This article is an on-site version of The Lex Newsletter. Sign up here to get the complete newsletter sent straight to your inbox every Wednesday and Friday

Dear reader,

Greetings from Edinburgh, where Nicola Sturgeon has just handed over to Humza Yousaf after more than eight years as Scotland’s first minister.

Yousaf, widely viewed as the continuity candidate, faces many unenviable tasks in his new job. Not least will be reuniting the governing Scottish National party, recently branded by its own president a “tremendous mess”. Less immediate, although no less testing, will be managing fragile relations with the oil and gas industry in Aberdeen.

Once at the heart of the SNP’s economic arguments for independence, the industry now finds itself out of favour. Scotland’s draft energy strategy includes a “presumption against new exploration for oil and gas”. It prioritises the “fastest possible” shift to cleaner technologies.

Their heyday may be a distant memory but oil and gas producers and suppliers still account for more than 42,000 Scottish jobs. Most homes have gas boilers and the majority of cars still run on petrol or diesel. The switch to technologies such as electric heat pumps and electric vehicles is yet to happen at scale. Yousaf’s government will face a difficult balancing act maintaining cordial relations during the transition, particularly given his party’s power-sharing agreement with the environmentalist Scottish Greens.

North Sea exploration licensing is reserved to Westminster so much of what the SNP government says on the matter is symbolic. Yet it adds to an overall feeling among many oil investors that the UK is a hostile environment.

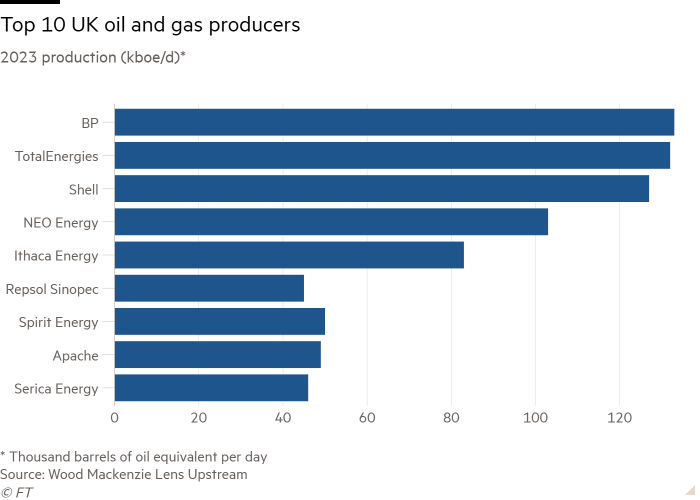

Nine out of 10 North Sea operators are cutting back on investment, according to trade body Offshore Energies UK, which partly blames political uncertainty. Lower investment will hasten production declines.

UK taxation policy is equally at fault. The Westminster government twice increased taxes on oil and gas producers last year to fund reductions in energy bills for British households. Their headline tax rate is now 75 per cent, up from 40 per cent a year ago. For shorter-term projects, in particular, investment allowances introduced alongside the UK’s windfall tax often aren’t enough to outweigh the damage, according to analysts at Wood Mackenzie.

This is reflected in the share prices of companies such as Harbour Energy and Serica Energy. The two companies’ stock has fallen 46 per cent and 40 per cent respectively in the past 12 months. While small compared with the oil majors, these so-called independents are increasingly influential in the UK North Sea.

The arguments for and against more hydrocarbons are well rehearsed. Climate campaigners argue renewable technologies should be prioritised. Oil and gas groups insist the country’s dependence on dirtier imports will accelerate if the domestic industry is run out of business prematurely.

Energy companies are often guilty of moaning. Many have made big windfalls from the surge in oil and gas prices sparked by Russia’s invasion of Ukraine. Yet it appears the UK government is now persuaded the windfall levy will have unintended consequences. Commentators, including Lex, argued it might.

Shares in several of the so-called independent oil and gas producers rose on Monday after the FT reported that Rishi Sunak’s government is expected to offer the sector some relief from the windfall tax on Thursday.

Energy companies are hoping for a commitment that the tax will be removed before 2028 if oil and gas prices return to more “normal” long-term levels. Several executives told me a sensible oil price trigger would be in the region of $60 to $65 a barrel. Brent is trading above $75 a barrel at present.

Would the expected change make the North Sea suddenly more investable? It would principally help smaller oil and gas companies that rely on a type of borrowing known as reserves-based lending, say executives. The second windfall tax rise in November triggered a sharp reduction in such facilities as banks reassessed their lending models. The concession could force lenders to reconsider.

The UK government is desperate for North Sea producers to open the purse strings as it tries to boost domestic energy supplies. The UK has been a net energy importer since 2004. An important test of whether it has done enough will be if Norway’s Equinor presses ahead with the large Rosebank oil and gas field 130km off the Shetland Islands.

There will be further bumps in the road. Many in the industry are already assessing what a pro-windfall tax Labour government would mean for planned projects. Sir Keir Starmer’s party suggested raising the energy profits levy to 78 per cent. Unlike Sturgeon’s tenure, the interplay between politics and the UK’s oil and gas industry is nowhere near drawing to an end.

Elsewhere in Scottish news

My FT colleagues Mure Dickie and Lukanyo Mnyanda produced an insightful analysis of Sturgeon’s legacy, as have several others including The Spectator’s Lucy Dunn. Good profiles of Yousaf include this one by The Guardian’s Severin Carrell.

I’ve also been enjoying my former FT colleague Lucy Kellaway’s book Re-educated: Why it’s never too late to change your life, recounting her experiences retraining as a teacher. Perhaps Sturgeon should add it to her reading list, in between driving lessons, as she embarks upon life after politics.

Enjoy the rest of your week,

Nathalie Thomas

Lex writer

If you would like to receive regular Lex updates, do add us to your FT Digest, and you will get an instant email alert every time we publish. You can also see every Lex column via the webpage