This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. US stock markets rose nicely yesterday, and have been grinding upwards, by stops and starts, for two weeks. The S&P 500 is back to where is was on March 8, the day Silicon Valley Bank announced its doomed capital raise. All clear, then? We’re thinking about it. Meanwhile, some thoughts below on whether bad accounting rules contributed to the SVB mess. Email us: robert.armstrong@ft.com & ethan.wu@ft.com.

Can we blame the accounting?

In the Wall Street Journal yesterday, Jonathan Weil paints an unflattering picture of the way six large banks have accounted for their large securities portfolios. The article serves to crystallise the debate over whether securities accounting — in particular the treatments of “held to maturity” (HTM) and “available for sale” (AFS) securities — is misguided and contributed to the failure of Silicon Valley Bank and stresses on other banks, most prominently First Republic.

If a bank classifies a security as held to maturity, then it is held at cost. Changes in the market value of the security — though disclosed in the footnotes to the financial statements — do not flow through the income statement, and they are not recorded on the balance sheet, so they do not influence capital levels. If the same security is marked as available for sale, changes in its value, while still left off the income statement, are reflected in its balance sheet, and therefore in the bank’s equity capital.

Weil’s piece points out that the six banks (JPMorgan Chase, Wells Fargo, Truist, US Bancorp, PNC and Charles Schwab) together moved half a trillion dollars in securities from AFS to HTM last year. Rising interest rates mean that the fair value of the securities was falling; keeping them in AFS would have meant a significant hit to capital. If the banks marked their HTM securities to market, that would have meant an 18 per cent hit to their equity.

The unstated implication of the article is that this “switcheroo”, while it breaks no rules, is nonetheless dodgy. The article quotes Sandy Peters, head of financial reporting policy for the CFA Institute:

This is an artificial accounting construct, not an economic measure of the value of the assets . . . The value of a bond doesn’t change based upon how management decides to classify it. It’s worth what it’s worth.

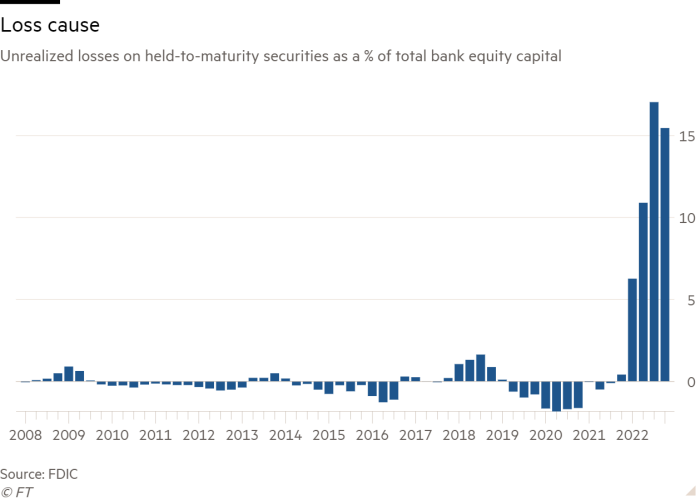

While Weil focuses on specific banks, it is worth noting that the US banking system as a whole looks a lot like those banks. Here is a chart of all banks’ unrealised losses on HTM securities as a percentage of total equity capital in the system:

Some people say the system would be work better if all securities got the AFS treatment. They argue that forcing banks (and their investors) to recognise losses on securities would force more prudent management. By coincidence, two of those people, Charles Calomiris and Phil Gramm, made this case in the WSJ opinion pages on Tuesday, asserting that loss recognition would force banks to reduce leverage and hold more cash.

There is clearly something odd about banks devoting large portions of their balance sheets to securities, and then effectively declaring that the market value of those portfolios doesn’t matter to their financial strength. It is also odd for a bank to effectively promise never to sell its securities (on pain of a big hit to capital) when, historically, the reason for banks to hold securities is as a source of liquidity.

Indeed, it is downright bizarre, as the FT’s Jennifer Hughes pointed out to me, that the same government-backed securities can be accounted for as held to maturity at the same time as they count as high-quality liquid assets for the purposes of calculating banks’ liquidity ratios.

So what is the argument for allowing HTM accounting for bank securities? For one thing, one has to ask if it makes sense for banks to adjust their capital ratios upward when interest rates fall. AFS accounting would make most banks automatically better capitalised whenever rates fell, even if the reason for those declining rates was, say, a major recession.

This is just one example of a larger issue, which is that AFS accounting would make the asset side of the balance sheet much more volatile than the liability side. Chris Marinac, director of research at Janney, told me:

The issue all along [has been] that both sides of the balance sheet need to be marked. If interest rates rise and harm the value of banks’ loans and securities, the opposite side needs to be marked up for deposits and liabilities. A zero-cost demand deposit and other contractual deposits (CDs/time deposits) have more value as interest rates rise, at least in theory.

[But] of course, banks are leveraged 12-to-1 so the inherent value of deposits is highly questioned after a “bank run” [such as the one we saw] at a handful of institutions in March 2023 . . . When we force accounting marks on to leveraged financial institutions, it creates volatility and therefore new guardrails and safety netting need to be installed

Finally, it must be acknowledged that imposing AFS accounting on banks securities would force banks, as a group, to either hold more capital, own fewer Treasuries and agency mortgage-backed securities, or both. I won’t get into the debate over bank capitalisation levels here, except to note that there is a trade-off between the safety of higher capital and the risk that more lending gets forced out of the banking sector and into less-regulated places. On securities, didn’t we conclude after 2008 that it was good for banks to be holding a bunch of assets that have no credit risk?

I have very mixed feelings about this debate, but one source, a veteran banker, suggested that there might be a middle way. It is really only the very large securities portfolios that cause the problems: SVB and a few other banks have used government-backed bonds to make what amount to all-in bets on rates. One regulatory option would be to say that if a securities portfolio was above a certain size relative to a bank’s capital, it has to be marked to market or sold off.

What really would have helped, of course, is if SVB and its supervising regulator had simply stress-tested its balance sheet against rising rates, come to the conclusion it was a time bomb and done something about it. How this didn’t happen remains a mystery, at least to me. Not every bank failure calls for a rule change. Firing a bunch of bank regulators might do the trick almost as well.

One good read

Caitlin Clark is good.