At a crossroads in downtown Shanghai, the market for bubble tea is crowded. Opposite one of ChaPanda’s 8,000 domestic stores, rival tea specialist Heytea vies for customers. Next door, another establishment is under construction.

“Teenage students, white-collar workers in their thirties, they’re drinking it every few days,” said a worker at ChaPanda. “They can’t go without it.”

Best known for the variety invented in 1980s Taiwan that includes tapioca balls or “bubbles”, flavoured milk tea beverages have proved a hit worldwide. Now mainland Chinese companies, buoyed by a recent domestic boom, are seeking to raise money and expand beyond their borders.

Overseas markets had “huge potential”, said Wang Hongxue, an executive director at ChaPanda at a press conference in Hong Kong on Monday, ahead of a listing in the territory that aims to raise about $330mn.

The company, which sees opportunities in south-east Asia as well as further domestic growth prospects, opened its first store in South Korea in 2023. Heytea launched in New York in December.

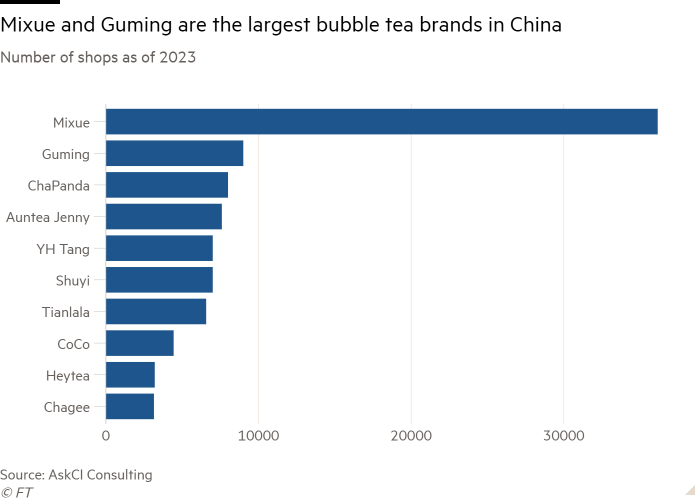

Mixue and Guming, both known for their low prices and for being the first and second-largest bubble tea chains in China, respectively, are also planning initial public offerings in the coming months in Hong Kong, where proceeds can be more easily directed outside of mainland China.

Mixue opened its first international store in Hanoi in 2018 and now has more than 3,000 stores outside of China. Guming, which described the Chinese market in its prospectus as “highly competitive and rapidly changing”, said it would “continually evaluate opportunities to enter overseas markets”.

They will be building on their domestic success.

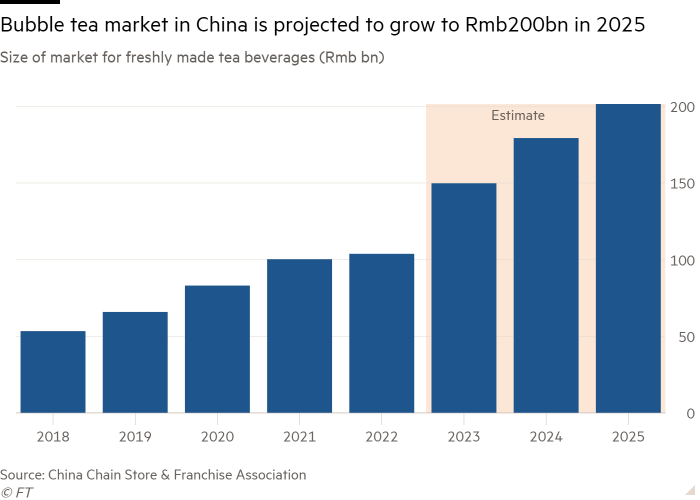

Within the mainland alone, the China Chain Store & Franchise Association said the market for freshly made tea beverages was Rmb104bn ($14bn) in 2022, almost double its 2018 size of Rmb534bn. It estimated in September that the market in 2023 would reach Rmb150bn.

For ChaPanda, sales at its franchises rose from Rmb10bn in 2021 to Rmb17bn in 2023 at a time when many other consumer industries were battling the effects of the Covid-19 pandemic.

“[Milk tea brands] have a much wider appeal in comparison to coffee chains,” said Jason Yu, managing director at Kantar Worldpanel, a consumer research group. Mainland companies, under pressure to compete with new ideas, have “taken the category to the next level”.

“It’s not just milk tea any more,” he said. “It’s really a beverage that can be infused with everything you can imagine.”

Such products, which in Shanghai typically cost Rmb15 to Rmb20, are also seen as resilient to a wider loss of consumer confidence in mainland China. Beijing set its lowest economic growth target in decades, at 5 per cent, last year and this year.

Against a cautious economic backdrop, the focus has shifted to the idea of “consumption downgrading”, in which households cut back on more expensive purchases.

“All the data shows that Chinese consumers are tightening their belts this year,” said Jeffrey Towson, founder of TechMoat Consulting. But he added that products such as ice cream and bubble tea were “inexpensive indulgences for consumers” and that such businesses “should do fine in a slowdown”.

The products vary in price, but drinks from Mixue, which had 30,000 stores as of December and like many of its peers operates a franchise model, can cost as little as Rmb6 and are popular in smaller cities where suppliers often crowd the same street. Mixue has its own factories and said in its IPO prospectus that it provided “nationwide free logistics services” to its thousands of franchisees, which purchase ingredients, marketing materials and equipment from it.

ChaPanda and Guming declined to comment. Mixue did not respond to a request for comment.

Many international providers highlight bubble tea’s Taiwanese origins, but milk tea beverages sold across the mainland are often associated with the country’s ancient tea-drinking traditions.

For Mark Tanner, managing director of Shanghai-based branding agency China Skinny, there is an element of national pride bound up in demand for the product. “Coffee is a foreign product, whereas tea is very much Chinese,” he said. At the same time, “all the innovation that’s happening is driving a lot of these young consumers”.

Ping Xiao, a professor of marketing at Melbourne Business School, said overseas markets with Chinese diaspora or student communities presented “a genuine opportunity for foreign consumers to encounter Chinese brands and the [country’s] rich tea culture”.

Sexy Tea, another bubble tea competitor, is known for incorporating so-called guochao, or “national wave”, elements of Chinese culture into its products, according to consultancy Daxue.

Jeongwen Chiang, a professor of marketing at China Europe International Business School, said expansion “can be achieved easily through joint ventures with local partners or licensing arrangements”.

At a Shanghai store run by Chagee, a popular milk tea brand that allows customers to order at a discounted price of Rmb16 on a WeChat app, Jing Li, 30, was buying a set of takeaway drinks for her colleagues.

“Mainland tea is evolving because of competition,” she said. Another customer in his forties said he liked coffee and tea, but the latter was “more suited to the Chinese palate”.

On the wall behind, there were signs of the country’s long history at play in its marketing slogans, a crucial part of a hyper-competitive race for customers.

“How far does a cup of tea go?” read an inscription in classical calligraphy. “You need to watch the eastern wind, as it blows tea leaves around the world and sets the scene for the next thousand years.”