Private equity boss Simon Borrows surely is a man of Action. The bulk of UK-listed 3i’s portfolio capital is invested in the Dutch discount retailer. A third quarter update from the investment group revealed that Action performed well over Christmas, boosting the retailer’s internal valuation.

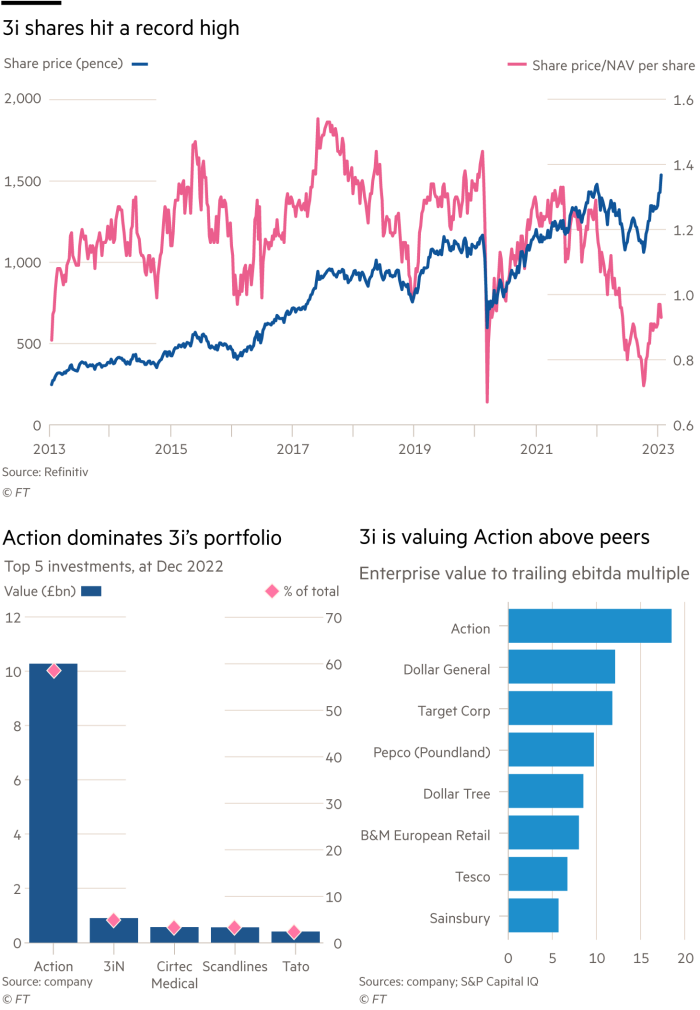

That in turn lifted 3i shares to a record high on Thursday, up some 9 per cent. Yet a stubborn discount to net asset value has appeared in the past year, hinting at market doubts about the Action valuation.

Traditionally, private equity funds aim to buy assets, improve them over about five years and then return investors their money, ideally with a profit. Even if the industry has modified this in recent years, 3i has stuck with Action since 2011, exceeding Borrows’ tenure.

Results from last year show why letting go will be hard. Action’s ebitda of €1.2bn rose 46 per cent year on year. That result was more than double that of 2019. While much of those gains resulted from opening 280 new stores, life-for-like top line still expanded by 18 per cent. Action claims that store openings can continue at this pace for 15 years. Little variation in store offerings enables lower cost expansion.

Even a partial sale would test the chunky valuation 3i ascribes to Action. The reported 18.5 times enterprise value to trailing ebitda derives from 3i, meaning that its 53 per cent stake is worth about £10bn. That is very pricey compared with rival discounters in Europe. Consider that slower growing B&M, and Poundland owner Pepco, are valued at 8 and 9.7 times trailing ebitda, respectively. In the US, Dollar General carries a 12 times ebitda multiple.

Despite the share price’s 40 per cent surge since mid-October, 3i’s shares trade at a 5 per cent discount to its reported NAV. Prior to last year a sizeable premium has existed. Also, Action is one of the few portfolio holdings valued above relevant listed peers.

The market wants proof of the premise that Action deserves this premium. Borrows will at some point be forced to act accordingly.

If you are a subscriber and would like to receive alerts when Lex articles are published, just click the button “Add to myFT”, which appears at the top of this page above the headline.