Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

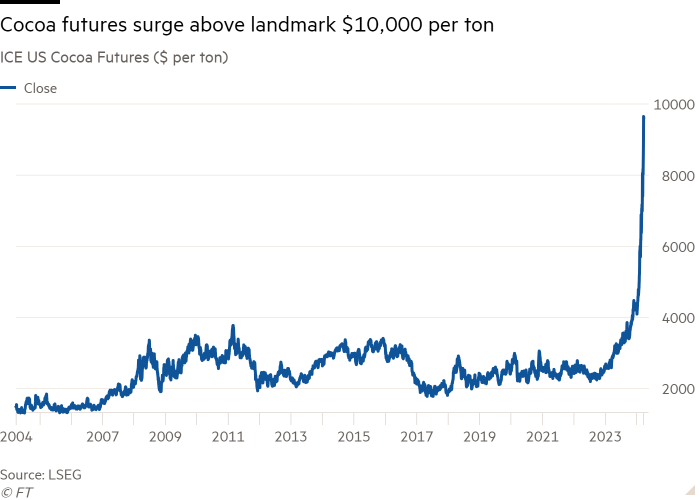

The price of cocoa surged through $10,000 per ton for the first time on Tuesday, as a dizzying rise in prices caused by poor harvests in Africa accelerates.

Cocoa futures traded as high as $10,080 in New York, more than double their price only two months ago, as traders warned a global shortage of cocoa beans would herald higher price tags for chocolate bars. Prices later fell back to trade at $9,624.

The market was “out of control”, said Andrew Moriarty, price reporting manager at Mintec, a commodities data group. “Everyone is just bracing for impact.”

Poor weather and disease have slashed crop yields in Ivory Coast and Ghana, which together produce more than two-thirds of the world’s beans. Decades of low prices have left cash-strapped West African farmers unable to invest in their plantations. As a result most are planted with old, decaying trees that are more vulnerable to disease and extreme weather.

This has created a global cocoa shortfall for the third year running, driving an unprecedented price rally. Two months ago cocoa traded in New York at below $5,000; a year ago it was less than $3,000. London cocoa futures have more than doubled since the start of February and more than tripled since this time last year.

“The handwriting was on the wall for a long time that there was going to be a major reduction in supply this year,” said Judy Ganes, an independent soft commodities consultant.

The situation has nonetheless created panic as the industry tries to find enough beans to meet consumer demand. “From the [cocoa] processors all the way down to the [chocolate] manufacturers, all of them are very, very low on cover,” said Moriarty.

While processors are struggling to find beans, manufacturers are having a hard time procuring enough cocoa butter and cocoa liquor, he said, adding that this was driving prices higher.

Analysts said the squeeze might also be exacerbated by traders who had bet that prices would collapse. As prices rocket higher, many are faced with soaring calls for more margin, a form of insurance they must deposit at an exchange to maintain their bets.

Many traders could be forced to close their positions to protect themselves against losses, which would mean buying back their contracts at higher prices. That would push the market up even further.

Hedge funds that latch on to market trends, however, have been profiting from the huge rally. For instance, London-based Aspect Capital’s Diversified fund is up 18.2 per cent so far this year, with cocoa its biggest driver of performance. The fund has been selling down its position as the price has risen to help control risk, said a person familiar with the fund.

These speculators holding bets that prices would continue to rise “are making money hand over fist”, said Moriarty.

Intercontinental Exchange, which runs the cocoa futures contract in New York, said that speculators had been reducing their positions in the last year.

With skyrocketing prices hitting margins, chocolate makers have said they have no choice but to pass on costs to consumers. Hershey warned in February that cocoa prices would limit earnings growth this year, as it reported a 6.6 per cent drop in sales in the fourth quarter of 2023.

Additional reporting by Laurence Fletcher