This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. Nelson Peltz, the activist investor, reached a detente with Disney yesterday, saying that the company has done basically everything he wanted and that he “will be rooting” for it. We were reminded of this line, which ran in the FT last month:

“He always starts by crushing management and humiliating them publicly as he did today on CNBC. Then he usually gets what he wants — in this case, a seat at the table,” said a second person who has worked with Peltz. “Finally, he becomes friends with them.”

Just another day at work for Mr Peltz. Email us: robert.armstrong@ft.com and ethan.wu@ft.com.

Intel on offence

How will companies respond to a recession, if one comes? For a preview, look to semiconductors, where an inventory glut and soft demand have created a sharp downturn. The response has not been uniform. Some groups (notably Micron) plan to cut production, while others (such as Samsung and Intel) are investing through the downturn.

So we had an up-close look at Intel, which, on top of scaling up during a semiconductor bust, is trying to shake off a bleak few years. Is its approach crazy? Or should investors watch keenly?

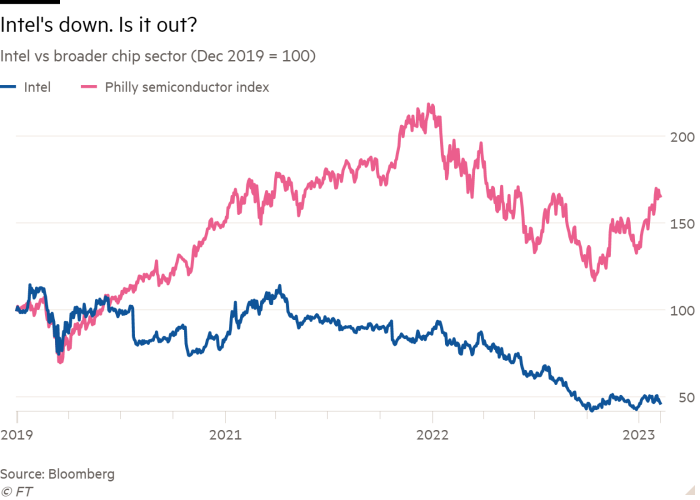

Though pain in the chips market has been widespread, Intel’s stock flop stands out:

For much of its history, Intel was a shark among minnows. The company makes logic chips for PCs and servers. Logic chips process information and are usually built for a particular purpose, as opposed to storage chips, which are more commoditised. High-end chip buyers, especially in cloud, also tend to like incumbents who can provide a steady stream of improvements. Business is sticky, unless you screw up.

Intel has done just that. Unlike its primary rival, AMD, Intel both designs and manufactures its chips, whereas AMD sends its blueprints to TSMC, the Taiwanese foundry. Since 2013, Intel has stumbled at least two, and arguably three, times in manufacturing new chips on time.

High-end chip manufacturing can be grouped by how tightly transistors are crammed in — the tighter, the better. But increased transistor density makes manufacturing harder too, as defects creep in. A new chip only launches when it can be made well at an economical scale. This, again, is hard. Intel faced delays with its 14 nanometre chip in 2013-14 and again with its 10nm chip in 2015. Gaurav Gupta, a semiconductor analyst at Gartner and former Intel engineer, adds:

When Intel fell behind [TSMC in manufacturing], it also became conservative, because its products were not as good as AMD’s products and they were losing market share. When I say conservative, they weren’t spending on expanding their capacity, which hurt them later.

Intel’s conservatism may well have been fuelled by past efforts to compete in mobile chips, where $10bn of investments produced little to show for it.

The company eventually fessed up to its problems in PC/server chips, promising its next 7nm generation would learn from its earlier failures. That confidence was misplaced. In 2020, 7nm was put off to this year. All the while, Intel bled customers to companies working with TMSC, who faced none of Intel’s manufacturing problems. AMD’s market share in PCs began 2019 at 6 per cent, but hit 23 per cent in the second quarter of last year, according to New Street Research. Around that time, after decades of picking up its rival’s scraps, AMD overtook Intel in market cap. Intel’s dominance in server chips has also cracked, with 99 per cent market share in 2016 slipping nearer to 80 per cent.

