Policymakers at the World Bank and IMF spring meetings this week will grapple over more funds for debt-strapped nations and development goals as global crises stretch aid budgets.

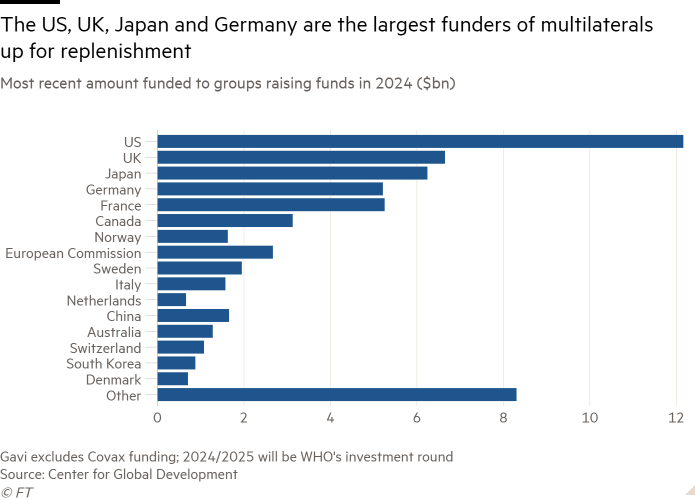

The International Development Association, the World Bank’s $200bn lending arm to the world’s poorest countries, is leading a wave of fundraising this year for “replenishment” of the equity that backs grants and loans needed to help countries struggling to pay back a decade of borrowing from China and bond markets.

But this year a record number of other developmental organisations and programmes, including the World Health Organization and Gavi, the alliance rolling out the first anti-malaria vaccine, are also aiming to top up their contributions from western governments distracted by elections at home and wars in Europe and the Middle East.

“There is a record amount of need and a record number of funds coming forward, meanwhile, the international community’s focus is elsewhere,” said Clemence Landers, senior policy fellow at the Center for Global Development, a think-tank.

“The fact is that these funds need to be replenished to avoid poverty, health and other crises, and it is unclear if there is full-throttled political support to get to the numbers needed.”

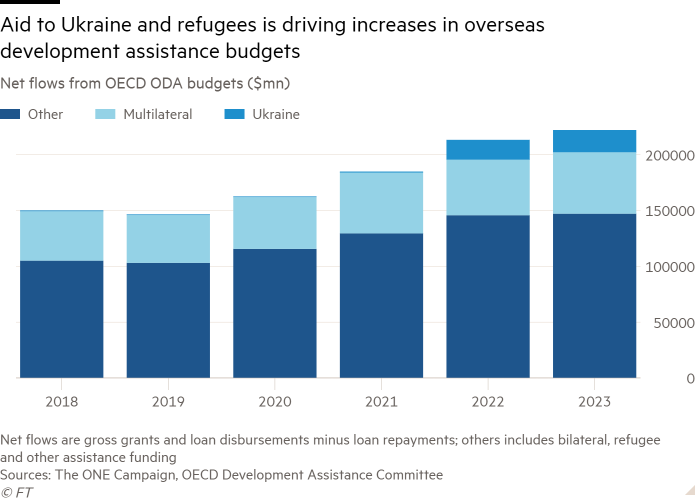

Overseas development assistance budgets, which rich countries typically use to allocate cash for development banks and multilateral funds, rose to a historic high last year, according to OECD data released last week.

But the plethora of conflicts in Ukraine, the Middle East and Africa is draining budgets, even though multilateral sources are one of the few ways that developing countries can access fresh money for debt repayment and climate action.

Total development assistance has increased by 46 per cent in nominal terms since 2018 to $223bn, according to the OECD. A large share of that growth has been driven by a 28-fold increase in aid to Ukraine since 2022.

Meanwhile, according to anti-poverty advocacy group the One Campaign, assistance to multilateral funds such as the IDA and the Global Partnership for Education has only increased by 17 per cent since 2019, partly reflecting a decline in 2021-22 as money for Ukraine took priority for rich countries.

Other gears of the financing machine for poor countries are either rusty or going into reverse.

A handful of African countries this year have managed to tap international bond markets, after a two-year freeze amid rising interest rates. But they are paying up for the privilege. Kenya recently issued dollar debt with a yield of close to 10 per cent.

The boom in loans from China, the biggest bilateral creditor to poor nations during the past decade, is also over.

“For over 40 low- and middle-income countries, cumulative net debt flows from Chinese creditors since 2019 are now negative,” meaning countries are paying China back more on loans than is being disbursed, Jay Shambaugh, under-secretary for international affairs at the US Treasury, said last week.

Beyond increases in humanitarian funding to war zones such as Gaza, the leading funders of IDA and other funds are likely to offer up less capital in the next year.

Elections in the US and UK, and competing budget demands in other critical donor nations, such as economically stagnant Germany, are prompting funds to rethink how they could use debt leverage or other new methods to raise money.

While their share of donor budgets has shrunk, multilateral funds have also proliferated in recent years, particularly those with single-issue remits, such as health or agriculture.

“There is an issue of duplication, where too many funds seem to be chasing similar prospects . . . without co-ordinating their investments,” said Bright Simons, vice-president of research at Ghanaian think-tank Imani.

“This results in an ‘overheads overhang’,” he added, where multiple bureaucracies are “all marketing a bewildered array of poorly differentiated financing solutions to overwhelmed developing countries”.

While some of the flourishing number of funds can take in alternative private sources of investment, such as philanthropic cash, most legally cannot.

Additionally, relatively few development funds have records of tapping capital markets to raise money.

Despite its size and triple A credit rating, even IDA has only regularly issued bonds since 2018. Its issuance of about $30bn in bonds since then compares with many tens of billions more sold by the International Bank for Reconstruction and Development, the World Bank’s lending arm for middle-income countries.

Both institutions have also typically issued this debt at maturities below 10 years, which means they are now encountering another problem — in the next few years they will replace maturing bonds by paying higher global interest rates to sell new ones, just as demand for their loans increases.

Because much of IDA’s support is in zero-interest grants, it is particularly affected by this mismatch and is set to hit leverage limits sooner than was forecast just a few years ago.

Others are calling for rich countries to use reserve assets dispensed by the IMF, the special drawing rights (SDRs) which equate to hundreds of billions of US dollars, to back more bond sales by the World Bank at a lower cost.

Governments cannot use their SDRs to put more capital into the bank directly. But they could in theory buy bonds denominated in SDRs.

“There is a very compelling case for using [SDR bonds] to fill some of the funding holes in IDA in particular,” said Brad Setser, a senior fellow at the Council on Foreign Relations. It would help reduce the cost of issuing longer-term bonds that are better matched to IDA’s multi-decade loans, he said.

“Chinese policy lending has more or less dried up,” Setser said. “The bond market has opened up — but at a high price. Multilateral development banks right now are the only game in town.”