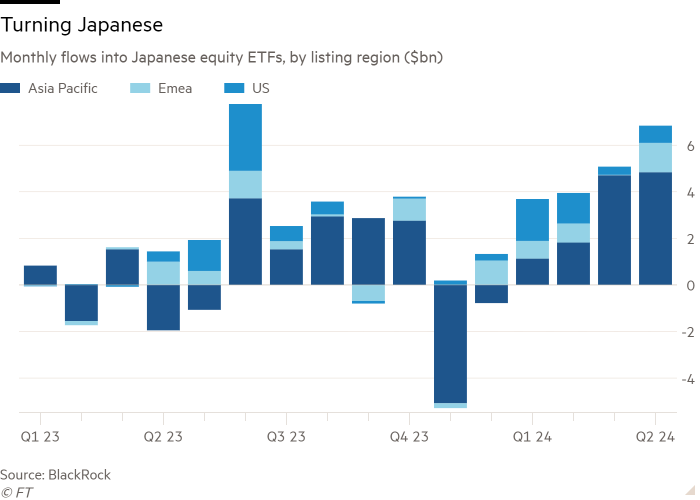

Japanese equities are also in demand, with the $6.8bn of net buying in April the second highest monthly reading since the start of 2023 — even as the Bank of Japan has ended its marathon 14-year ETF buying spree that has seen it pocket 7 per cent of Japan’s stock market capitalisation.

The demand for Japanese equities is evident among European and American investors, as well as those in the Asia-Pacific region,

Chedid believed this was a structural trend that had further to run, with Japanese stocks currently accounting for less than 2 per cent of the average European wealth portfolio, compared to Japan’s current weighting of 5.3 per cent in the MSCI All Country World Index.

Tying these together, Bartolini said US-listed developed market ex-US equity ETFs notched up a record 46th consecutive month of inflows in April, a trend he attributed to the use of ETFs as building blocks in asset allocation models, as well as “stretched valuations in the US and more conducive valuations overseas”.