Battery costs make up the lion’s share of electric vehicle prices. Lithium is the key protein in that big cat diet. But supply problems have pushed up volatile prices.

That has left manufacturers and investors groping for a cheaper substitute in the form of sodium. This has similar chemical properties to lithium, which make it useful in batteries. The element is even more abundant geologically and thus cheaper to extract.

Lithium carbonate prices rose 13-fold between early 2021 and late 2022. It has given up three-quarters of that gain this year. The metal still accounts for about 40 per cent of the cost of a lithium-ion battery cell. If lithium doubles in price again that proportion would rise to 70 per cent, Bernstein analysts say.

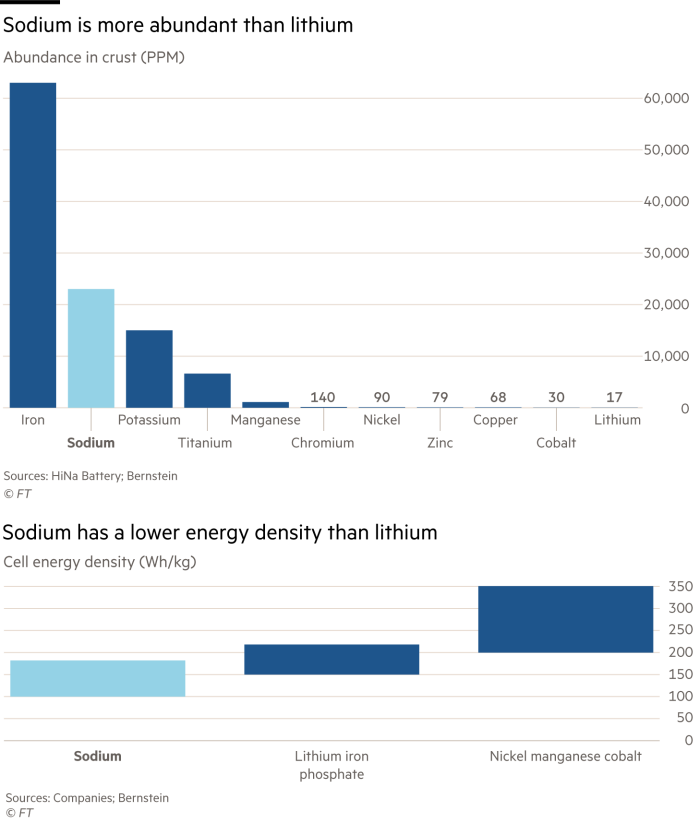

Sodium costs less because the earth’s crust contains about 1,300 times more of it than lithium, itself hardly a rare commodity. Sodium currently trades at about one-tenth the price of lithium. In theory, that makes for a much cheaper battery.

But you get what you pay for. Sodium has a lower energy density than lithium. Adjust for that factor and sodium’s true price advantage looks closer to 10 per cent versus currently popular lithium iron phosphate (LFP) batteries.

On the plus side, sodium-based batteries tend to retain their charge longer, especially at low temperatures, than either LFP or energy-dense lithium nickel-manganese cobalt power cells.

Sodium batteries make sense for micro EVs and scooters, less so for high performance EVs that need to offer longer ranges.

China is spearheading the charge into sodium batteries. CATL leads the industry in sodium battery production. Listed EV makers JAC and BYD, and privately held Chery will all launch four-door vehicles powered by sodium batteries this year. These offer ranges of about 200-300km, 30 per cent below average. BYD’s Seagull should have a cheap sticker price close to $11,000.

Energy experts say sodium batteries are better suited to static power storage than EVs. That application best exploits cheapness, lower energy density and superior safety characteristics. Sodium batteries are less prone to overheating than lithium alternatives.

Even so, sodium has a role to play at the lower end of the EV market as a substitute. Investors should respond to forecasts of prolonged lithium shortages by ingesting a little sodium feedstock — as a pinch of salt.

Lex is the FT’s concise daily investment column. Expert writers in four global financial centres provide informed, timely opinions on capital trends and big businesses. Click to explore