Pour one out for one of the weirdest macroeconomic phenomenons of all time. From the FT’s Tommy Stubbington just now:

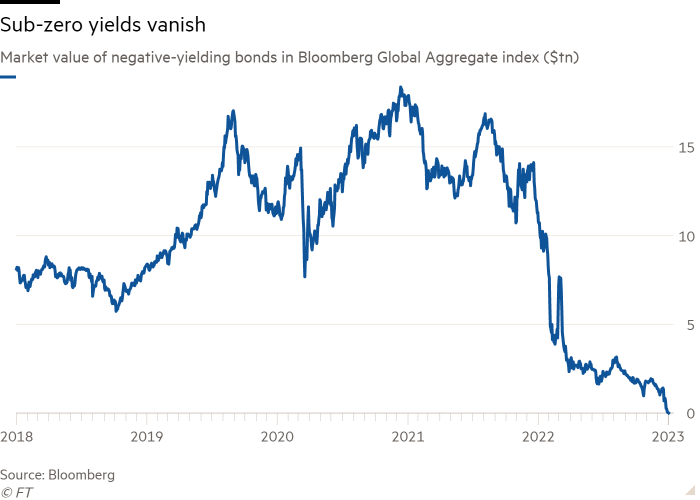

The global stock of negative-yielding bonds has dwindled to zero after last month’s unexpected policy shift by the Bank of Japan undermined the last bastion of sub-zero yields.

Negative yields — which occur when bond prices climb so high that buyers holding them to maturity are guaranteed to lose money — engulfed a broad swath of global fixed-income markets in recent years, with the market value of debt trading at a yield below zero soaring above $18tn in late 2020 after central banks slashed interest rates and launched huge bond-buying programmes in the wake of the Covid-19 pandemic.

But last year’s abrupt end to the era of easy monetary policy sparked a historic bond sell-off that rapidly shrank the pile, as central banks in the eurozone and Switzerland brought down the curtain on years of negative interest rates.

Behold, a classic vomiting camel chart:

FT Alphaville wrote about the imminent prospect of zero sub-zero yielding bonds back in March last year, when we were a bit sad about the death of something that broke so many macro minds. It was particularly hilarious when even some euro-denominated “high yield” bonds traded at negative yields.

But now that this era has finally passed, we should take a moment to reflect on how remarkably smooth the demise of negative-yielding debt has been.

Sure, a lot of investors have lost a lot of money etc etc. But that was never really in doubt. A few years back a lot people thought that unwinding all this would inevitably cause financial chaos on a massive scale: bond fund runs, bank collapses, pension fund insolvencies, human sacrifice, dogs and cats living together, mass hysteria.

And while it hasn’t been without a few dicey moments, all things considered it seems to have gone surprisingly well? And now Bonds Have Been Made Great Again!