Hello everyone, this is Cissy from Hong Kong.

When I was at the CES trade show in Las Vegas earlier this year and wrote a story about Chinese EV maker Xpeng’s big ambition to deliver its dual-mode electric vertical take-off and landing (eVTOL) vehicle — a flying car, in other words — a contact from its rival texted me: “The industry considers it [dual-mode] a joke.”

It’s too early to say whether Xpeng’s flying car ends up a joke or not, but flying cars are already making a big buzz in China’s cyber space, even if they’re not yet available for the daily commute.

Last month, Guangzhou-based autonomous aerial vehicle maker Ehang started to sell its air taxi on Taobao, with a price tag of Rmb2.39mn, or around $330,000. Two days later, the company got Chinese influencer Luo Yonghao to sell it via livestream. That night, Luo sold one air taxi for Rmb1.99mn — which goes to show that you can get just about anything at a bargain price through live commerce in China — and received 12 pre-orders, with a deposit of Rmb39,990 each. The only full-priced sale was apparently to Ehang itself.

So why did my contact say Xpeng’s dual-mode flying car was a joke? Basically he thinks Xpeng is trying to do too much. In the rush to commercialise its flying vehicles, it is betting on both EV (the land mode) and eVTOL (the aerial mode), he said. This approach could leave the company facing not one but two sets of harsh regulations, one for land vehicles and one for aerial vehicles.

EV-enabled lift-off

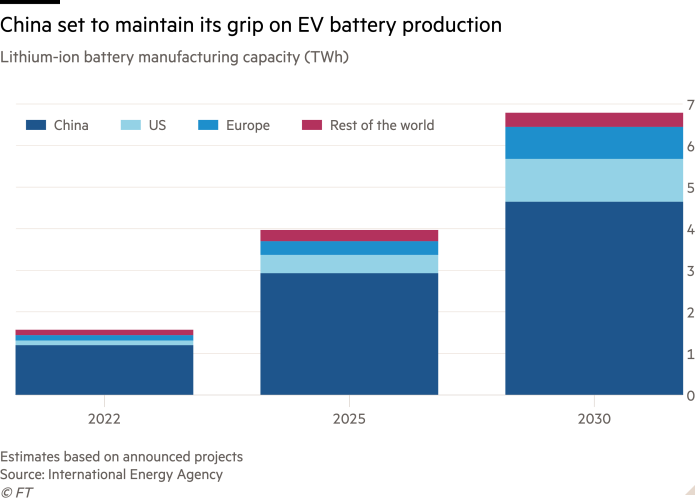

China accounts for 50 per cent of the world’s total eVTOL models, far above the US’s 18 per cent and Germany’s 8 per cent, the latest research shows. This significant lead can be attributed to China’s advanced EV-related technologies, particularly in the field of batteries, writes Nikkei’s Shizuka Tanabe.

For flying cars, batteries with a high energy density — more than 400 watt-hours per kilogramme — are considered essential. Chinese battery manufacturers, such as global frontrunner CATL, are working to develop battery solutions specifically for eVTOL vehicles, giving Chinese eVTOL manufacturers an edge when it comes to procurement.

With local governments’ support for the so-called low-altitude economy, Chinese vehicle makers such as Xpeng, Ehang, Guangzhou Automobile Group, Geely and their affiliates are all racing to claim a large share of the emerging global market. Among them, Nasdaq-listed Ehang received authorisation to mass produce its flying vehicles earlier this month.

Although local governments such as Guangzhou and Shenzhen are offering support to the sector in terms of production expansion and field tests, hurdles to widespread use remain. There are still few take-off and landing points, and traffic rules for individual drivers are not yet in place.

Coming up short

Jeff Yass’s Susquehanna International Group first invested $80,000 in TikTok parent ByteDance a decade ago, betting on an idea sketched out on a napkin in a Beijing coffee shop.

His global financial firm followed up with a further $2mn months later, becoming the first big backer of ByteDance founder Zhang Yiming and buying itself a stake in a Chinese company now worth about $40bn and which represents a significant chunk of Yass’s net worth, write the Financial Times’ Ryan McMorrow, Tabby Kinder, Demetri Sevastopulo and Alex Rogers.

In recent months, as TikTok’s fate became intertwined with US politics, the billionaire Republican donor stepped up his political spending, laying out more than $46mn for conservative candidates he hoped would vote against the ban-or-divest TikTok bill working its way through Congress.

But with TikTok at the centre of a geopolitical showdown between Washington and Beijing, his outlays ultimately came up short. On Wednesday, President Joe Biden signed the legislation likely to result in TikTok’s banning.

Power surge

Small Japanese EV battery suppliers are suffering from too much of a good thing. Global battery makers are scrambling to secure essential machines and materials, but many of these suppliers are struggling to meet the surging demand due to lack of workers, finance, and space to build more factories, writes Nikkei Asia’s Ryohtaroh Satoh.

Unlike their Chinese and South Korean counterparts, around 90 per cent of Japan’s EV battery suppliers are small and midsize enterprises that operate in more specialised niches, with each one catering to a specific aspect of the production process. Their Asian rivals, meanwhile, opt for expansion through mergers and provide a wide range of equipment for battery production.

These circumstances are already forcing some Japanese suppliers to turn down new orders from overseas customers. Now, they are even facing competition from overseas makers in their home market.

Tag-team for AI

Two of Asia’s leading chipmakers, SK Hynix and TSMC, will jointly develop advanced chips for artificial intelligence to strengthen their positions in the fast-growing AI market, write Nikkei Asia’s Kim Jaewon, Cheng Ting-Fang and Lauly Li.

SK Hynix dominates production of next-generation high-bandwidth memory (HBM) chips, which are critical for generative AI computing, while TSMC’s advanced packaging technology helps HBM chips and graphic processing units (GPUs) work together efficiently.

SK Hynix and TSMC are both key suppliers to Nvidia, the leader in the AI chip market.

HBM is a critical component for generative AI because the high-end stacking allows quick data transmission between processors and memory, which in turn unleashes greater computing power. Currently, only SK Hynix, compatriot Samsung Electronics and America’s Micron are capable of providing HBM chips.

Suggested reads

-

US Congress approves bill banning TikTok unless Chinese owner ByteDance sells platform (FT)

-

Japan and India to be next AI hotspots: Vinod Khosla (Nikkei Asia)

-

Malaysia rolls out ‘Golden Pass’ to lure unicorns and VC firms (Nikkei Asia)

-

Japan’s Turing eyes 2025 self-driving trial in challenge to Tesla (Nikkei Asia)

-

Malaysian trade minister touts ‘neutrality’ to grow chip industry (Nikkei Asia)

-

SoftBank to spend $960mn to boost computing power for generative AI (Nikkei Asia)

-

Chinese flying taxi sector claims global lead thanks to regulatory support (FT)

-

Apple removes WhatsApp and Threads from China store under pressure from Beijing (FT)

#techAsia is co-ordinated by Nikkei Asia’s Katherine Creel in Tokyo, with assistance from the FT tech desk in London.

Sign up here at Nikkei Asia to receive #techAsia each week. The editorial team can be reached at techasia@nex.nikkei.co.jp.