Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Embracer Group, the Tomb Raider developer that became Europe’s most valuable video games business after a rapid series of acquisitions, plans to split into three listed companies as it battles to regain investor confidence.

Lars Wingefors, the Swedish entrepreneur who leads Embracer, is unwinding the empire that he built in a three-year buying spree, after warning in February that the company would miss its debt reduction target.

“The time is right for Embracer to become three public companies, each boasting sufficient scale, coherent strategies, specialised business models and empowered by visionary leadership teams,” Wingefors said.

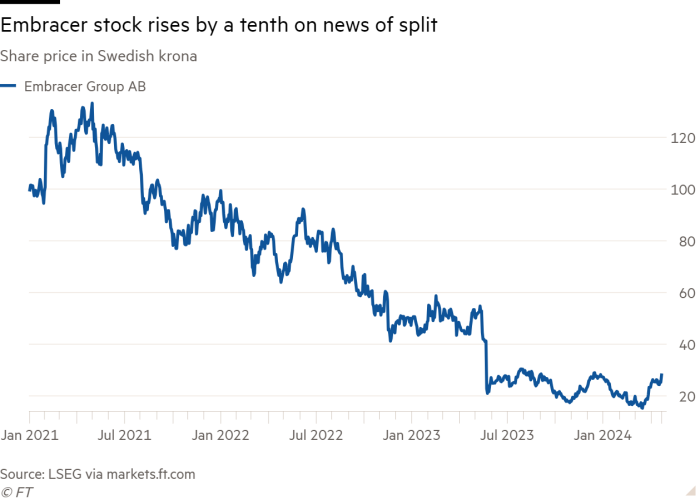

The news sent Embracer’s stock up 10 per cent on Monday to SKr27.87, valuing the company at about SKr37bn ($3.4bn).

Shares in Embracer plummeted in May 2023 after it slashed forecasts and said a mooted $2bn partnership deal had fallen through. Its stock has lost more than three-quarters of its value since 2021’s peak, at a time when many video game companies are struggling to find growth in the console or mobile markets after the end of the Covid-19 pandemic boom.

Sweden-based Embracer has laid off hundreds of employees and divested key assets over the past year including Gearbox Entertainment, which makes the Borderlands and Duke Nukem games, and Saber Interactive, as it works to pay down debt.

Embracer said in February that it had net debt of SKr16.1bn at the end of December and that it was “unlikely” to meet its target of reducing this to SKr8bn by the end of March.

On Monday Embracer said it would spin off Asmodee Group, the maker of boardgames including Settlers of Catan, and its console-to-mobile developer Coffee Stain & Friends, as dividends and list them on Nasdaq Stockholm.

Middle-earth Enterprises & Friends, which holds film and gaming rights to The Hobbit and The Lord of the Rings books as well as the Tomb Raider franchise, will remain part of the existing Embracer group. Wingefors said he would again rename Embracer, which was rebranded from THQ Nordic in 2019 as he embarked on a multibillion-euro dealmaking binge.

Embracer said it had lined up a new €900mn financing agreement through Asmodee as part of the transaction.

Wingefors, Embracer’s co-founder and largest shareholder, said he planned to be a “long-term, active, committed and supportive owner of all three entities”. He owns about 20 per cent of Embracer’s capital and controls 40 per cent of votes.

Wingefors is dismantling his empire just weeks after insisting that Embracer’s restructuring had ended with March’s $460mn sale of Gearbox to Take-Two, the US-based games group behind Grand Theft Auto.

“Rather than imposing conformity on thriving businesses, we should foster an environment that amplifies existing success,” said Wingefors in a shareholder letter on Monday. “I am confident that this will be easier with three distinct winning formulas in specific market segments.”

Analysts at Citi said in a note to clients on Monday that the three-way split was “a more extreme step than we had anticipated”. Citi said the plan “makes sense” given the “lack of comfort the market has with [its] financial leverage”.