This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. A merry day for bank stocks yesterday, although they look set to end March off 25 per cent. One bank got a particularly big fillip, First Citizens, whose stock shot up 54 per cent after finalising a deal to buy Silicon Valley Bank. Should it have risen more? More on that below. Email us: robert.armstrong@ft.com and ethan.wu@ft.com.

SVB, resolved

Silicon Valley Bank has been sold. Who — to use technical finance terminology — is holding the bag, and why?

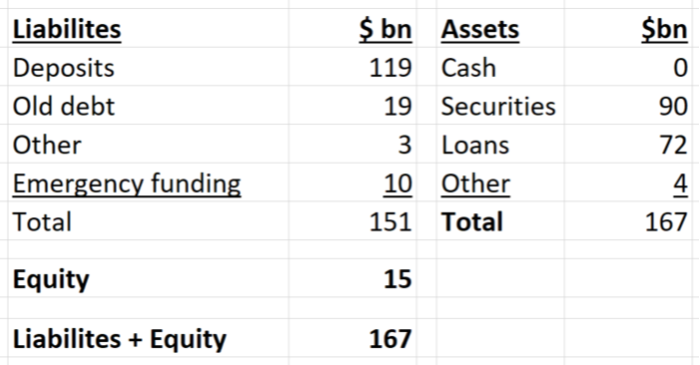

Even now that First Citizens has bought SVB, we don’t have all the answers. What we do know is best told chronologically. Start way back on December 31 2022. Here is what SVB’s balance sheet looked like then (the numbers won’t sum perfectly because of rounding):

Notice that this is, superficially, an adequately capitalised bank balance sheet. It has a leverage ratio (equity/assets) of 7.7 per cent, which no one goes around bragging about, but is fine. But, as we all now know, trouble was brewing. Those $120bn in securities has yields of under 3 per cent locked in, and deposit costs were rising fast. Margins were compressing. The company tried to solve the margin problem by selling some of the securities and raising new equity, this caused a shareholder panic, and depositors ran.

On March 10, the Federal Deposit Insurance Corporation took over the bank. As of that day, according to the FDIC, the bank had $119bn in deposits. That is, $54bn of deposits had “run”, since December, less than a third of the total. The bank also had $167bn in assets. We don’t know what the rest of the balance sheet looked like on that date, but the bank could have been technically solvent at that point. Here is a made-up, hypothetical, inevitably wrong balance sheet for March 10 that nonetheless is consistent with the facts we do know:

We know the total assets and deposits numbers are factual. We also know that, on the asset side, the loan and securities numbers are about right, because they are at that level as of today (First Citizens has the loans, the FDIC has the securities). So, to fund the $54bn in deposit outflows, the bank could have — again, we’re guessing here — burnt through its $14bn of cash, sold $30bn in securities, and raised $10bn in new debt, which I call “emergency funding” above. If so, the bank would still be solvent! It was probably messier than this, though, with losses on the security sales and less residual equity. But it doesn’t really matter because, as we know now, deposits kept flowing out, fast, after the FDIC took over.

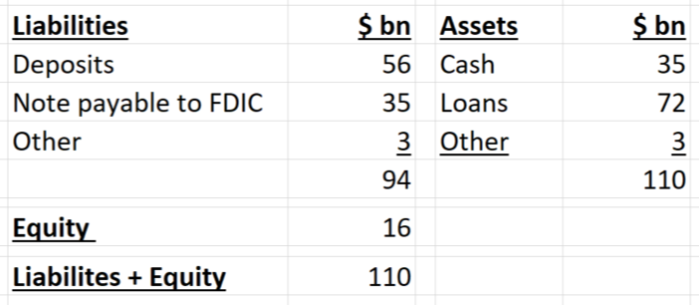

We know this because we know First Citizens took on all the remaining SVB deposits when it bought the bank over the weekend, and they only got $56bn worth; so another $63bn had made for the doors in the meantime. Here is the bank that First Citizens bought:

Basically, First Citizens got $72bn in loans, $56bn in deposits, and a $35bn loan at a below-market rate of 3.5 per cent (which shows up as a loan liability and a matching cash asset). The $16.4bn difference between the assets and the liabilities — described by the bank and the FDIC as a “discount” on the assets — is best understood as equity that comes with the acquisition. Why does First Citizens get what looks like a gift of $16.4bn in book value from the FDIC? Because more deposits might leave, and the loan book might fall apart. That’s also the reason for the loan: the FDIC does not want First to have a liquidity problem if more depositors leave.

The equity market has already given an estimate of what that $16.4bn in new book equity is worth, on a risk-adjusted basis: the market cap of First rose by $4.4bn yesterday. Part of the market’s risk adjustment would reflect the fact that the FDIC will take half of all losses over $5bn on the loan book (a “value appreciation instrument” will also let the FDIC participate in the gains in First’s share price over the next few weeks, up to a cap of $500mn; as of today, it looks like they will get all of that).

What is the FDIC left with? Well, it now owns the SVB securities portfolio, which has a face value of $90bn, but a market value considerably below that (that difference between face and market value is where all the trouble started, after all). Against that, it has probably already shelled out $63bn, and probably more, to SVB depositors. It presumably takes the $16.4bn “discount” given to First as a loss. Then it has to estimate the cost of the insurance against loan losses it provided to SVB. Finally, getting all this done costs money. In sum, the FDIC estimates that its Deposit Insurance Fund will be out $20bn — a cost that will be spread across the FDIC’s member banks (admittedly, we’re not fully sure how the FDIC reached this estimate).

The cost to the banking system is, ultimately, a socialised cost, because it takes capital out of the banking system that could otherwise be put to work in the economy. How big a cost is it? One FDIC representative put it in context as follows. A bank with $212bn in assets failed, and society ended up on the hook for less than 10 per cent of that; that is less, they said, than the 17 per cent of assets the FDIC had to absorb from bank failures in the great financial crisis.

Another cost to be considered is the implicit guarantee offered to all uninsured depositors in all US banks when the authorities stepped in so quickly to say that all SVB depositors would get 100 cents on the dollar. I do not think that depositor risk aversion imposes discipline on banks; that is, banks don’t manage their balance sheet prudently to attract depositors (SVB proved that point!). It is worth noting that US uninsured depositors have been consistently bailed out for decades; and it will probably always be that way, because bank panics are so destructive. Still, perhaps the empty posture of depositor risk is useful. Maybe bank executives behave differently because they are afraid uninsured depositors, who don’t understand that the government will always bail them out in the end, may run? It’s certainly possible.

If there is a final coda to this chapter of the banking crisis of 2023, though, it is this: the problems at SVB started with profitability. It was failing profitability that led to the depositor run and then the solvency problem. The profitability problem, in turn, came down to a bad business model: taking a flood of deposits from a single highly cyclical industry, without a plan for profitably deploying that capital, except for buying duration. Steven Kelly of the Yale Program on Financial Stability sums up the point very well:

This was a run on SVB’s business model. And when a bank’s business model no longer looks viable, then it starts mattering what the bank looks like from a liquidation perspective. In general, a bank is always going to look horrible through that lens, and the balance sheet grinds to a halt. So much of a bank’s value is tied up in counterparty/depositor/borrower relationships, providing its balance sheet as a service, its employees, ongoing management of assets within that bank’s corporate structure, long-term viability, etc. Capital ratios measure capital to assets, but the market measures capital ratios against a firm’s business model.

One good read

Polls are just polls, but this one is wild. The only American value “that has grown in importance in the past quarter-century is money”.