Interest in meme stock Bed Bath and Beyond (NASDAQ:BBBY) is exploding, according to a key online indicator.

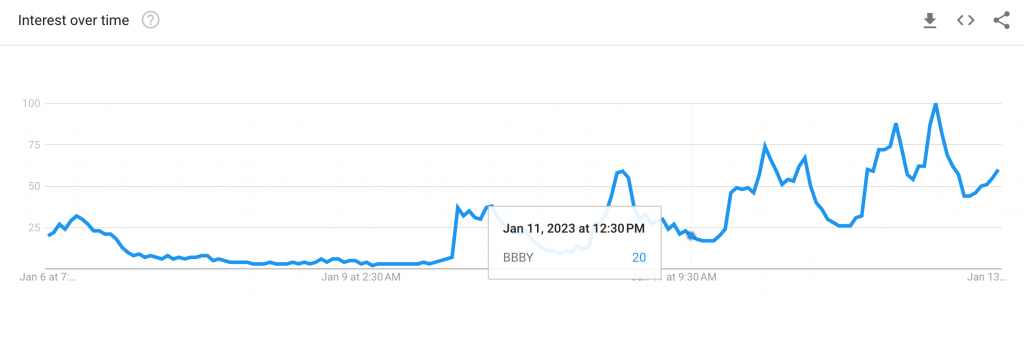

Google trends data shows the number of Google searches for the term ‘BBBY’ has risen 2,200% in the four days since January nine.

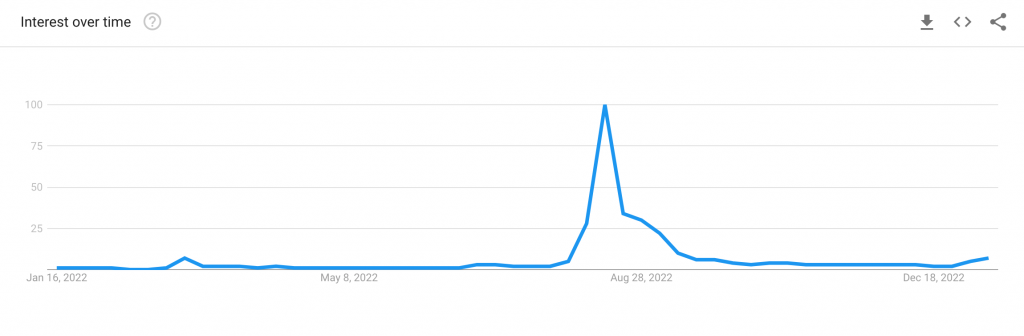

The last time Asia Markets noted such a sharp increase was in August of last year, when BBBY searches jumped 714% in a single day.

(It important to note that the current spike in search volume is far smaller than the one observed last year. See the graph directly below).

What does it mean?

Investors often observe Google Trends data for their chosen stocks because it can potentially identify early warning signs of their performance.

Often, it is an important signal for them to decide when to buy a stock and, just as importantly, when to sell.

That was certainly the case during BBBY’s previous price increases.

So it poses the question, how should BBBY react to the enormous increase in Google search volume?

BBBY stock: Time to buy or sell?

Most investors will understand that any sudden spike in hype or interest around a stock generally means a sharp fall will eventually follow.

The hard part is predicting how much longer that hype will continue before reaching a plateau and dropping.

The price chart below shows that at the time of publication, the price is still in an upward trend.

However, mainstream media is urging buyers to beware, amid concerns Bed Bath and Beyond is running out of money and could file for bankruptcy.

BBBY has risen and fallen quickly before and finance experts are warning there is a high likelihood it will happen again.

Which stocks are yet to spike?

Most serious investors will tell you it’s important to find stocks that are yet to enter a hype cycle, like the one BBBY is currently experiencing.

Chris MacIntosh, a Hedge Fund manager from Glenorchy Capital, is among those who believe oil and gas stocks could be the next to boom because right now nobody is talking about them.

“The common narrative is that the world will be using less coal, natural gas, and oil in 5, 10, 20 years from now,” he said.

“For all the many reasons we’ve pointed out in over the last few years we believe this is a grand delusion – Hogwash.

“Hence the reason why we keep banging on about investing in businesses within the energy sector that will benefit from a gradual awakening from the grand delusion.”

In his latest newsletter to his subscribers, MacIntosh lists five stocks he believes will increase at least 300% from their current prices, including oil stock Forum Energy Technolgies (FET).

“Recent commentary in earnings releases suggests that earnings are picking up fast with drilling activity,” he said.

You can access Chris MacIntosh’s high-performing stock picks by subscribing to his ‘Capitalist Exploits Insider Newsletter’. (In January 2023, you can trial the service for 30 days for just $1. Click HERE for the special offer.)