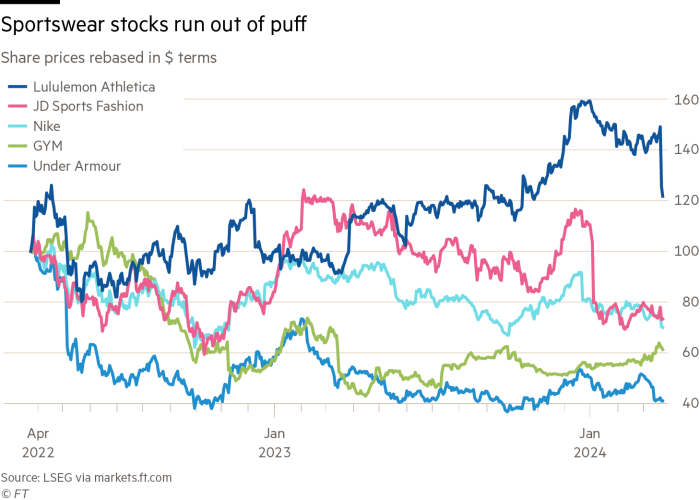

Gym bunnies appear to be flagging. Athleisure retailer Lululemon and sneaker maker Nike, reporting last week, both fell short of the mark.

Lululemon was on the money for its fourth quarter but signalled that the current one will come in below consensus forecasts. Nike was similarly leery. Shares wilted in the next few days, to the tune of 14 per cent in Lululemon’s case. JD Sports, which issued a rare profits warning in January, flagged “challenging” trading conditions — which it hopes a packed sports summer will help it withstand — in its update this week.

This is an industry in recovery mode — few sectors were as badly pummelled by the pandemic, which shuttered gyms. Pricey branded sportswear was harder to justify with no one to see it. But while retail spending on sportswear is back above pre-Covid levels — at $395.5bn globally last year, according to Euromonitor — share valuations have yet to catch up.

Some of this is company specific. Nike, with shares down 20 per cent in the past 12 months, is still taking strides to get its innovation mojo back.

German peer Adidas is coming back from a ghastly 2022, when China sales sank as consumers boycotted the brand for shunning cotton from Xinjiang over human rights abuses. It also axed its best selling Yeezy brand, after antisemitic comments by its business partner rapper Kanye West, and exited Russia.

The UK’s listed universe of sportswear merchants is a small one. A plethora of cult brands remain in private hands, despite periodic IPO talk by the likes of Gymshark. Others, such as Sweaty Betty, now owned by US shoe group Wolverine Worldwide, have been acquired.

Mass market purveyors, such as JD Sports and Fraser Group’s Sports Direct, cater to a broader audience — like Nike, whose shoes they sell, these are as much about streetwear as track or gym wear. But less global focus can mean missing out. Lululemon’s sales in mainland China were up 60 per cent year on year in the latest quarter on a constant currency basis, and now make up nearly a tenth of total sales.

While athleisure wear is seen as more resilient than luxury wear, it is not immune to economic headwinds. Lululemon, where a pair of yoga pants can set you back £108, saw a slower start to the year in North America. Fashion is fickle and — when it is not — is easily replicable by cheaper unbranded manufacturers and retailers.

Yet there are bright spots domestically. One is the proliferation of gyms across UK cities. Wimbledonites now refer to their leafy borough as “Gymbledon”.

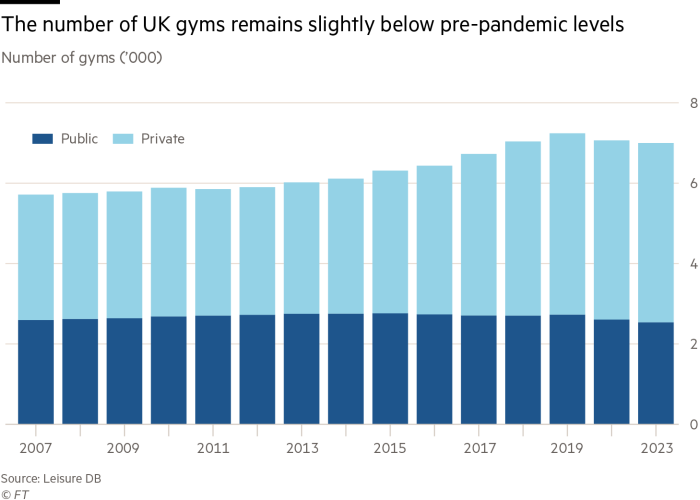

Total numbers are still a tad below pre-Covid 2019 at 4,460 in the private sector, according to fitness market data specialist Leisure DB, with 7mn members. But consultants PwC see scope for growth, reckoning on room for another 600-850 low-cost gyms, on top of the existing 756.

That segment is dominated by UK-listed Gym Group and private equity owned PureGym. GymGroup, with 233 sites and 850,000 members, reckons to be on track for revenues growth of 4-5 per cent this year, after an 18 per cent jump last year.

Trading on a total enterprise value 7.7 times forward ebitda on capital IQ data, the chain comes in at a sharp discount to the branded sportswear stablemates as well as US peer Planet Fitness.

Some companies are limbering up and are worth a look. But don’t expect many personal bests in the near term.

Flutter looks a worthwhile bet on US growth

In any other sector, a market share of more than 50 per cent might lead to complacency. In the relatively young US sports betting industry, there is no time for self satisfaction.

Disney’s ESPN was just one potentially formidable competitor that entered the market last year to challenge leaders Flutter — owner of FanDuel — and DraftKings. Early signs suggest Flutter can still flourish stateside despite the competitive assault.

Since the US Supreme Court in 2018 struck down a federal law banning sports wagering, the US market has been seen as a new source of rapid growth, particularly for international betting companies that faced tighter regulation in mature markets such as the UK.

Flutter — previously Paddy Power Betfair — was an early mover. It now operates mobile sports betting in 22 states and online gaming in five. Its US business delivered its first full year of profitability last year. Further growth is expected: US adjusted earnings are forecast to more than triple to about $710mn in 2024 on revenues of $5.8bn to $6.2bn, up from $4.4bn in the US last year.

Performance so far this year suggests Flutter’s confidence is not misplaced. Total US revenues were up nearly 56 per cent between January 1 and March 17. At the end of 2023, its share of the sports betting market stood at 53.4 per cent.

Of course, much can still change. Despite Flutter touting its superior technology, competitors are quick to copy once a new product proves successful, points out Peel Hunt’s Ivor Jones.

Yet the adage that size matters does seem to still hold true stateside, where margins are thin and competition to acquire new customers fierce. Smaller, highly leveraged peer 888 Holdings is looking at options to sell or exit its US consumer business as part of its latest turnaround strategy, which includes a slightly desperate rebrand to evoke.

Flutter’s US growth prospects, plus its secondary listing in New York in January, have allowed it to far outpace challenged London-listed rivals. Its shares have gained more than 20 per cent in the past 12 months. Shareholders will vote on switching its primary listing to New York in May.

On a forward price/earnings ratio of 35 times, Flutter’s shares look expensive. But its strong US business justifies the premium compared with UK peers. With gearing coming down, Flutter also has the bandwidth to make acquisitions to defend its position in the US if necessary.

New US competitors will not find it easy to gain territory from the market leader.