So now, burnt by past under-investment and with customers wary of further cock-ups, Intel is spending like mad. It is planning new facilities in Ohio, Arizona, Germany and elsewhere in Europe. As capex has exploded, free cash flow has collapsed:

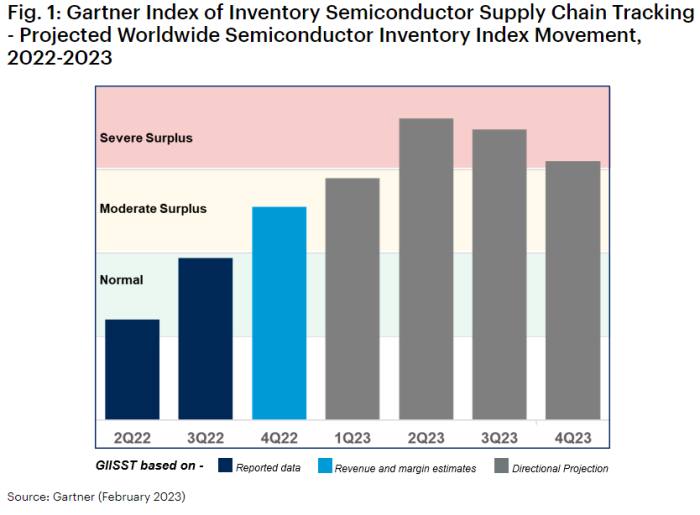

This poses two questions. First, how long until chief executive Pat Gelsinger’s investments pay off? Revenues are falling, down 32 per cent year on year in the fourth quarter. Intel also pays a chunky dividend, about $6bn in 2022 or three-fourths of net income. Unless the chip market proves surprisingly resilient or Intel slashes its dividend, it will have to borrow. And the business environment looks unforgiving. Gartner forecasts that industry-wide revenue will contract 6.5 per cent this year, with the chip glut only normalising well into 2024:

Second, will the pay-off be big enough? Gelsinger has argued that Intel needs to build out foundry capabilities to achieve a scale that keeps costs down. The hope is that handling both internal and external orders will instil cost discipline and restore a steady rhythm of chip upgrades.

He probably also sees the global chip race, and the cornucopia of state aid that comes with it, as a tailwind to his foundry ambitions. But Joseph Moore, semiconductor analyst at Morgan Stanley (who is underweight Intel), noted that while it behoves Intel to take advantage of state subsidies:

Ultimately, it has to be in support of the business opportunity that’s there. You can alleviate the capital intensity of these businesses, but ultimately you need to execute .

Intel has not proven themselves in the foundry business, and needs to build up that capability over time to make that investment worthwhile.

In other words, subsidies are a nice boost, but won’t save Intel from another blunder.

The foundry push, if executed well (a big if), could help Intel stabilise its market share. But taking back lost share will be harder, and further execution problems can’t be ruled out. Still, much of this is already priced into the stock. Antoine Chkaiban of New Street Research sees the hallmarks of an attractive value buy, arguing that the stock is so depressed that even stabilising could be cause for a share price bounce:

Intel has lost a lot to AMD and some of that is irreversible. They’re never going to get back to the dominant position that they were in 5-plus years ago. But there’s a lot of upside. Expectations are now quite conservative. Intel is now shipping below end demand [as PC and cloud customers work down bulging inventories] . . . I think there is some room for some beats in the second half of the year.

On a valuation standpoint, the stock is trading at 13 times earnings [that] are completely broken. At the moment, Intel’s revenues are down [nearly] 40 per cent year over year . . . These businesses have very high fixed costs, so when revenues collapse, gross margins collapse. So their earnings are completely broken at the moment.

This is the bull case for Intel: a good chance of acceptable returns, with perhaps a tiny shot at glorious returns, should Gelsinger’s mega-investments pay off big.

There is a wider lesson here. Intel is in a sector-specific bust made worse by firm-specific failures, but in a recession plenty of companies will face the same basic dilemma: whether to play defence in downtimes or go on offence. To make up for past mistakes, Intel has chosen offence. How many other companies would do the same? (Ethan Wu)

One good read

Forty-seven years after a murder, charges are filed.