Revolut chief executive Nik Storonsky has blamed recent banking turmoil for the latest delays to the fintech’s long-awaited UK banking licence, claiming the cause of the hold up “is really not us”.

Revolut has been locked in discussions with the Financial Conduct Authority and Prudential Regulation Authority about a UK banking licence for more than two years, far longer than the typical turnround time of less than a year.

Since the application was lodged in January 2021, Revolut has lost several of the most senior executives in its UK banking team. Regulators have also carried out a review of the fintech’s culture, which executives say has been improved.

Revolut’s chief financial officer Mikko Salovaara said a UK licence was coming “any day now” on March 1.

The fintech sees a UK licence as crucial to its hopes of offering loans and other services to the more than 5.8mn clients it already has in the UK. It would also act as a seal of approval to help win other banking licences in key markets.

“Ultimately it is not really us, it is generally the banking crisis we see at the moment that makes regulators extra cautious,” Storonsky told the Financial Times of the hold-up to the UK licence approval.

The FCA and PRA both declined to comment. The operational teams working on Revolut’s licence application are not the same officials who were overseeing the UK’s regulatory work on Credit Suisse and Silicon Valley Bank — two of the biggest victims of a banking crisis that shows no sign of abating — though there is some overlap at very senior level.

Two people familiar with the UK licence process said the recent turmoil “would not impact” Revolut’s application.

Regulators in the UK quizzed Revolut bosses about the qualification on their delayed 2021 accounts, which warned that there was a risk that revenues were “materially misstated”, a person familiar with the situation told the FT. Separately, the FCA ordered an independent review of Revolut’s policies to prevent and detect financial crime in 2020, under a process known as a section 166.

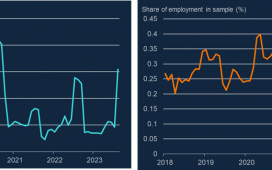

Fees from crypto trading were Revolut’s single biggest source of revenue in 2021, accounting for approximately a third of its reported £636mn. Other streams include subscription services for higher-tier cards and lending products in Europe such as a buy now, pay later service.

The FCA has faced criticism for being slow to process licences and other authorisation applications made to it generally.

In a recent interview with the FT, FCA chief executive Nikhil Rathi would not comment on Revolut’s case but said most of the delays in its licence applications were down to genuine regulatory concerns and said the regulator would be “much more forthright and public about saying that in future”.

Movement on Revolut’s banking licence appears to have slowed down, or almost halted, according to two people familiar with the approval process. In the meantime, the lack of a licence is preventing Revolut from competing fully in the US, Canada or Australia, because regulators there are watching the UK’s decision making.

Revolut said it does not comment on licence applications or its regulatory relationships.

“If you are a business and you want to build something, uncertainty is a thing that kills you because you don’t know what you can do, what you can’t do,” Storonsky added.

Two people familiar with the company said it has considered leaving the UK, in what would deal a blow to the UK’s fintech sector and at odds with prime minister Rishi Sunak’s aims to become a global tech hub.

The company said in a statement: “We’re a British company and London is our home.”

When asked about the government’s aspirations to encourage innovation and investment, Storonsky said: “The reality is pretty different.”